Restaurant Industry Snapshot™ – May 2021

Strong Recovery in Restaurant Sales, but Traffic Still Faces Uphill Climb

Restaurant sales have recovered in recent months, as well as achieving growth rates stronger than in recent years. Comp sales in May dropped 1.6 percentage points from the results posted in April. Nonetheless, 2-year same-store sales were robust at +5.4% during the month.

With sales posting encouraging results, the attention of operators should turn to increasing traffic at restaurants. While traffic has come a long way from 2020 losses, it has a long way to go to reach positive territory. Traffic for the month was -5.3%.

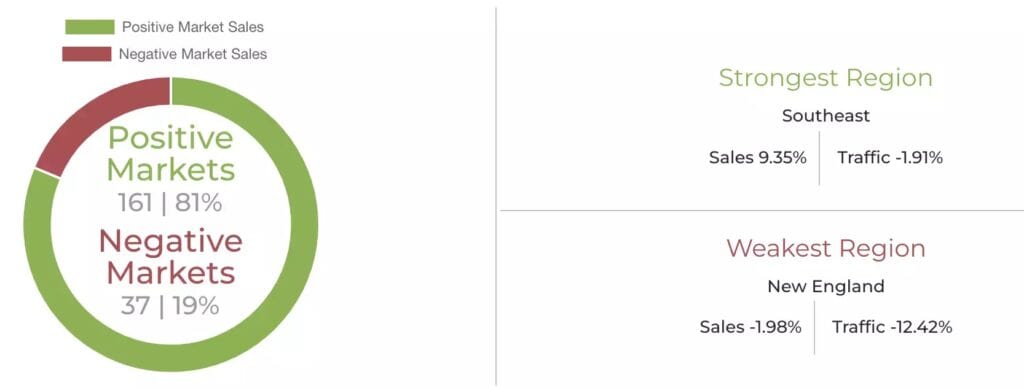

The Southeast region posted a strong 9.35% same-store sales growth, while New England was the worst performer at -1.98%. New England was the only region that experienced negative sales growth during the month.

After struggling with sales growth during the pandemic, California has rebounded significantly. For the second month in a row, same-store sales in the state were positive.

The Restaurant Workforce

Job growth & turnover

While unemployment fell and the food service sector added almost 300,000 jobs during the month, many restaurants still struggle to find employees. Staffing levels are significantly lower at restaurants than they were in 2019.

Staffing pressures have translated into some wage increases at the national level. Hourly wages for quick service employees remain virtually unchanged at the federal level, although there are more than 5% increases in some states.

Check Growth Lifts Restaurant Sales; Traffic Far from Recovering

After three consecutive months of sales stronger than they were back in 2019, the restaurant industry’s recovery from the pandemic remains solid. Thankfully, this recovery came much faster than initially expected. Same-store sales growth was +5.4% during May on a 2-year basis. While robust, sales growth dropped 1.6 percentage points from the results posted in April.

Not only have sales fully recovered in recent months, but they have also achieved stronger growth rates than in recent years. As a comparison, 2-year same-store sales growth for all of 2019 was only +2.4%, while growth has averaged over twice that rate (+4.9%) during the last three months.

Restaurant Traffic Lost Ground During May

Sales headlines give plenty of reason for optimism, but the new metric to focus on during the road to full recovery is traffic. Same-store traffic growth on a 2-year basis was -5.3% for May, a 1.2 percentage point decline from April’s growth. The industry has come a long way from the -22% loss in traffic reported for 2020. Nonetheless, at an average of -6.1% during the last three months, it is far from climbing back to positive territory.

There are currently plenty of tailwinds for existing restaurants, which include: less competition because of restaurant closings, expanded unemployment benefits, significant pent-up demand for dine-out experiences and consumers becoming more confident as the country emerges from the COVID-19 crisis. Even so, this has not been enough to reverse the trend of falling guest counts in comparable restaurants, which has been a constant for the industry for over ten years.

Despite Unusually Large Growth Last Year, Guest Checks Continue Growing Rapidly in 2021

Guest check growth is the driving force behind restaurant sales recovery, as customers are willing to spend more during visits. Growth in average check during May was +11.0% compared to the same month in 2019. Average guest checks continue to grow rapidly year over year, which bodes well for restaurant sales. Average checks in May grew by +4.7% year over year, higher than the 3.2% growth reported back in 2019.

Quick service and fast casual segments grew their guest checks the most compared to May of 2019. These segments have maintained the fastest rate of increase throughout the pandemic with check growth more than double what was recorded for casual dining, upscale casual, and fine dining.

Fine Dining Top Segment in May, Limited-Service Outperformed Most

Fine dining restaurants emerged as the top performer in May based on same-store sales growth. The segment grew by +16.4% compared to its 2019 sales during the month. The combination of strong pent-up demand for higher-end dine-in experiences, coupled with special occasions due to Mother’s Day and graduation season, contributed to the 11.1 percentage point improvement in sales growth for fine dining compared to April.

