Restaurant Industry Snapshot™ – January 2021

Industry Comp Sales & Traffic

The restaurant industry experienced a jump in sales growth in January driven by an acceleration in average spend per guest. At -4.9%, comp sales in January were the best month for restaurants since March of 2020. While these numbers are encouraging at a glance, closer inspection reveals that sales worsened throughout the month, likely related to the effects of stimulus checks wearing off as the weeks progressed.

Limited-service brands continued to fare better than full-service counterparts, posting sales growth of 8.2% in January. Full-service brands experienced losses of -14.7% year over year. The mid-afternoon daypart is still the best-performing daypart for all segments. Dinner was the second-best performing daypart in January, with sales growth of -5.3%.

Regional & Market Performance

The sales upswing was apparent in all states, as all fifty improved comp sales growth from December. Additionally, 15 states were even able to post positive sales growth in January.

The Southeast, Southwest, Mountain Plain, Florida, and Texas were the best-performing regions in January. The Southeast region was able to post positive comp sales in January, at 4.08%, compared to -4.73% in December. California continued to struggle with sales losses of more than 40% over the last two months.

The Restaurant Workforce

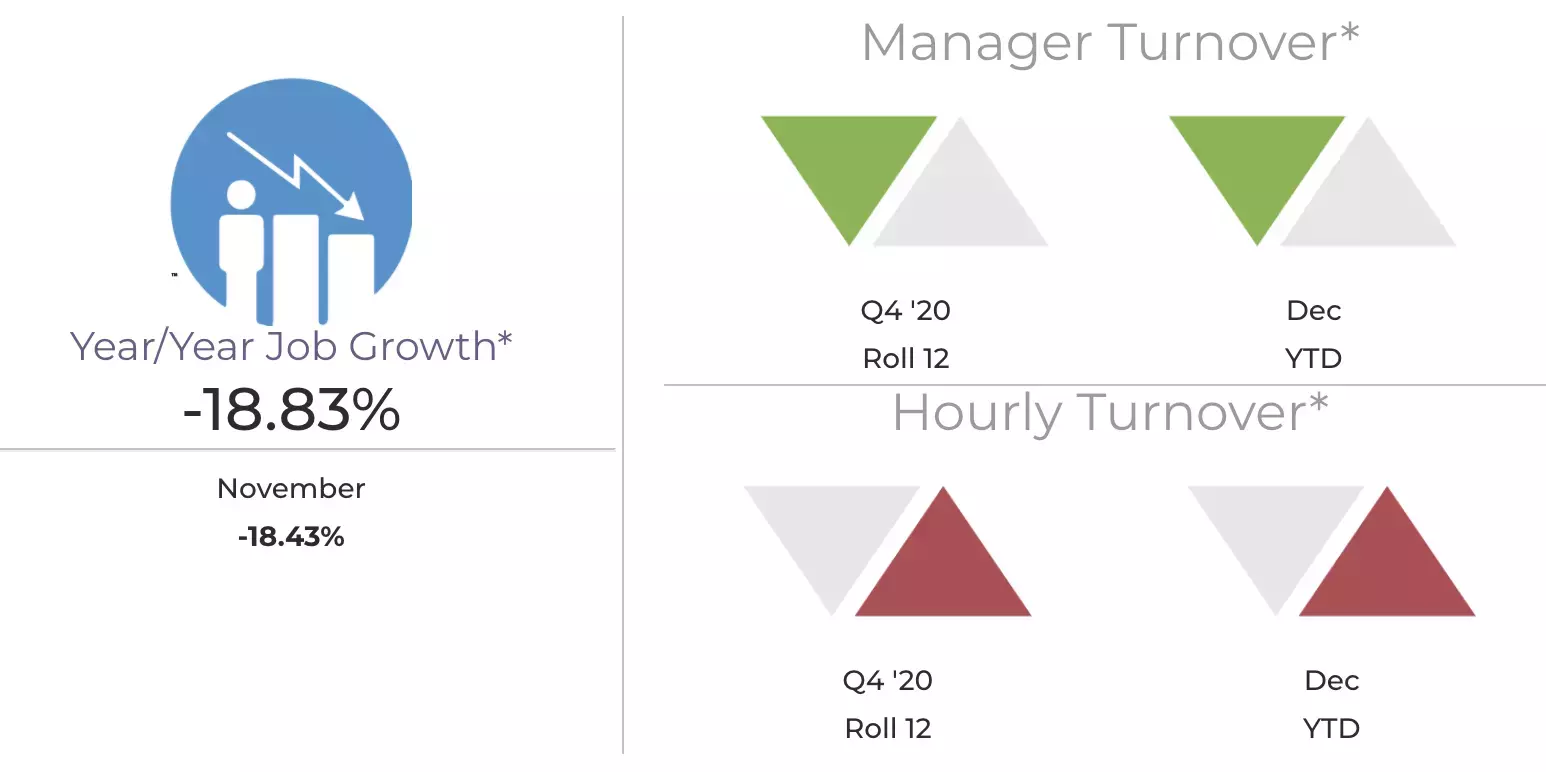

Job Growth & Turnover

The restaurant industry still has over 2.3 million jobs unfilled according to the Bureau of Labor Statistics. Across all segments, restaurants are operating at lower staffing levels than they did pre-COVID. Limited service brands are operating with one less non-management employee per location.

Staff cuts are much larger for full-service brands. The average number of front-of-house staff reduced by about 9 for full-service restaurants in Q4 2020, and 3 for back-of-house.

January sales brought welcome good news to the restaurant industry after a disappointing end to 2020. To achieve pre-pandemic performance, restaurants still have a substantial sales gap to close; nonetheless, the industry is headed in the right direction. January’s same-store sales growth was the best month for the industry since March, at -4.9%. In October 2020, the industry climbed up to same-store sales growth of -6.5%, only to fall back to growth rates of -10% or worse for the last two months of the year.

This big jump in sales growth was driven by an acceleration in average spending per guest. Average spend per guest/transaction grew by 7.5% year over year in January, up from 6.2% growth in December and 6.7% in November.

With an 8.4 percentage point boost over December, sales improved at a faster pace than traffic during January. Same-store traffic growth for the month was -12.2%, the best result for the industry since February 2020.

The topline numbers for sales and traffic recovery fuel newfound optimism for restaurants, however, closer examination of the weekly results reveals the industry is not out of the woods yet. For example, same-store sales growth for the first week of the year peaked at an impressive -3.6%, the first time the industry was able to break the -5.0% mark in year-over-year sales growth since the first week of March. However, same-store sales growth worsened in the following weeks. The last week of January posted results of -8.3%, performance lows we haven’t seen since September or October.

