Performance Snapshot: Sales, Traffic, and Check Growth

April Marks Strongest Sales Month of 2024

Although April was the strongest month for same-store sales so far this year, sales growth remains weak compared to the 1.9% average seen in the second half of 2023.

Traffic Growth Experienced a Slight Uptick

While sales growth has decelerated considerably in recent months compared to last year, same-store traffic growth continues to hold up better. The average traffic growth for the second half of 2023 was -2.1%. Excluding December’s boost from favorable weather, the average is -2.3%, identical to April’s rate.

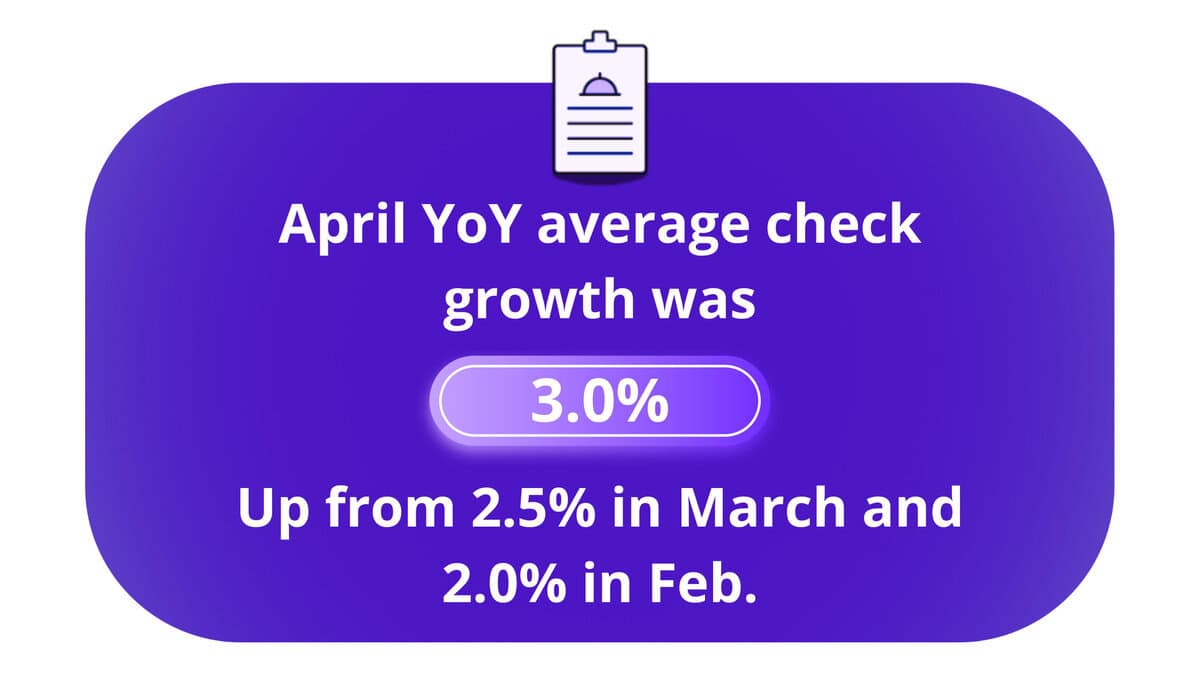

Check Growth Remains Low Compared to 2023

Even with this uptick, check growth remains lower compared to what we saw in 2023. It’s also important to note that April’s increase in check growth is the key driver behind the gains in same-store sales for the month.

Limited Service Outperformed Other Segments

The standout performers in the industry based on YoY same-store traffic continue to be those classified under limited-service restaurants: Quick service and fast casual, despite posting negative traffic growth in April, outperformed other segments and are expected to continue leading the pack this year (given their lower price points amid softening economic conditions).

