Sales, Traffic, and Check Growth by the Numbers

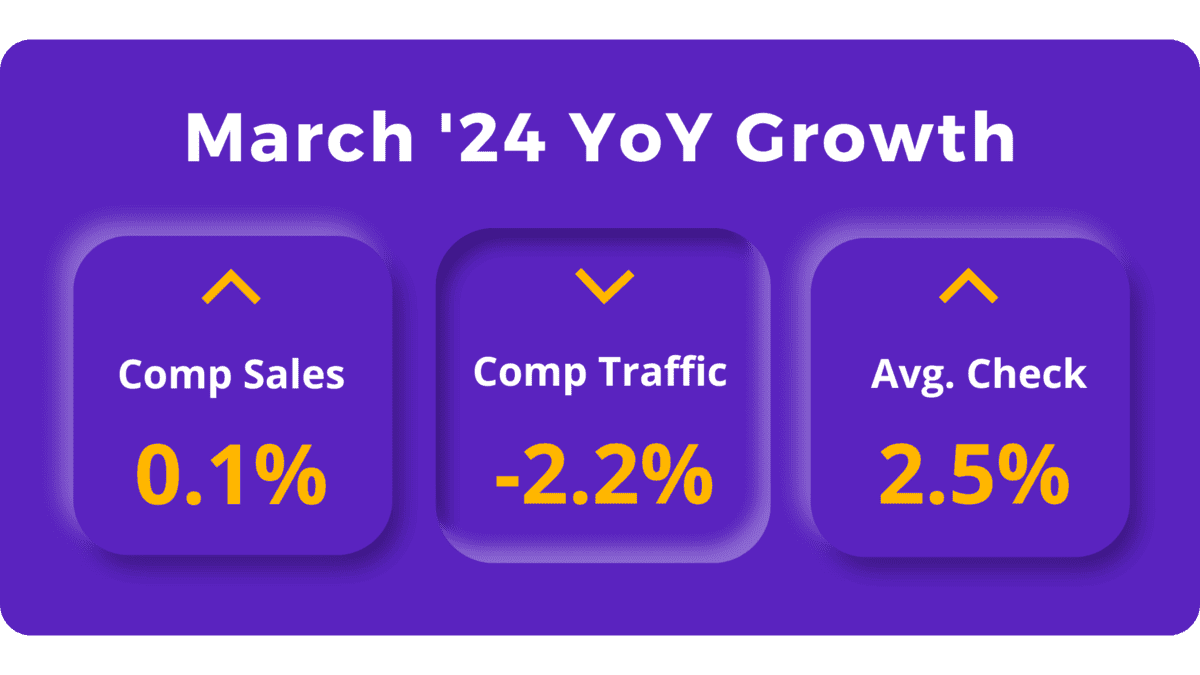

March’s year-over-year (YoY) same-store sales growth was a modest 0.1%, marking the first positive sales growth of the year. Although this is an improvement of 0.6 percentage points from February and 4.6 percentage points from January, the weather likely dampened results in the first two months of this year.  YoY same-store traffic growth in March was -2.2%, a slight 0.1 percentage point improvement from February. Average check growth increased by just 2.5% YoY, down from the 3.6% average in Q4 of last year, and is expected to remain low due to conservative menu price increases and more value-conscious consumer behavior.

YoY same-store traffic growth in March was -2.2%, a slight 0.1 percentage point improvement from February. Average check growth increased by just 2.5% YoY, down from the 3.6% average in Q4 of last year, and is expected to remain low due to conservative menu price increases and more value-conscious consumer behavior.

