We’ll explore these themes in more detail at our Restaurant Industry Snapshot webinar

Many of us had concerns going into 2024 due to fears of a recession at the end of last year. Now that we are halfway through, we have a much better picture of the state of the restaurant industry and what is to come. Let’s break down our top three restaurant industry insights in 2024 and what they mean for the rest of the year.

1. Sales and Traffic Simmers Down

We have seen a lot of contradicting pieces of news about how the restaurant industry has been doing over the last six months.

Some had concerns about a recession.

California had a big change regarding the minimum wage increase.

Meanwhile, it was announced that GDP growth is at a higher-than-expected 2.8% , and – in our own data – we have seen some momentum in restaurant sales that we hadn’t previously.

So what does the state of the industry really look like?

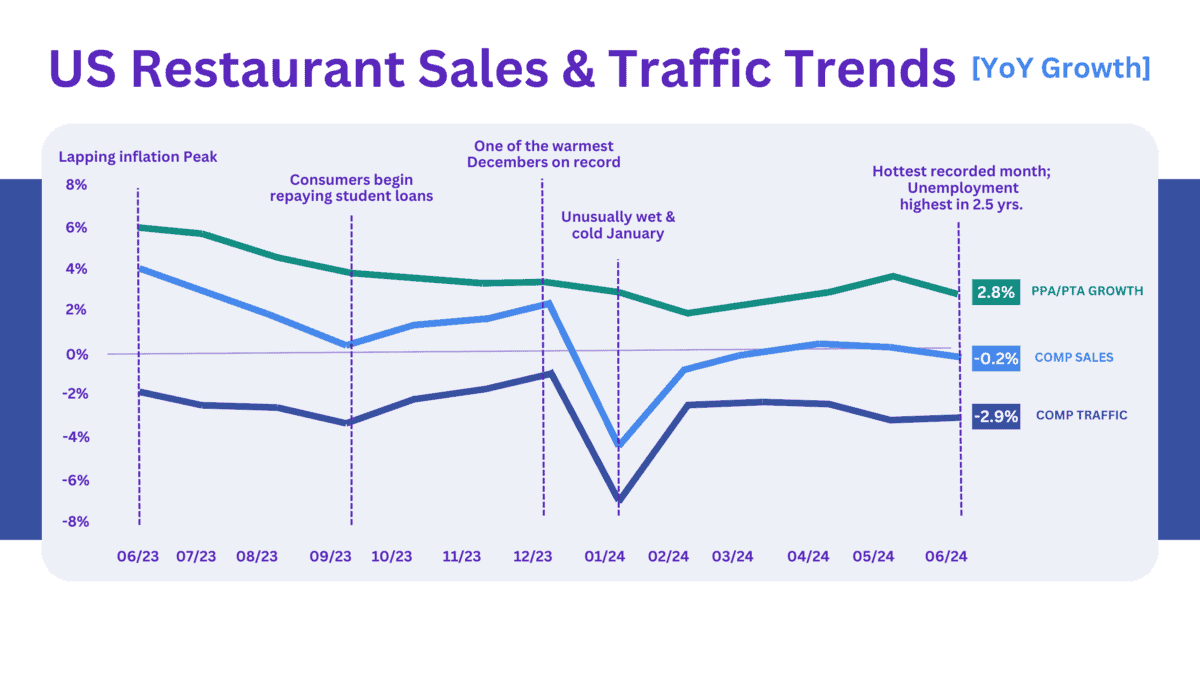

Overall sales plateaued in May and actually dipped into the negatives in June.

Based on trends, the data shows that we can expect the rest of the year to be weaker overall. Why?

Consumer spending is slowing down, causing a dip in traffic and sales.

Yes, based on trends, the data shows that we can expect the rest of the year to be weaker overall. Why? Consumer spending is slowing down, causing a dip in traffic and sales.

There is a strong correlation with the population growth seen in the US.

The more population we see in a given area, the less of a decline there is in traffic.

And on the contrary? The less population we see in a given location, the weaker traffic becomes.

Then, with local conditions, unemployment rate, income growth, and poverty rate– It spells out even more bad news.

In a survey, consumers indicated trading down to less expensive options. 23% of consumers said they were trading down specifically to grocery and convenience stores.