Limited-service brands continue to outperform most in full-service. Sales growth for quick service and fast casual combined was +11.5% during May, a small slowdown from the +12.6% from April’s results.

Full-service brands had combined sales growth of +1.7% during May, down from the +3.4% posted during April. Full-service restaurants have now achieved two consecutive months of positive sales growth over 2019.

The one area of concern within full-service continues to be family dining, where sales have not yet recovered to pre-pandemic levels.

Dine-In Sales Made Small Progress, Off-Premise is the Driving Force

Restaurant operations are far from recovering dine-in sales. Despite the recent improvements overall, dine-in sales growth remains negative and relatively flat. Dine-in sales fell by 46% in limited service compared to May of 2019, a small improvement from the 49% loss in April.

The situation is similar for full-service, with dine-in sales falling by 15.6% compared to May of 2019. Dine-in sales growth remained essentially unchanged from the -15.7% reported in April.

It has been up to off-premise sales to continue pushing the industry into recovery. For limited-service restaurants, off-premise sales growth was +30.0% during May, which is highly elevated compared to what was common pre-COVID and flat compared to the +30.7% growth reported for April. Off-premise sales in quick service and fast casual are not showing signs of slowing down, as dine-in is demoted in terms of its relative importance for these segments.

The story is similar for full-service restaurants. With +121.4% off-premise sales growth during May 2019, full-service restaurants continue to see skyrocketing growth in their off-premise meals. But contrary to limited-service, full-service restaurants have seen a tradeoff between dine-in and off-premise sales. The latter is growing at an impressive pace, although the rate of increase has begun slowing down in recent months. In May, off-premise sales growth represented a decrease of almost 14 percentage points from April’s growth rate and an 11-point drop from March.

Alcohol Sales Still Far from Recovered

Sales of alcoholic beverages in full-service restaurants were down by 13% compared to May 2019. This represents only a marginal improvement from the 14% lost in April, but a bigger jump from the -19% reported for March.

Despite the recent improvements, alcohol sales still represent a much lower percentage of total sales than they did before the pandemic. The pre-COVID norm for alcoholic beverages was to represent about 14% of total restaurant sales in full-service (excluding family dining). As of May, alcohol sales were only 11.3% of the total, up slightly from the 10.5% reported for April.

Dinner 2nd Best Performing Daypart, Mid-Afternoon Remains at the Top

The mid-afternoon daypart remains the strongest based on sales growth, a trend that started before the pandemic. Good news for full-service restaurants, Dinner has experienced three consecutive months of positive 2-year same-store sales growth with May’s +7.6% improvement. It was also the second-best performing daypart during the last two months.

Breakfast and lunch are more dependent on typical pre-COVID work schedules when fewer people work from home. These dayparts are now posting positive sales growth over 2019, but at +4.8% and +2.5%, respectively, their sales growth is softer than what has been reported for overall sales.

Late night is the daypart that remains the most challenged by the current environment, and the only one with negative sales growth over 2 years.

Top Performing Cuisine Types Shifted During May

Cuisine types classified under “healthy”, sandwiches and steak rose to the top during May from 2-year same-store sales growth. The latter is undoubtedly linked to the resurgence of the fine dining segment in recent months.

Restaurants based on hamburgers, pizza, and chicken posted strong sales performance but were overtaken by those other cuisines during the month.

The restaurant brands based around breakfast menus, as well as Mexican and Italian food experienced softer sales growth during May.

Only New England Saw Negative Sales Growth During the Month

The restaurant recovery continues to be widespread from a geographic standpoint. Only 7 states, plus the District of Columbia, experienced negative sales growth during May.

For the first time since March 2020, only one region of the country (New England) suffered negative 2-year same-store sales growth. In addition to New England, the regions with the softest sales growth during May were New York-New Jersey, the Midwest, and Mid-Atlantic.

California’s sales have rebounded strongly and posted two consecutive months of positive 2-year same-store sales growth. This is a huge accomplishment for a region that was frequently considered the worst-performing throughout the pandemic period.

The regions with the strongest 2-year sales growth during May were the Southeast, Florida, the Southwest, and the Western region (excluding California). The first three have been commonly found among the best-performing regions over the last year.