Understanding the Consumer in 2024

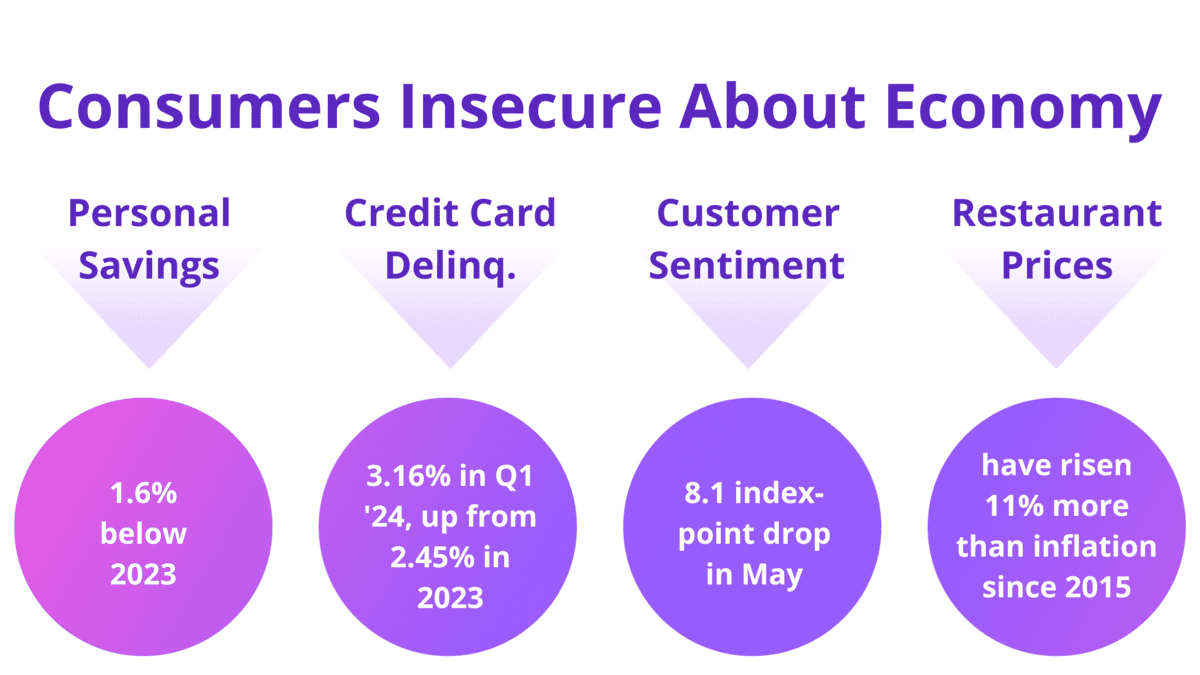

The economic landscape is a mixed bag. The US has managed to avoid a recession so far, and employment numbers remain robust. But the average person continues to feel insecure: The personal savings rate is 1.6% below last year, the delinquency rate on credit card loans increased from 2.45% in Q1 2023 to 3.16% in Q1 2024 (a rate not seen since the Great Recession), and May saw an 8.1 index-point decrease in consumer sentiment, the lowest in five months.

The economic landscape is a mixed bag. The US has managed to avoid a recession so far, and employment numbers remain robust. But the average person continues to feel insecure: The personal savings rate is 1.6% below last year, the delinquency rate on credit card loans increased from 2.45% in Q1 2023 to 3.16% in Q1 2024 (a rate not seen since the Great Recession), and May saw an 8.1 index-point decrease in consumer sentiment, the lowest in five months.

Most importantly, consumers are tired of inflation devaluing their hard-earned dollars. Since 2015, restaurant prices have risen 11% more than overall inflation.

As a result, the industry has seen declining traffic and trade downs over the past several years. However, despite outperforming all other segments, quick-service restaurants are starting to become too pricey for a significant percentage of their customer base.

According to a February poll by Revenue Management Solutions, roughly 25% of low-income consumers (earning less than $50,000 annually) are eating less fast food.

And when quick service becomes too expensive, consumers turn to groceries instead. Walmart, for example, has noted a rise in grocery purchases.