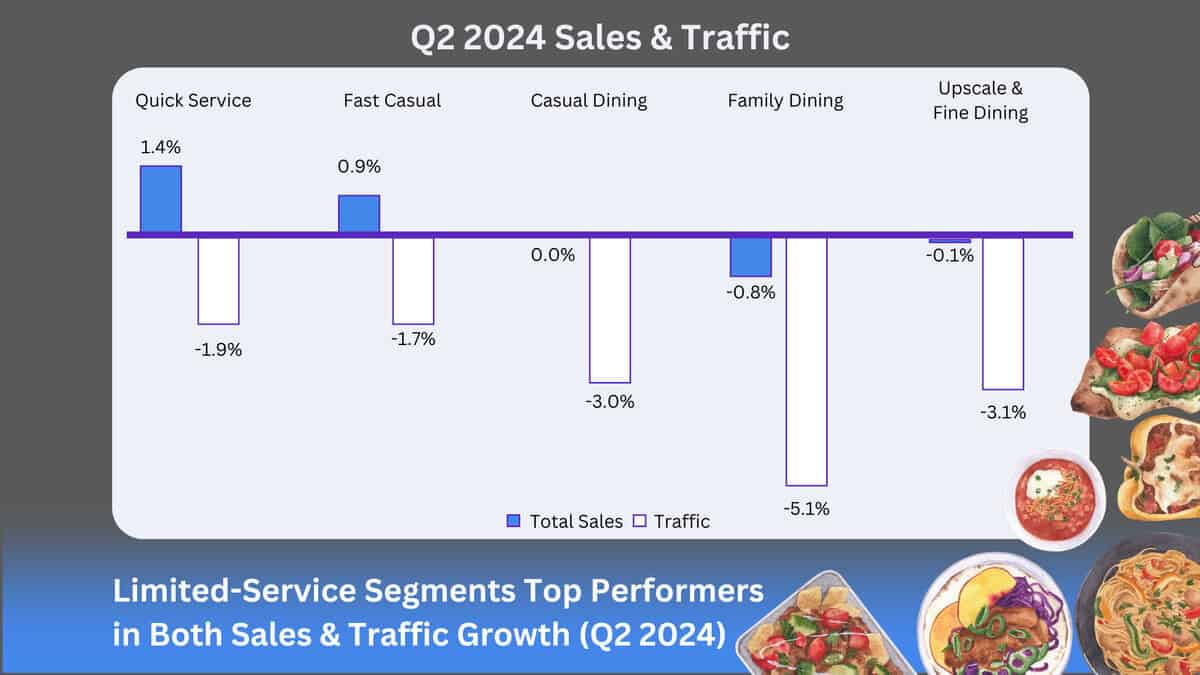

That is also why it’s no surprise that limited service is performing better than the rest of the industry. Quick-service restaurants (QSR) and fast-casual restaurants are the only two segments seeing positive comp sales.

With a roughly 16-point loss in traffic, there is a decline in traffic in all segments regardless of the state.

In a survey, consumers indicated they are actively seeking out less expensive options – with 23% of consumers saying they were trading down specifically to grocery and convenience stores.

That is also why it’s no surprise that limited service is performing better than the rest of the industry.

Quick-service restaurants (QSR) and fast-casual restaurants are the only two segments seeing positive comp sales.

So, why aren’t consumers spending?

2. Guests Are Saving Their Dough

First, let’s set the scene. In 2024, consumers have a lot on their plates.

No pun intended.