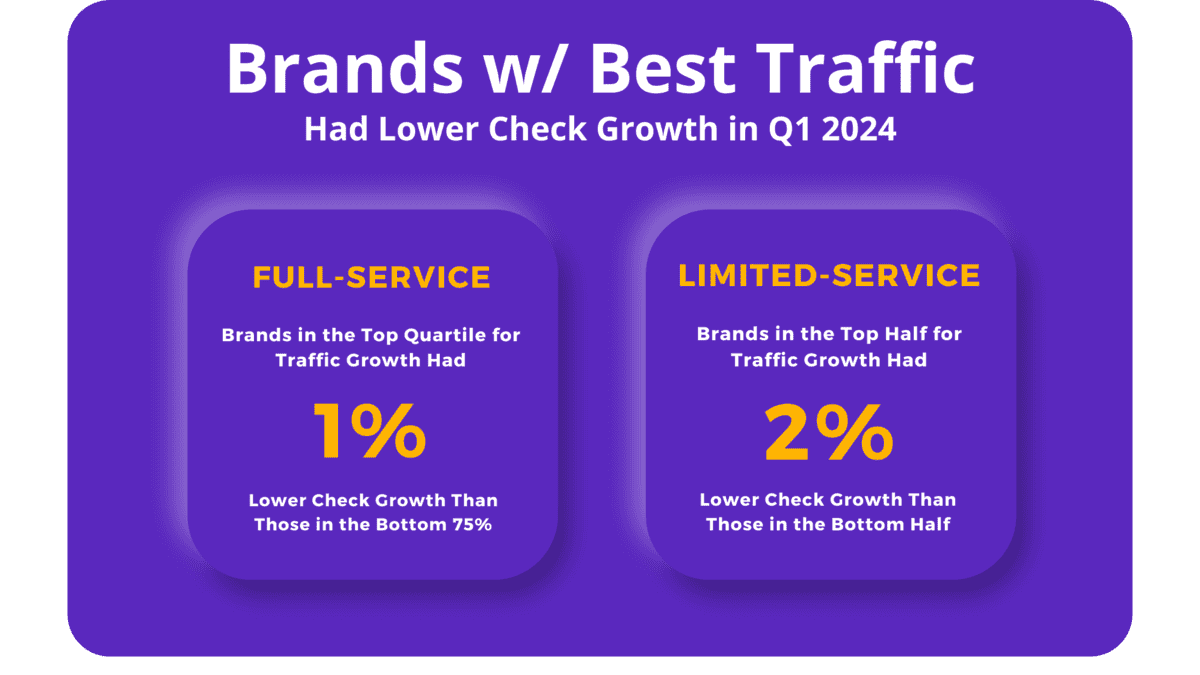

And since customers have become increasingly sensitive to price changes following four years of high inflation, it makes sense that brands practicing caution when increasing prices often reap the benefits.

In Q1 of 2024, brands with better traffic growth had, on average, lower check growth. Limited-service brands in the top half for traffic growth had 2% lower check growth than those in the bottom half. Additionally, full-service brands in the top quartile for traffic growth had 1% lower check growth than those in the bottom 75%.

In Q1 of 2024, brands with better traffic growth had, on average, lower check growth. Limited-service brands in the top half for traffic growth had 2% lower check growth than those in the bottom half. Additionally, full-service brands in the top quartile for traffic growth had 1% lower check growth than those in the bottom 75%.

Off-Premise Remains a Significant Revenue Stream

Our data from 2023 shows that limited-service brands with an over 68% off-premise sales mix—which comprises both takeout, drive-thru, and delivery options—experienced, on average, 3 percentage points higher sales growth than those with under 68%.

Denny’s, for example, exemplifies this trend. As highlighted by Restaurant Dive, the brand considers off-premise channels crucial for attracting new guests and boosting transactions. In the first quarter of 2023, off-premise sales made up 21% of Denny’s total sales, maintaining a level above 19% since the first quarter of 2020.

Denny’s, for example, exemplifies this trend. As highlighted by Restaurant Dive, the brand considers off-premise channels crucial for attracting new guests and boosting transactions. In the first quarter of 2023, off-premise sales made up 21% of Denny’s total sales, maintaining a level above 19% since the first quarter of 2020.