Consumers Primarily Value . . . Value

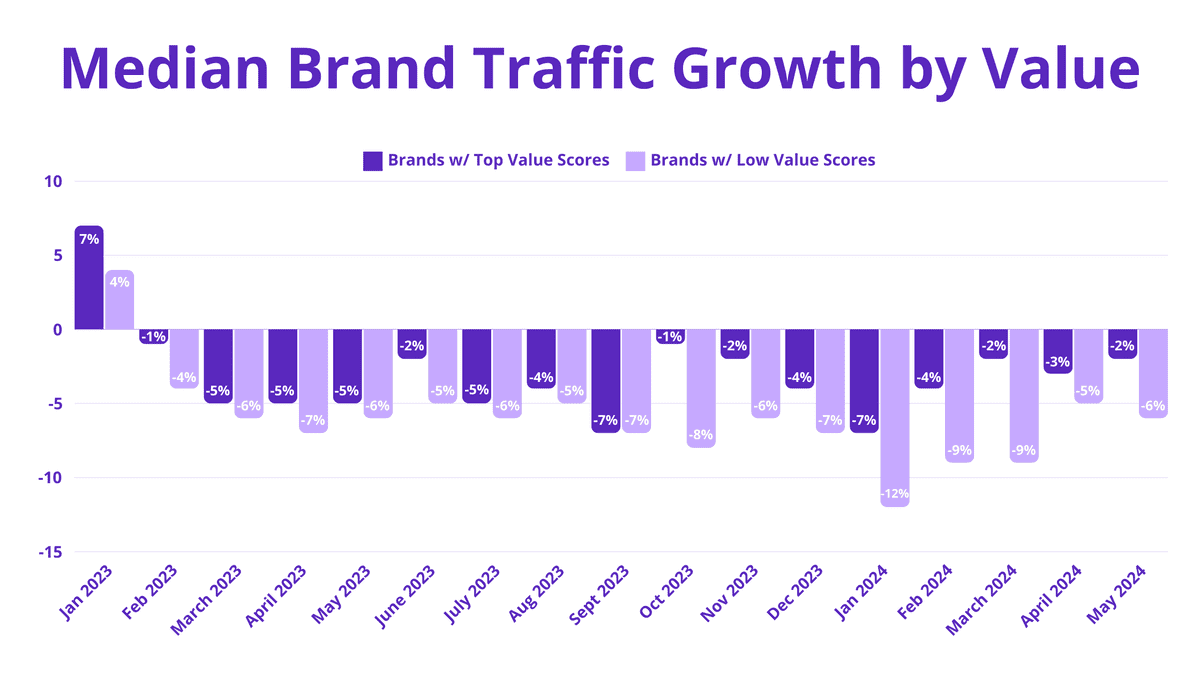

Over the past several months, value has been a running theme among consumers. From earnings calls to potential strategy shifts, value is a current focus of restaurant executives. Black Box Intelligence is no exception and has been beating the value drum over and over since the rise of inflation.

Over the past several months, value has been a running theme among consumers. From earnings calls to potential strategy shifts, value is a current focus of restaurant executives. Black Box Intelligence is no exception and has been beating the value drum over and over since the rise of inflation.

