Out of the Box: Monthly Restaurant Industry Update

Restaurant Industry in Review: Trends from October 2024

OCTOBER: BY THE NUMBERS

The restaurant industry started turning a corner in August and September.

And recovery for the industry is continued into October.

Now, two consecutive months of positive growth have been logged.

Additionally, early November data is hinting at a likely third.

Here are the most significant October 2024 Restaurant Trends.

And, more importantly, what they mean for restaurant leaders.

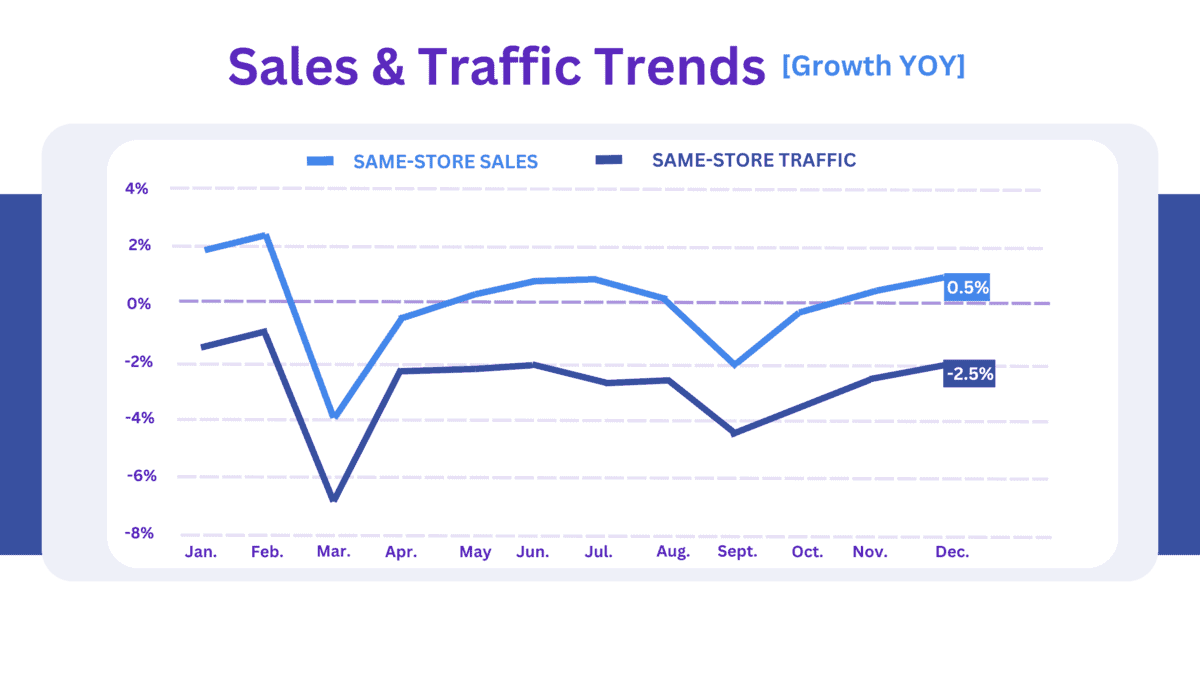

| Month | Nov. ’23 | Dec. ’23 | Jan. | Feb. | Mar. | Apr. | May | Jun. | Jul. | Aug. | Sept. | Oct. |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Comp. Sales | +1.9% | +2.3% | -4.5% | -0.6% | +0.1% | +0.6% | +0.4% | -0.1% | -2.3% | -0.4% | +0.4% | +0.5% |

| Comp. Traffic | -1.5% | -0.9% | -7.1% | -2.3% | -2.2% | -2.3% | -3.1% | -2.8% | -4.6% | -3.6% | -2.7% | -2.5% |

Same-Store Sales Growth: Turning the Tide

October’s same-store sales growth reached 0.5%.

This marks a modest but critical improvement over September.

It’s the strongest month since May 2024.

Therefore underscoring a positive shift in consumer spending patterns that is much needed.

This is especially true after July’s low of -2.3% and August’s near-flat performance (-0.4%), which painted a challenging picture.

The recent uptick suggests that the industry may be in full-fledged recovery mode.

Traffic Growth: Progress Amid Persistent Challenges

Traffic growth remains a critical area of focus.

In October, same-store traffic growth was -2.5% YOY—still negative, but an improvement of 0.2% from September.

This made October the strongest month since April in terms of traffic recovery.

Despite the October 2024 restaurant trends gains, the industry still faces hurdles in driving foot traffic.

Consumers seemingly continue to weigh discretionary spending.

Therefore, restaurants need to balance providing value while keeping operational costs in check.

Average Check Growth: Balancing Price and Value

Average check growth held steady at 3.1% YOY in October.

Meanwhile, the average for all months in 2024 is a slightly lower 2.9%.

This is a result of restaurant companies being much more conservative with their menu price increases this year.

As a comparison, average guest check increased by a much higher 5.4% in 2023 and an unusually large 9.0% the year before.

Thus, in the recent past, we have seen more aggressive pricing for value offerings.

This year’s moderation reflects a strategic shift: restaurants are prioritizing value.

And they are doing so through conservative menu price increases and enhanced affordability.

While this benefits consumer perception, it also requires brands to manage margins with even more precision.

Segment Performance: Value-Driven Success

The standout performers in October were the fast casual and quick service segments.

This is aligned with brands’ push to emphasize value and competitive price points.

Limited-service restaurants have consistently outpaced the broader industry in recent years.

Conversely, casual dining and fine dining segments experienced a decline in traffic growth YOY.

We suspect these October 2024 restaurant trends point to the challenges of attracting diners amid heightened competition.

Value Sentiment: The Key to Traffic Growth

While price is a component, value encompasses much more:

- Quality

- Service

- Experience

- Overall brand trust

October data highlights that brands with strong guest sentiment around value are better positioned to retain and attract traffic.

Conclusion

October 2024 marked a pivotal month for the restaurant industry.

It shows positive same-store sales growth and improving traffic trends.

Segments that are outperforming the industry proved that Value-Driven Strategies are crucial.

As we look ahead, restaurateurs should continue to focus on leveraging data to refine strategies and enhance guest experiences.

For deeper insights into how your brand measures up, check out our suite of products that provide a far more up-to-date deeper and customizable insights on the restaurant industry for restaurant brands.

Talk to an expert about actionable opportunities for your brand below.