The initial boost in sales created by stimulus check distribution and optimism for a new year may wear off a bit throughout the month and January’s strong performance may prove hard to beat in upcoming months.

QSR and Fast Casual Segments Achieve Positive Sales Growth for First Time

While full-service restaurants* experienced same-store sales losses of -14.7% year over year in January, limited-service** brands achieved robust growth of 8.2% during the month; the first time both segments saw positive sales results.

Previously, it had only been quick service that had posted positive sales results year over year. The growth rates experienced by both these segments exceeded anything seen in many years, emphasizing how current times favor those in limited service.

In full-service, casual dining continues to outperform, while the worst same-store sales are found in fine dining and family dining. These two segments have been at the bottom of sales growth each month since July.

*Full-service segments: family dining, casual dining, upscale casual and fine dining

**Limited-service segments: quick service and fast casual

Restaurants Open for Dine-In Jumps to Highest Levels Since April

7% of all chain restaurant locations in operation before COVID hit remain completely closed. The percentage is similar for full-service and limited-service restaurants, despite the latter having fared much better. This suggests that restaurant chains may have evaluated their portfolio of restaurants early in the pandemic and used the situation as an opportunity to permanently close underperforming locations.

There are some wider differences in the percentage of restaurants that are open for dine-in service. For full-service restaurants, virtually all restaurants that are open in any capacity are offering dine-in for guests. But in limited service, about 20% of all restaurants that are in operation are doing so through off-premise* sales only.

The best news is that the percentage of restaurants open for dine-in improved for all restaurants compared to December and is at the highest levels measured since April. This is especially true for full-service restaurants which traditionally depend heavily on dine-in sales. This is likely a driving factor behind January’s strong results.

*off-premise sales: to-go, delivery, drive-thru (where applicable)

Dine-In Sales Recovery Continues, Off-Premise Still Rapidly on the Rise

Dine-in sales continue to be the biggest challenge for restaurants. Same-store year-over-year dine-in sales growth was -50.9% in limited-service and -33.7% in full-service during January. Though far from being able to close the gap to where they were a year ago, all industry segments saw an improvement in their dine-in same-store sales growth during the month. The biggest gains in dine-in sales growth performance were in fine dining, family dining, and upscale casual. All posted double-digit improvements in their dine-in sales growth compared to December.

It’s anticipated that it will likely take the arrival of warmer Spring weather, further decline of COVID cases, and increases in vaccinations for guests to feel more comfortable dining in and for performance levels to return to pre-pandemic numbers. This is particularly true in areas of the country where outdoor dining is virtually eliminated during the winter months.