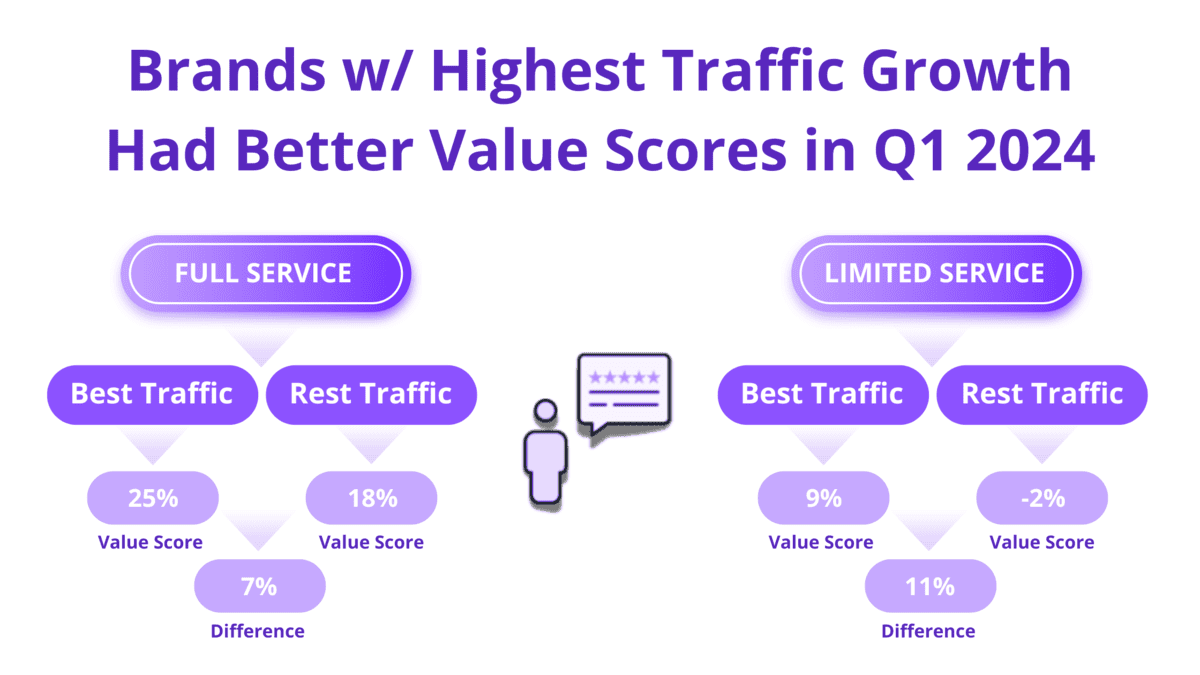

According to our data, in terms of traffic growth, value is no longer important but essential: brands with the highest traffic also have the best value scores.

When we look specifically at casual dining, “value brands” or brands that emphasize deals experienced a 4% higher increase in traffic growth compared to the rest.