Customer Sentiment Clearly Related to Sales and Traffic

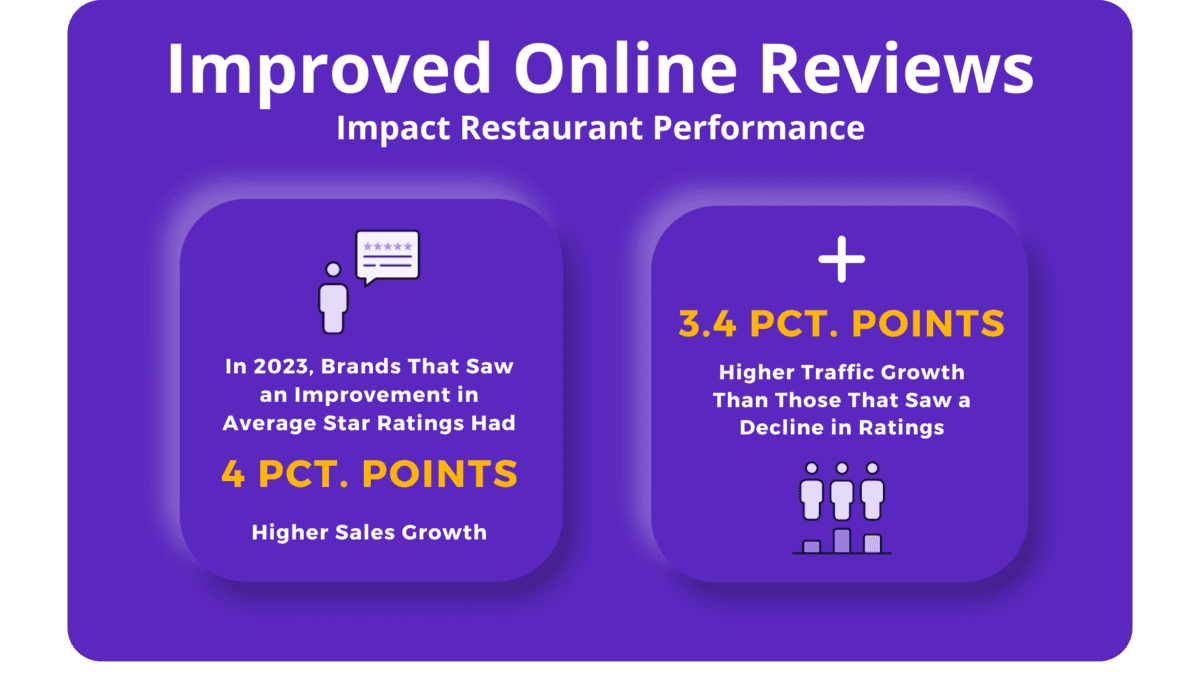

Improved online reviews tend to impact restaurant performance: in 2023, brands that saw an improvement in their average star ratings had, on average, 4 percentage points higher sales growth and 3.4 percentage points higher traffic growth than those who experienced a decline in ratings.

Further, in Q1 of 2024, restaurants with the best traffic growth consistently had higher food, service, and value net sentiment scores (net sentiment is the difference between the percentage positive and percentage negative online reviews).

Further, in Q1 of 2024, restaurants with the best traffic growth consistently had higher food, service, and value net sentiment scores (net sentiment is the difference between the percentage positive and percentage negative online reviews).

Value, in particular, emerged as a significant differentiator: restaurants with the best traffic growth averaged 7 points higher value net sentiment scores in full service and 11 points higher in limited service.

Some major brands are already prioritizing value. For instance, McDonald’s recently announced efforts to convince franchisees to adopt a bundled meal featuring a McChicken or a McDouble, aiming to attract more customers by addressing their immediate financial challenges.

But it’s important to remember that value in the restaurant industry is, in fact, multifaceted and extends beyond just price. It encompasses the overall customer experience, including food quality, portion sizes, service efficiency, ambiance, cleanliness, and more. Combined, these factors create a holistic sense of value that can significantly influence customer satisfaction.

Employee Retention Is Paramount

While turnover rates have slightly eased, they remain above pre-pandemic levels: In Q1 of 2024, limited service witnessed a turnover rate of 140% for non-management employees (compared to 133% in 2019) and 53% for managers (compared to 45% in 2019). Full service experienced a turnover rate of 101% for non-management employees (compared to 105% in 2019) and 38% for managers (compared to 31% in 2019).