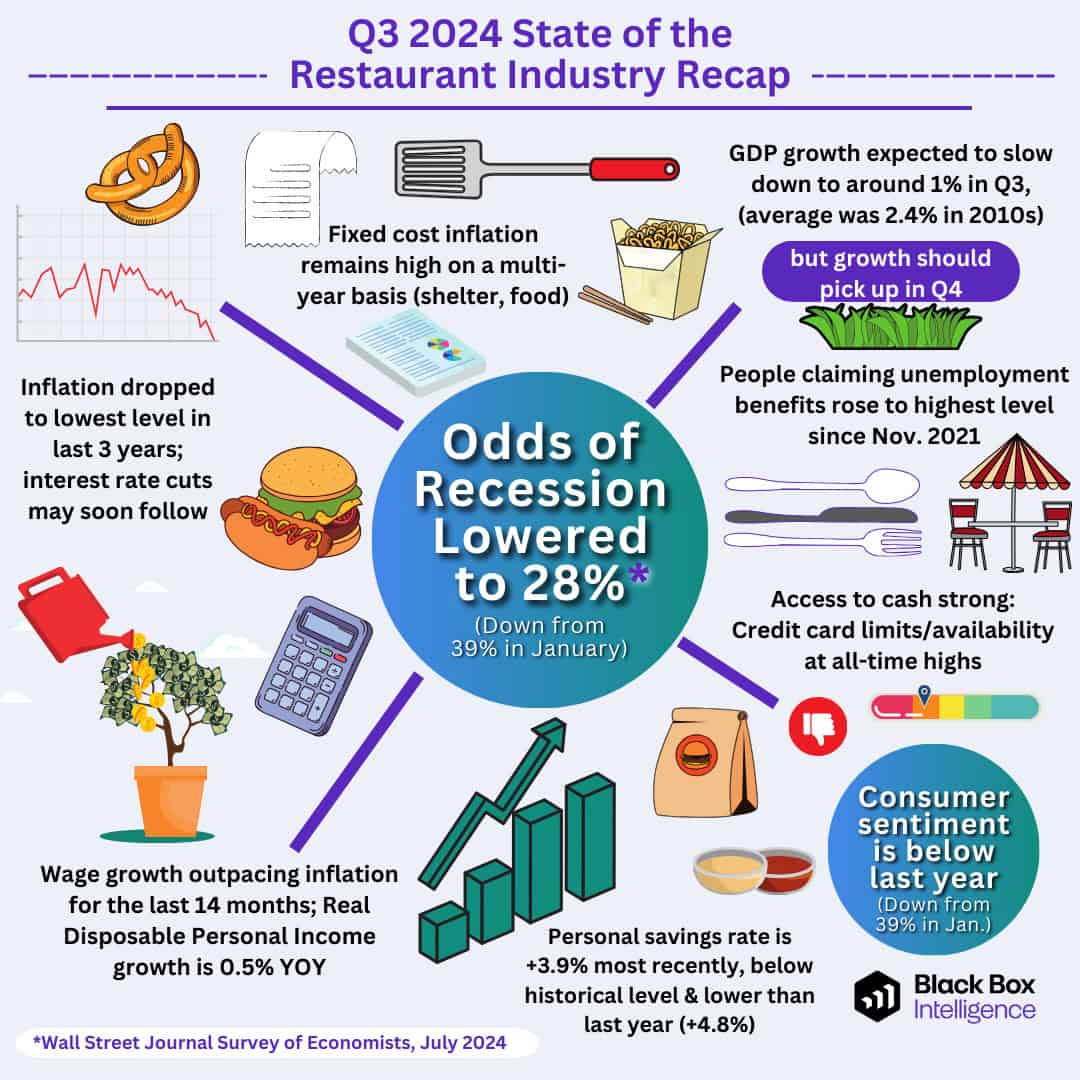

With increased unemployment claims, declining consumer sentiment, and other economic challenges, it’s no surprise consumers are becoming more “choosy” about where they want to eat.

However, the problem isn’t disposable income.

There is actually room for new spending, with a 0.5% yearly growth in real disposable income.

-

Inflation is at its lowest in the last three years

-

Higher credit limits are available.

-

There is more money to spend.

So, you may say: “If there is more disposable income, why aren’t they spending?”

The truth is that prices are still significantly higher than a few years ago.

And the consumer still feels it in their wallet.

But luckily, people still love restaurants.

And we have got the data to prove it.

Looking at the percentage of spending captured by food service and drink places, we can still see huge wins.

The majority of food and beverage expenditures come from dining out. This is even when stacked up against grocery and liquor store purchases.

That means the industry is still capturing the bulk of consumers’ extra income.

So, how can we get even more consumers back and spending?

3. Guest Experience is King: The Way to Increase Sales

If you want more sales, you must give your guests a phenomenal experience.