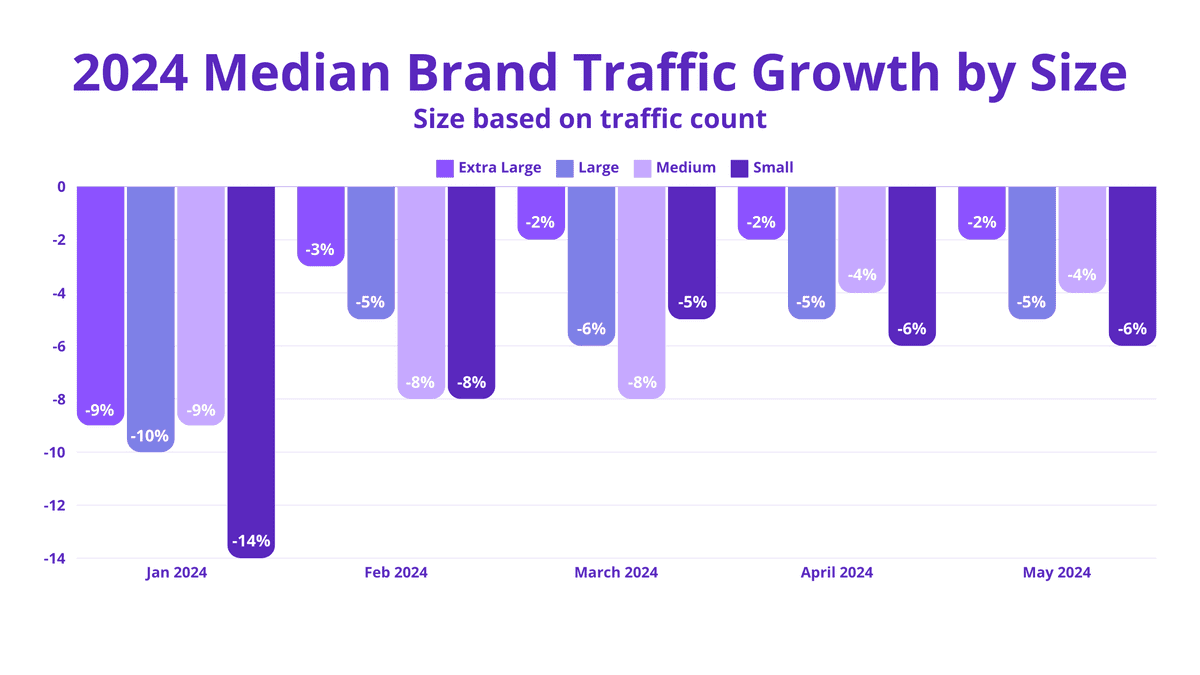

Size Matters

Large brands seem to have some advantages over smaller brands when it comes to value:

Large brands seem to have some advantages over smaller brands when it comes to value:

- Extra-large brands in the casual dining sector have been outpacing smaller competitors by about 3% in YoY traffic.

- A likely reason is that a larger marketing budget allows them to get the word out on deals and drive traffic. Also, as inflation rises, they are in a better position to negotiate better prices than smaller businesses.

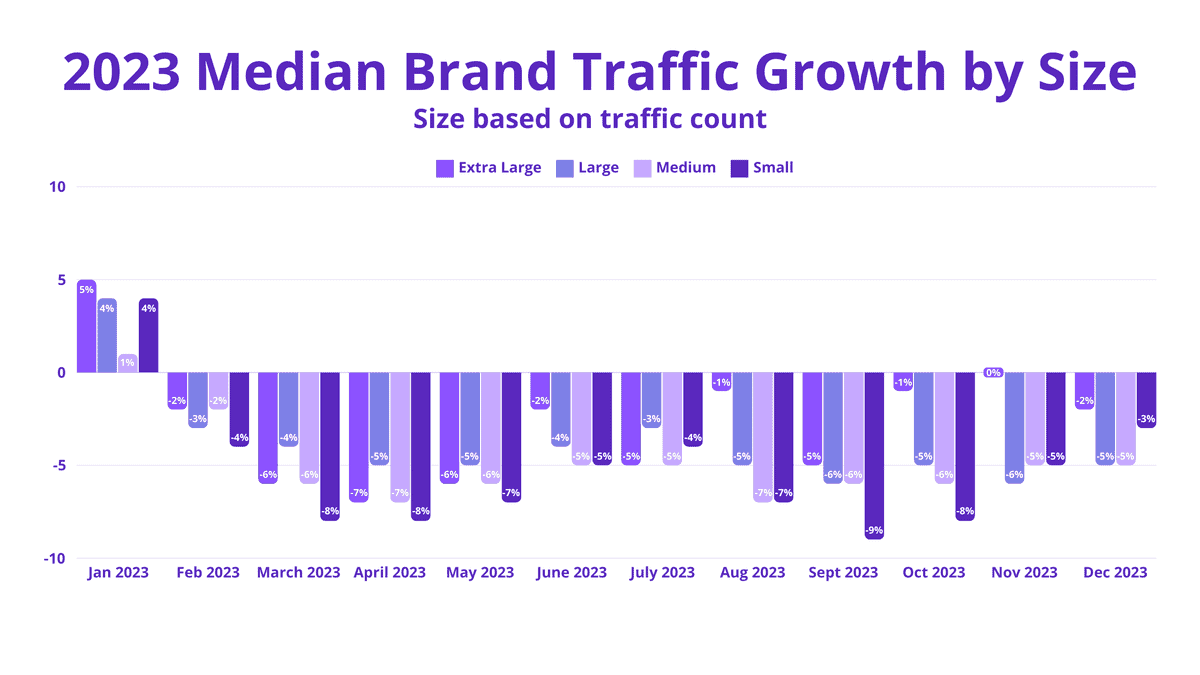

For reference, here are last year’s numbers:

A Short-Term Solution with Long-Term Consequences

The current environment has led some brands to prioritize profits over customer traffic. Traditionally, restaurants focused on increasing customer numbers to boost sales, but rising costs have forced them to raise menu prices instead.