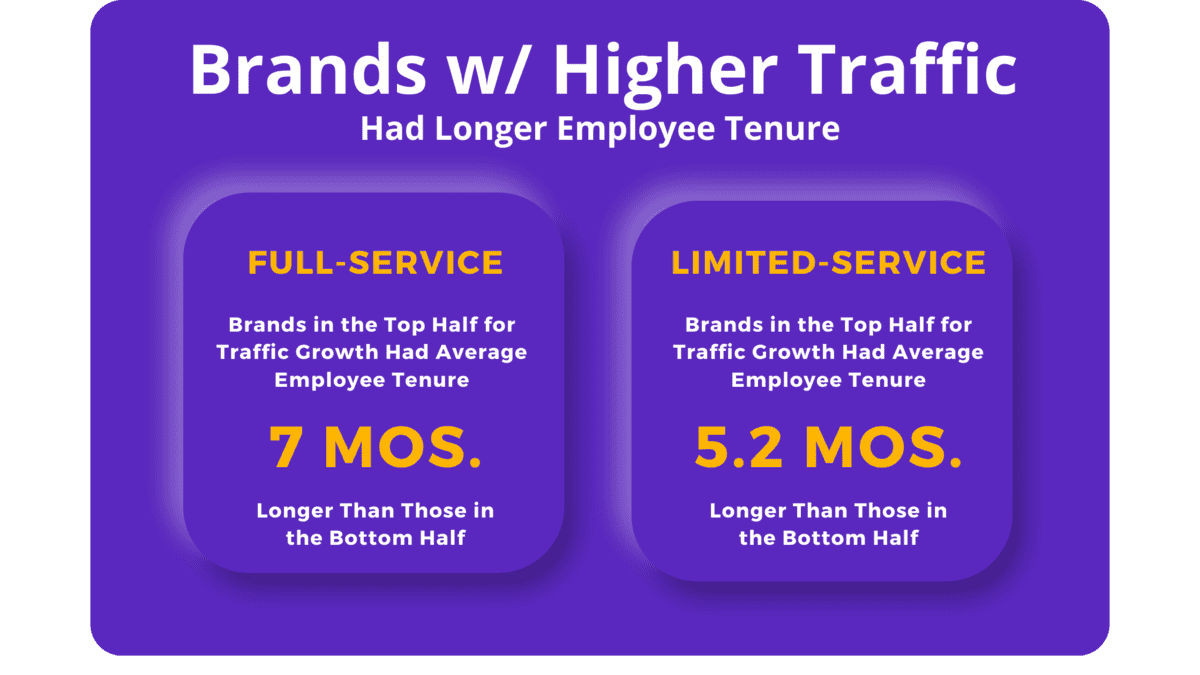

Importantly, brands with the highest traffic growth tend to have employees with longer average tenures.

Based on YoY traffic growth in Q1 of 2024, limited-service brands in the top half for traffic growth had an average employee tenure 5.2 months longer than those in the bottom half. Full-service brands in the top half of traffic growth had employee tenure 7 months longer.

The takeaway here seems to be clear: the more successful the restaurant, the more likely they are to retain staff.

The takeaway here seems to be clear: the more successful the restaurant, the more likely they are to retain staff.