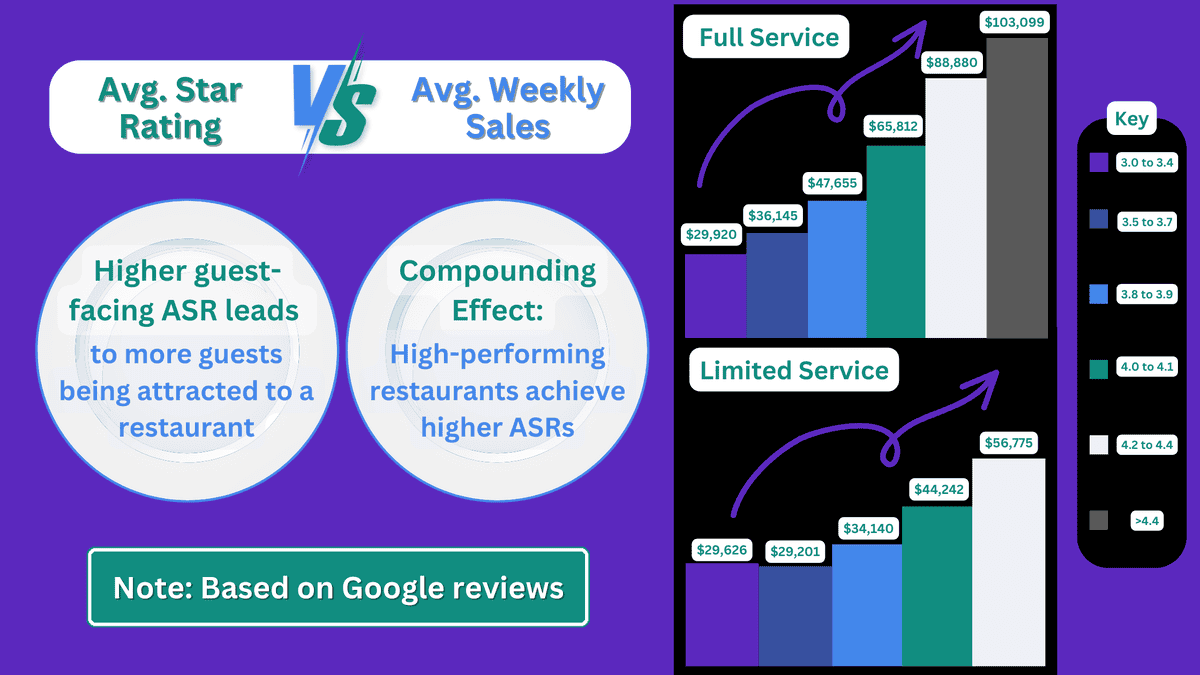

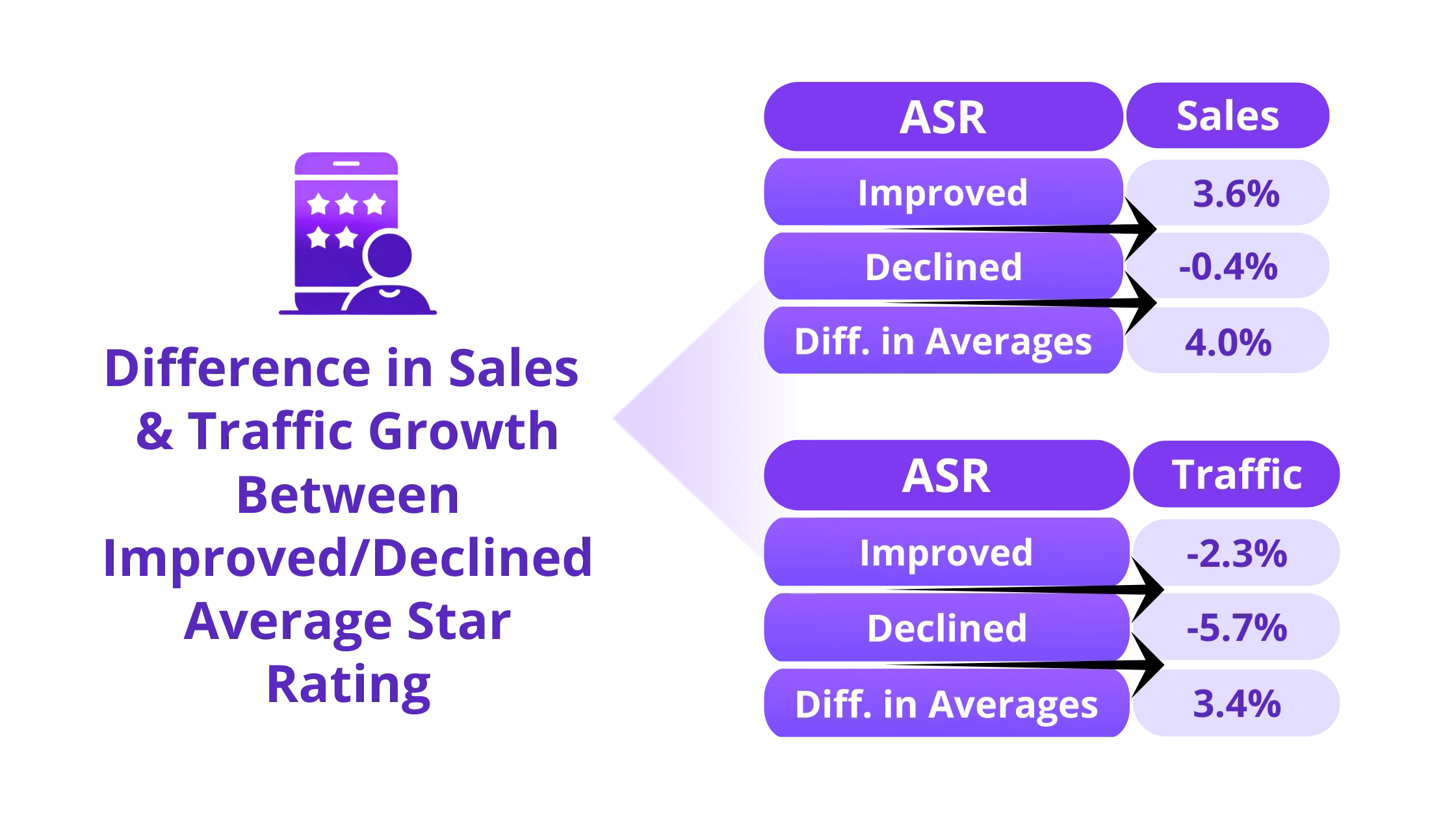

Whether you are in limited service or full service, the data shows that higher average star ratings (ASR) are strongly associated with increased weekly sales.

Restaurants focusing on improving their guest experience (and ASR by proxy) can expect substantial financial benefits.

We compared the impact ASR had on sales and traffic in the first half of 2024 to 2023.

When we broke down the data, we saw that a 3.1% increase in annual sales could represent an additional $39k for a QSR unit and $125k for a Casual Dining unit. That is massive!

That being said, it’s easier said than done. How do you make impactful changes in your business if you don’t know how to move the needle? Use data to guide your efforts.

Restaurants focusing on improving their guest experience (and ASR by proxy) can expect substantial financial benefits.

We compared the impact ASR had on sales and traffic in the first half of 2024 to 2023.

Star ratings significantly impact a business’s performance. They often create the first impression for potential customers, whether good or bad.

Think about what you do when looking for a place to eat. Are you looking at reviews to see what’s good in your area?

Then, you can almost guarantee your customers are doing the same.

And customers searching for a business online will likely see the company’s average star rating on Google first.

These ratings are not just valuable statistics—they are among the most essential factors in predicting a business’s success.

Conclusion

It’s clear that our industry faces both challenges and opportunities.

What is the main takeaway from the Restaurant Industry Insights for 2024?

Despite caution around money, consumers are in a position to spend right now… but only for the right experience.

The key to unlocking greater success lies in enhancing guest satisfaction.

Data indicates that ASR must be prioritized.

And while economic headwinds persist, restaurants can thrive.

By leveraging data and prioritizing guests, Brands can tap into the enduring love for dining out.

As the industry adapts, the commitment to excellence will pave the way for future success.

We are running a recap webinar of our Q3 State of the Industry live.