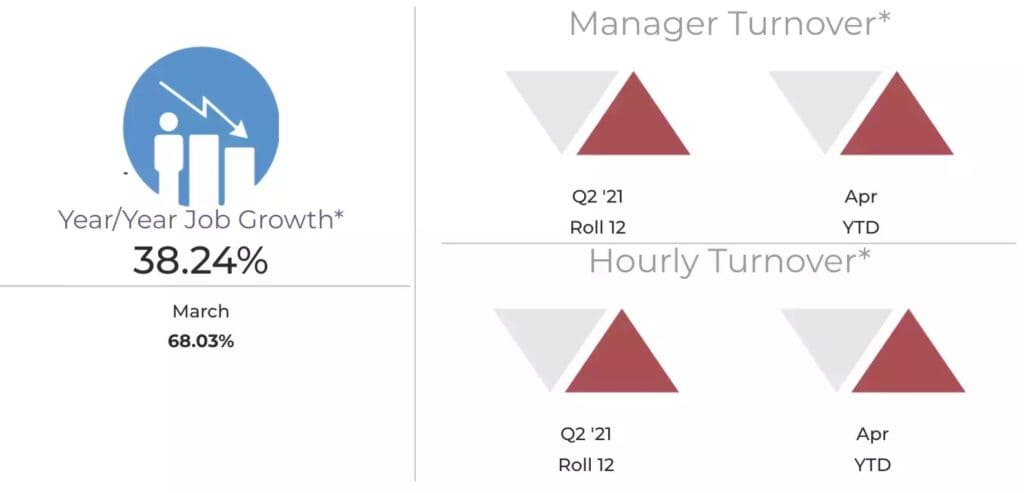

Restaurants Remains Understaffed Despite Employment Growth

The labor market continues to strengthen rapidly. According to the official numbers by the Bureau of Labor Statistics, hiring picked up in May and the economy added a total of 559,000 new jobs. As a result, the unemployment rate fell to 5.8%. Furthermore, it was once again the food service sector that led to job growth during the month. Food service and drinking places added 292,000 jobs during the month.

Solid employment notwithstanding, local markets can differ greatly. We continue to hear from many companies struggling to fully staff their restaurants. As of April, we are still seeing lower staffing levels than in 2019. Though many of the staffing cuts were intentional and necessary at first, as restaurants have been ramping up operations to 100% capacity in many parts of the country (and in the case of limited-service posting unprecedented sales growth for many months), it is hard not to imagine a situation in which cuts are at least partially driven by the staffing crisis.

The median restaurant company in limited-service ran its restaurants with a little over 1 less employee per location in April than they did back in 2019. Some locations are running with fewer managers, but on average staff was cut by only 0.3 managers during the period.

Full-service restaurants are still experiencing deeper cuts, as they have throughout the pandemic. The median company is running each restaurant with 7 fewer hourly employees in the front of the house and 2.6 fewer in the back of the house. The average reduction in staff was 0.2 managers per location compared to 2019.

At the national level, these staffing pressures have not yet translated into wage increases for quick-service restaurants, which is the largest segment in the industry based on the number of locations. Median hourly wages for team members have remained virtually unchanged for the last three quarters, though well above the federal minimum wage. However, at the state level, the situation is vastly different and some median wages have increased by more than 5% compared to where they were in Q4 2020.

For full-service restaurants, the wage pressure has been much more evident even at the national level. For example, median wages for line cooks increased by 2.0% in Q1 of 2021 compared to Q4 of 2020.

Inflation Pressures Threatening Restaurants and Consumers

“Optimism about the economy remains high, as job gains are strong, the unemployment rate is falling and most importantly, household income is rising solidly,” stated Joel Naroff, president of Naroff Economic Advisors and Black Box Intelligence economist. “That bodes well for a continued restaurant sector recovery. But problems stemming from the robust growth are already appearing. With the global supply chain still operating inefficiently, demand is outstripping supply across most industries. This is raising both producer and consumer costs. Inflation could reach four percent this year. The sudden reopening of the economy has put pressure on the labor supply and shortages, at going wages, are surfacing.

“For restaurants, the commodity inflation could take a year or more to ease. Unfortunately, in a year, the unemployment rate should be low enough to prevent the labor shortages/wage pressures from moderating significantly. Conditions could mirror the 2017-2019 period. However, firms have a measure of pricing power not seen in decades, so now might be the right time to raise prices. That is not the typical strategy coming out of a downturn, but this recession and recovery is not typical either, and the robust expansion should be put to good use.”

Looking Ahead

Staffing will continue to be the biggest challenge for restaurants in upcoming months, while the generous temporary unemployment benefits continue creating some resistance to people joining the workforce. Even when those expanded benefits expire, and many states are already gearing towards ending them earlier than anticipated, the industry will need to continue to compete with others who have been hiring aggressively and offer higher wages.

Wages are expected to rise at a faster pace in the next months as restaurants react to the current staffing crisis. Beyond wages, improving their employee’s quality of life is another key factor restaurants need to contend with if they are to remain competitive in the war for talent.

Another area of focus for restaurants later this year may be value. The industry continues to experience declining guest counts in comparable restaurants and the rapid acceleration in average checks is not helping to bring in additional dining occasions from guests. It will likely take moderation in check growth, back to pre-pandemic levels, to help boost traffic into recovery.

But the good news for the industry is that sales recovery remains solid and there are no signs of it slowing down. Restaurants should continue to see better sales in upcoming months than they did back in 2019. Even full-service restaurants, which suffered the most during the first year of the pandemic, are now on solid footing to continue posting positive sales growth.