July Brought Some Reasons For Optimism, But Plenty of Reasons for Caution Remain for Rest of the Year

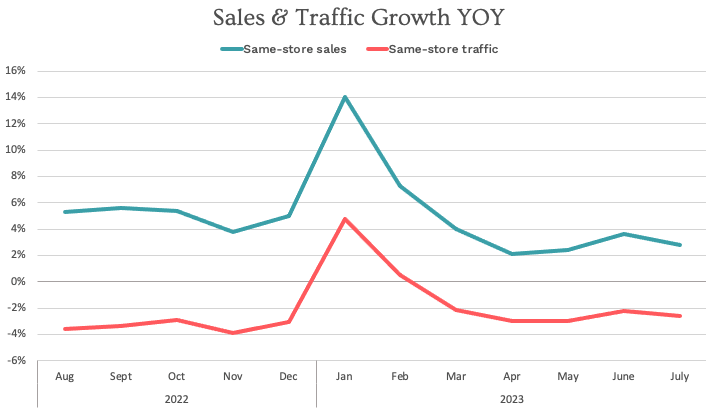

Restaurant sales and traffic growth slowed down during July but remained stronger than the growth rates posted by the industry back in April and May. Same-store sales growth was 2.8% for the industry in July, down 0.8 percentage points compared to the previous month’s year-over-year (YoY) growth. But June was somewhat of an anomaly, as the industry lapped over the month with the highest-ever average gas price and an inflation rate peaking at a 40-year high. The summer of 2023 has proven to be strong for restaurant activity despite the many pressures affecting consumers.

Same-store traffic growth was -2.6%, a deceleration of 0.4 percentage points compared to June. One of the biggest concerns for chain restaurants continues to be the sustained traffic erosion. YoY same-store traffic growth has now been negative during 15 of the last 17 months, and the only two months in which it was positive was when the industry was lapping over the negatively impacted Omicron variant months a year ago.

Although the results for the last two months show relative strength in consumer consumption in restaurants, stepping back a bit further shows a slightly different story. Same-store sales growth has been falling since March compared with the last quarter of 2022, but traffic growth has improved. The reason is that average guest check growth YoY has been moderating after years of skyrocketing price increases. Average guest check growth was only 5.8% YoY in July, the lowest it has been in the last three months and the second lowest since February of 2021. More modest price increases, as well as guests moderating their spending when they eat out, are providing less of a lift for sales this year but are providing some aid for traffic growth to beat expectations this year.

July brought mixed results from a segment standpoint regarding traffic growth. Most segments experienced a softening in their same-store traffic growth rates, with the only exceptions being upscale casual and fine dining. But despite some improvements in the high end of the industry, all industry segments again posted negative YoY traffic growth for the fourth consecutive month.

Even while it is impossible to anticipate the economy with perfect accuracy at any time, recent years have shown to be more unpredictable than usual.

Economists have found it challenging to understand the market in the wake of the COVID-19 outbreak and the resulting regulatory and behavioral changes. This is because, good or bad, the economy of today doesn’t resemble anything we’ve seen before.

The restaurant industry, being the largest US industry outside of the US government in terms of total employment, has been no exception to these volatile economic factors. Over the past few years, restaurateurs have struggled to manage multiple issues at once, including high inflation, poor visitation, employee retention issues, and an unexpected increase in demand for off-premises dining.

Understandably, they’re hoping for a little insight into what’s to come in the near future for the food industry.

The Good News

There are reasons to be optimistic. Inflation has cooled down to about 3%, the unemployment rate continues to its historically low levels at 3.5%, and most positively, for the first time in months, the Fed no longer expects the US economy to enter a recession. As discussed above, GuestXM’s Market Intelligence data suggests this as well, with sales and traffic growth picking up in recent months.

Turnover has already started to improve. Leisure and hospitality quit rates not only have decreased but are even below pre-pandemic levels. This is likely due to declining wage rate increases providing fewer incentives for “job switchers,” fewer job openings, and a changing financial landscape. With retention higher in both the front and back of the house, food and service reviews should see a marked improvement. Guest experience has been recovering for both full-service and limited-service brands, and increased employee retention should only help continue that trend.

The Bad News

Although we may avoid recession, the consensus continues to be that some economic slowdown is likely. Inflation may be cooling, but it remains higher than the target, and the Fed has indicated that further interest rate hikes are likely in the second half of 2023 and possibly even in 2024. Given that we are already at 16-year highs, these hikes will be tough on businesses and consumers.

Exacerbating this, in October an estimated 44 million Americans are set to resume payment of their student loans, which have been on pause since the beginning of the pandemic. According to the Federal Reserve, the average student loan payment is between $200 and $299 a month. These payments will further tighten the belt of the average consumer, already experiencing high credit card balances, which could result in a decrease in traffic come fall and will likely continue the recent trend of limited-service brands benefiting from trade-downs from the consumer.

The economy is showing mixed signals, and outlooks vary widely from some optimistic economists predicting booms to high-profile investors predicting busts. However, with turnover decreases signaling the end of the “Great Resignation,” inflation finally stabilizing, and the last of the pandemic-era moratoriums concluding in the student debt payments, we may finally be seeing the end of the COVID era. And for the restaurant industry, which was one of the hardest hit, this may be a blessing in itself.