Restaurant Glossary

Break-Even Point

Definition:

The Break-Even Point in the restaurant industry is the level of sales at which total revenue equals total costs, resulting in neither profit nor loss.

When a restaurant hits its Break-Even Point, it has covered all its fixed and variable expenses.

Understanding and calculating the break-even point is crucial for restaurant operators to determine how much they need to sell to avoid losses and start generating profit.

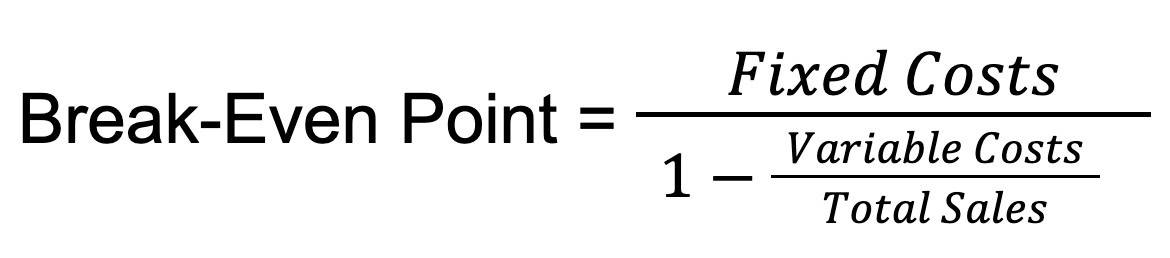

Formula:

To calculate the Break-Even Point in sales dollars, use the following formula:

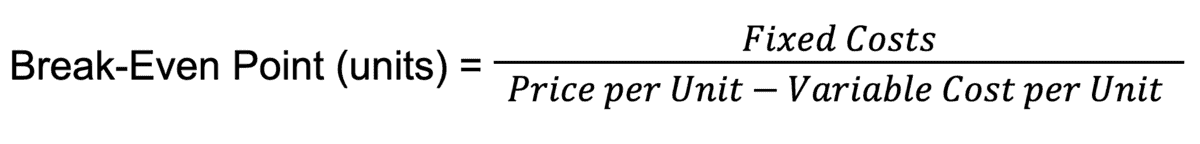

Alternatively, to calculate the Break-Even Point in units (e.g., number of meals), use:

Why It Matters:

- Financial Planning:

Knowing the break-even point helps restaurant owners and managers make informed decisions about pricing, budgeting, and financial projections.It serves as a baseline for setting sales targets and monitoring financial performance.

- Cost Management:

Understanding the break-even point allows restaurants to evaluate their cost structure.

By analyzing fixed and variable costs, operators can identify opportunities to reduce expenses and improve profitability.

- Pricing Strategy:

The break-even analysis informs pricing decisions by showing how different price points impact the sales volume needed to break even.

Restaurants can adjust their pricing strategies to ensure they cover costs and achieve desired profit margins.

- Investment Decisions:

Before investing in new equipment, expanding the menu, or opening a new location, restaurant owners can use break-even analysis to assess whether the potential increase in sales will justify the investment.

Example in Action:

A small café calculates its fixed costs (rent, utilities, salaries) to be $10,000 per month.

The variable costs (ingredients, packaging) are $5 per meal, and the average price per meal is $15.

Using the break-even formula, the café determines it needs to sell 1,000 meals per month to cover its costs and break even.

With this information, the café can set realistic sales targets and consider ways to increase revenue, such as introducing higher-margin items or promoting catering services.

Additional Resources & Related Terms

- Fixed Costs:

Expenses that remain constant regardless of the level of sales, such as rent, salaries, and insurance. - Variable Costs:

Costs that fluctuate with sales volume, including ingredients, packaging, and hourly wages. - Contribution Margin:

The difference between the selling price of a product and its variable cost, which contributes to covering fixed costs and generating profit. - Profit Margin:

The percentage of revenue that remains as profit after all expenses are deducted, reflecting the restaurant’s financial health.

Conclusion:

The Break-Even Point is a fundamental financial metric for restaurants, providing insight into how much they need to sell to cover costs and start making a profit.

By understanding and regularly calculating their break-even point, restaurant operators can make informed decisions about pricing, cost control, and strategic investments, ultimately leading to greater financial stability and success.