June 2025 Monthly Second Helping: Highlighting Hot Topics in the Industry

Plates, Passports, Pressure: How 2025 Travel Could Make or Break Restaurants

There has been considerable speculation about the impact of the new administration’s policies. This includes potential tariffs, cutting the budget on marketing U.S. destinations overseas, and a newly announced $250 Visa Integrity fee which will affect International travel to the United States. In turn, the restaurant industry is anxiously awaiting news of what to expect. Based on our data, here are the 2025 travel impacts for restaurants we predict are ahead.

Different Countries, Different Results

According to the U.S. Travel Association, Canada, the top country for U.S. tourism, is down 19% during the first half of 2025.

However, they also note that other international travel into the US seems to be resilient. In fact, Mexican tourism, the second biggest source of international visitation, increased 12.5% during this same period. The remaining top sources of visitors come from the UK, India, Germany, Brazil, Japan, and France.

This resilience for non-Canadian countries, could be due to the exchange rate of the US dollar. The strength of the US dollar was a headwind to international travel at the beginning of the year. Yet, tariff-talk has decreased the dollar relative to other currencies. Thus, it makes it less costly for foreign travels.

Black Box Data Also Reveals Mixed Results

At first glance, Black Box Intelligence’s data doesn’t show a decline. In fact, 7 of the top 10 DMAs for International Travelers outperformed the National benchmark in traffic growth for 2025 to date.

The top 10 DMAs for International Travelers were:

-

New York

-

Miami

-

Los Angeles

-

Orlando

-

San Francisco

-

Las Vegas

-

Washington

-

Chicago

-

Honolulu

-

Boston

However, a better approach would be to look at international travelers per resident. New York may have the most international travelers. However, a decline in international travelers likely won’t have the same impact as it would in other five DMAs. This is due to New York’s over 20 million residents.

When we examine the DMAs, the story becomes more nuanced.

The Chips are Down for Las Vegas

Las Vegas has already reported declines in International Visitors.

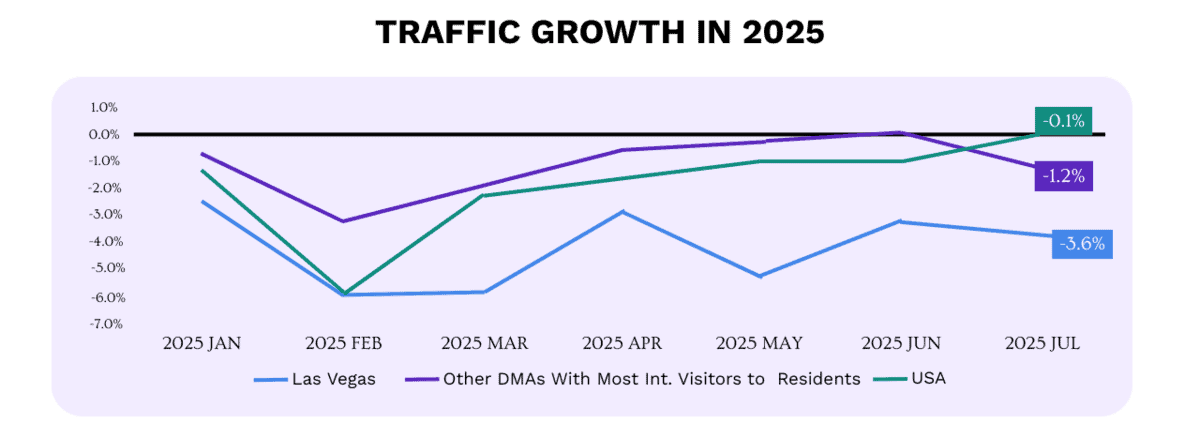

“For the year, visitation at 16.45 million is down 6.5%, or more than 1.1 million people. Airport passenger counts in May were down 3.9%,” according to CDC Gaming. This drop is reflected in Black Box Intelligence’s financial data. It shows Las Vegas struggling the most. As of 2025, year-over-year traffic is down 4.1%. We are also seeing traffic at 2.2% lower than the industry benchmark for the entire country. In fact, in every month of 2025, Las Vegas has underperformed the country.

Other Big Travel Destinations Are Less Convincing

Miami, the city with the most international travelers per resident, has also struggled. However, it’s less dramatic than Las Vegas in 2025. Its same-store traffic is down -2.3% year over year, -0.4% better than the national industry benchmark.

Conversely, San Francisco and Orlando mildly outperformed the national benchmark. Each put up -1.4% traffic for 2025 to date, compared with 1.9% for the country.

However, Orlando’s yearly growth numbers should be taken with a grain of salt. This is because they are lapping over a particularly poor first half of 2024 (-4.3% traffic in Q1 2024 and -4.9% traffic in Q2 2024). To add a little context, Orlando’s 2-year traffic growth numbers are underperforming the rest of the country (-5.9% for Orlando and -4.9% for the Nation).

Honolulu paints an entirely different picture altogether. Their restaurant traffic growth is actually positive in 2025 to date at 0.8%. This aligns with the Hawaiian Department of Tourism’s data, which shows that visitor numbers increased in April and May.

Dip In July

Given these very mixed results, it’s hard to say that International Travel has impacted this year’s restaurant growth apart from Las Vegas and possibly Miami and Orlando (the latter, when measured on a 2-year basis).

However, it could be that the first half of 2025 was too early for the policy changes to have an impact on travel behavior. Perhaps, visitors who already booked trips for the first half of the year weren’t going to cancel. Yet, potential visitors with nothing booked prior to policy changes? They’ll likely opt not to visit the U.S.

July data could be an early indicator of this theory. During the first two weeks of July, 4 of the 5 DMAs had lower restaurant traffic than the country. Those DMAs averaged -1.6% traffic growth, -1.5% worse than the national benchmark.

The only DMA which posted better traffic was Orlando, which again was lapping over a particularly weak period (Orlando’s 2 year traffic growth in July to-date is –1.3% worse than the nation’s). Even previously strong, Hawaii was -1.1% lower than the Nation.

Only time will tell whether the early July data were merely two bad weeks for these touristy DMAs… or the beginning of a decline in international tourism.

What to Expect in the Second Half of 2025

The answer to how international consumers will behave during the rest of 2025 may have less to do with psychology and National pride, and more to do with simple economics.

A strong dollar continues to make travel to the U.S. expensive for Canadians. Additionally, the Mexican peso, though still elevated, has shown signs of softening. Meanwhile, the euro has reached its most favorable exchange rate since the onset of the pandemic, making U.S. travel more attractive to European visitors.

With the U.S. dollar weakening against several major currencies since the Spring, we may see an uptick in international demand despite the headwinds. Additionally, domestic travel (since given the exchange rates, it’s now more expensive to travel internationally from the US) could help bolster traffic numbers.

Simply put, what is more powerful: lower costs or negative rhetoric?