Meanwhile, off-premise sales continue growing at a very rapid pace year over year. During January, off-premise growth for limited service was 30% year over year, an acceleration of almost 7 percentage points from December’s growth. In full-service, results continue to more than double, and sales growth was 126.1% in January; up by 13 percentage points from December.

Mid-Afternoon Daypart Grows, Dinner Posts Best Result in the Pandemic Era

After two months of sales declines, mid-afternoon sales returned to strong year-over-year results in January and continue to be the best-performing daypart. Although strongly attributed to fast casual and quick service performance, this trend is widespread throughout the industry and is expected to continue.

All industry segments experienced their strongest sales growth in the mid-afternoon daypart during January.

In what is undoubtedly great news for most restaurant concepts, the second-best performing daypart in January was dinner, with same-store sales growth of -5.3%. Restaurant sales continue struggling most at lunch and the late-night daypart. Late night has consistently been the worst-performing daypart throughout the pandemic. In January, same-store sales for the daypart were down more than 25% signaling an unlikely rebound to pre-pandemic levels any time soon.

All States Improved Sales During January Restaurant Employment Far from Full Recovery

The upswing in restaurant sales was widespread throughout the country, with all fifty states improving their same-store sales growth in January compared to their December results. Furthermore, fifteen states were able to post positive sales growth during the month.

The best-performing regions of the country during January based on same-store sales growth were the Southeast, Southwest, Mountain Plains, Florida, and Texas. All of them had year-over-year sales growth better than -5%. The Southeast has consistently been the best in the country in recent months.

The worst-performing regions were California, New England, New York-New Jersey, the Western and the Mid-Atlantic. All are still experiencing sales losses of over 10% year-over-year. California, which has been the worst-performing region since November, sales losses are much worse at more than 40% in the last two months.

Restaurant Employment Far from Full Recovery

As of January, over 2.3 million restaurant jobs that existed before the pandemic still have not been filled according to the Bureau of Labor Statistics. The number of restaurant jobs in January was down by almost 450,000 compared to the COVID-era peak reached in October.

Those restaurants that are open continue operating with lower staffing levels than they did pre-COVID. As of Q4 of 2020, the median limited-service brand operated its restaurants with one non-management employee less per location compared to their 2019 staffing levels. The number of managers per location remained essentially flat.

For full-service restaurants, the staff cuts remain higher. The average number of front-of-house non-management employees was reduced by about 9 in Q4 2020 compared with 2019, while the cut for back-of-house employees was only about 3. This is reflective of the sharp shift in full-service restaurants to a much larger mix of off-premise sales, which started increasing again towards the end of the year. In the case of managers in full-service, there was some change observed, with the average location now operating with 0.5 fewer managers.

Economy on The Right Track to Get Us to the “Next Normal”

Economic growth slowed in the last quarter of 2020 and that moderation has spilled into this year. Job gains in January were modest, after having declined sharply in December. “Still, there are reasons to be optimistic,” said Joel Naroff, president of Naroff Economic Advisors. “A massive new stimulus bill is in the works. While we can debate how much needs to be spent, the economy is not ready to stand on its own.

“When coupled with the over $900 billion package approved in December, whatever funding level that gets passed should take us through the end of the year,” Naroff continued. “By then, enough of the population should be vaccinated so that the government can withdraw from its role as chief economic force. But the vaccination process needs to be accelerated. Two more vaccines are close to being approved and that should ease the supply shortage. We still have a way to go before we get to the next normal, but the forces are being put in place to get us there.”

Looking Ahead

Challenging Times Ahead: Winter Storms and the Restaurant Recovery Path

In February the industry will face a challenge we had largely avoided thus far, with winter storms hitting large regions and much colder weather sweeping across most of the country. Restaurant sales typically feel the impact of this kind of temperature drop, but this year the effect may be amplified given the reliance on outdoor dining in regions that had experienced a very mild winter so far.

But with all the macroeconomic trends pointing in the right direction and the prospect of additional government helping boost consumer confidence, there is newfound optimism for continued restaurant recovery in 2021. However, January’s improvement may not be a good indicator of how quickly sales growth will accelerate going forward.

Consumer restaurant spending eroded a bit during January after the initial spike when the first stimulus checks went out. Restaurant sales growth results for the end of the month underperformed what was recorded for the first weeks of the year. This suggests restaurant sales will continue improving in 2021, but the path may not be as swift or direct as we’d like. And it will likely be next year when the industry can reach pre-pandemic sales levels.