Black Box Intelligence Forecast

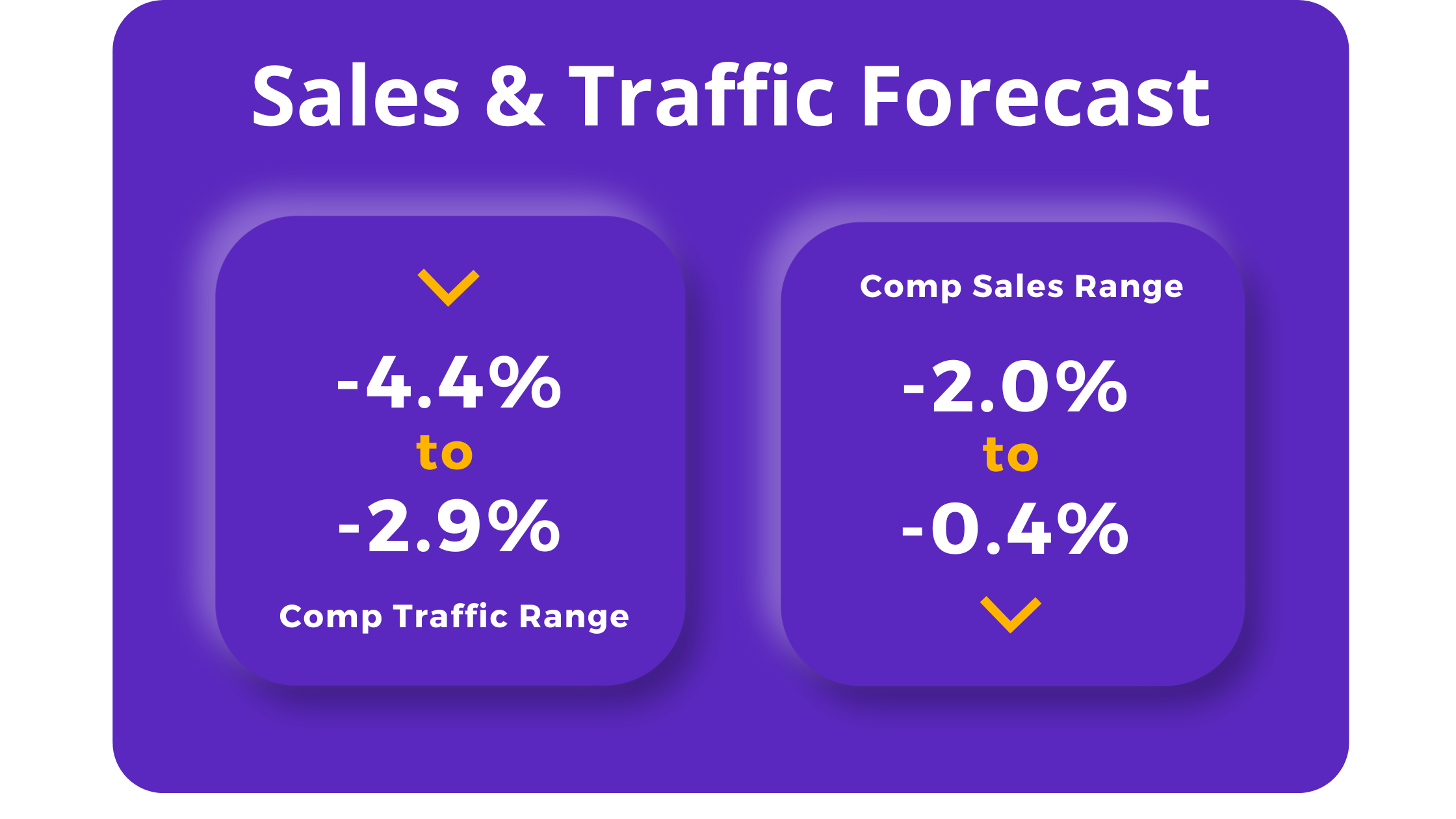

This year, restaurants can anticipate a challenging market environment, with projections indicating a YoY decline in both sales and traffic: comparable traffic is expected to range between -4.4% and -2.9%, while comparable sales is projected to range between -2.0% and -0.4%.

Restaurants able to deliver value to their customers—whether that involves offering bundled meals at reasonable prices, enhancing employee experiences to improve customer service, implementing more robust quality control measures, etc.— will be in a strong position.

These Q2 2024 State of the Restaurant Industry numbers may seem concerning. But as our insights suggest, there remains significant opportunity—even in this challenging market.

Similarly, those that are able to tap into additional revenue streams that cater to today’s customer preferences, such as the convenience of home delivery from their favorite restaurants, will also be well placed to succeed.

Sign up for our upcoming online Q3 SOTI briefing here to ensure you stay ahead of the curve with the latest industry trends.