But this strategy risks eroding the customer base and threatening long-term sustainability, especially if competitors swoop in with lower prices to attract customers.

Striking a Balance Between Raising Prices and Delivering Value

Raising menu prices requires caution. New research from TouchBistro reveals that while inflation has eased, customers are still feeling the effects of cost-of-living increases (31% say a price hike would significantly impact their choice to dine at a particular restaurant).

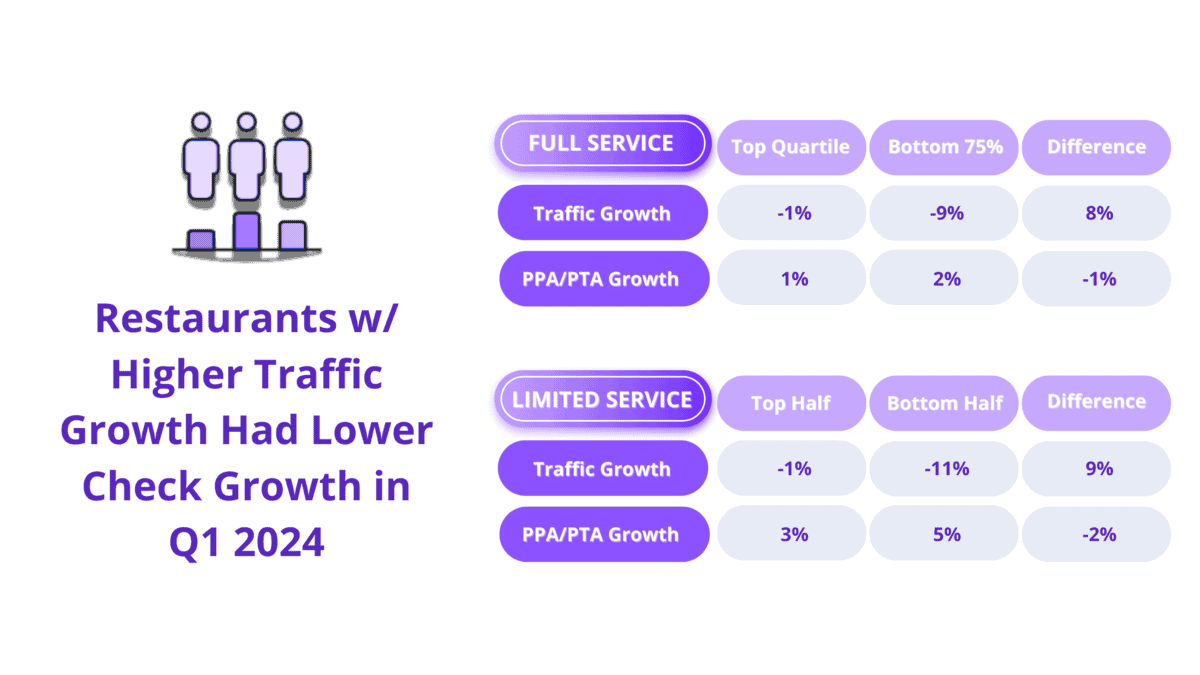

Additionally, based on our data, restaurants with higher traffic growth tend to also have lower check growth:

- In Q1 of 2024, full-service brands in the top quartile for traffic growth had 1% lower check growth than those in the bottom 75%.

- Limited-service brands in the top half for traffic growth had 2% lower check growth than those in the bottom half.

If brands, however, have no choice but to raise prices, their focus should shift to delivering other parts of the value equation. This includes elements such as service, portion size, food quality, cleanliness, speed of service, etc.

To reiterate, brands with the highest traffic also have the best value scores.

But how can restaurants find that sweet spot?

Customers are pretty clear about their needs in the feedback they provide; it’s up to restaurants to use that data to find solutions that benefit both parties.

And rather than reaching for quick wins, brands can leverage current and historical industry insights and trends to truly understand what drives sustained success in the restaurant industry.

Ultimately, we’re all riding this economic seesaw together—customers and businesses alike. By relying on solid data, restaurants can both keep their customers happy and enjoy financial stability.