Out of the Box: Monthly Restaurant Industry Update

Restaurant Industry in Review: Trends from September 2024

SEPTEMBER: BY THE NUMBERS

After a challenging summer, the restaurant industry showed signs of recovery in August which continued in September.

Additionally, there seems to be a positive change in regard to comp sales and traffic.

| Month | Oct. ’23 | Nov. ’23 | Dec. ’23 | Jan. | Feb. | Mar. | Apr. | May | Jun. | Jul. | Aug. | Sept. |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Comp. Sales | +1.4% | +1.9% | +2.3% | -4.5% | -0.6% | +0.1% | +0.6% | +0.4% | -0.1% | -2.3% | -0.4% | +0.4% |

| Comp. Traffic | -2.1% | -1.5% | -0.9% | -7.1% | -2.3% | -2.2% | -2.3% | -3.1% | -2.8% | -4.6% | -3.6% | -2.7% |

However, with Hurricane Helene and Milton, recovery remains fragile.

And the data is more critical than ever in guiding decisions.

Here are all the September 2024 Restaurant Trends you need to know.

Bouncing Back From July: Sales and Traffic in September

July marked a low point for the industry.

The restaurant industry has since experienced two consecutive months of improvement in its same-store sales and traffic performance.

The industry was able to continue its more positive momentum with September’s 0.4% same-store sales growth.

This was the best month for the industry since April’s year-over-year sales growth.

On same store traffic: Y-o-Y growth was -2.7% in September.

But this was a significant improvement from the -4.6% reported back in July.

This improvement signaled the start of a potential industry-wide recovery.

This recent data supports the hypothesis that the industry is on an upswing.

Moreover, recovery may have come earlier than expected (the forecast was for Q4 to start seeing some improvement).

However, we may need to temper our enthusiasm given the impact that the recent devastating hurricanes have had in the southeastern area of the country.

The Impact of Hurricanes on Restaurant Sales

Effects of Hurricane Helene During Week Ending Sep 29, 2024

| State | Percent of Units Not Reporting (closed for the week) | Estimated Drop in Comp Sales Due to Hurricane |

|---|---|---|

| South Carolina | 7.1% | -8.2% |

| Georgia | 1.7% | -9.9% |

| Tennessee | 0.9% | -2.5% |

| Florida | 0.7% | -4.5% |

| Virginia | 0.0% | -2.8% |

| North Carolina | 1.4% | -5.0% |

The disruptions from hurricanes aren’t just about the days during the storm.

They ripple out for weeks as communities recover.

Moreover, power outages, supply chain interruptions, and customer displacement can linger.

Thus, this can affect restaurant traffic and sales long after the storm has passed.

Additionally, recovery after a hurricane is slow and uneven across different regions.

Some restaurants can rebound quickly.

Meanwhile, others struggle, particularly those in areas with extensive damage.

Inflation’s Lingering Impact: Why Value Matters More Than Ever

More for the Money

“Who said less is more? More is more.”

The opening line to the iconic McDonald’s ad promoting their Extra Value Meal — set to Donna Summer’s “She Works Hard for Her Money” — feels just as relevant today as in 1999.

Over the past several months, McDonald’s and several other quick service brands are leaning strongly on value propositions, and it seems to be paying off.

Inflation Cooling But Still An Issue

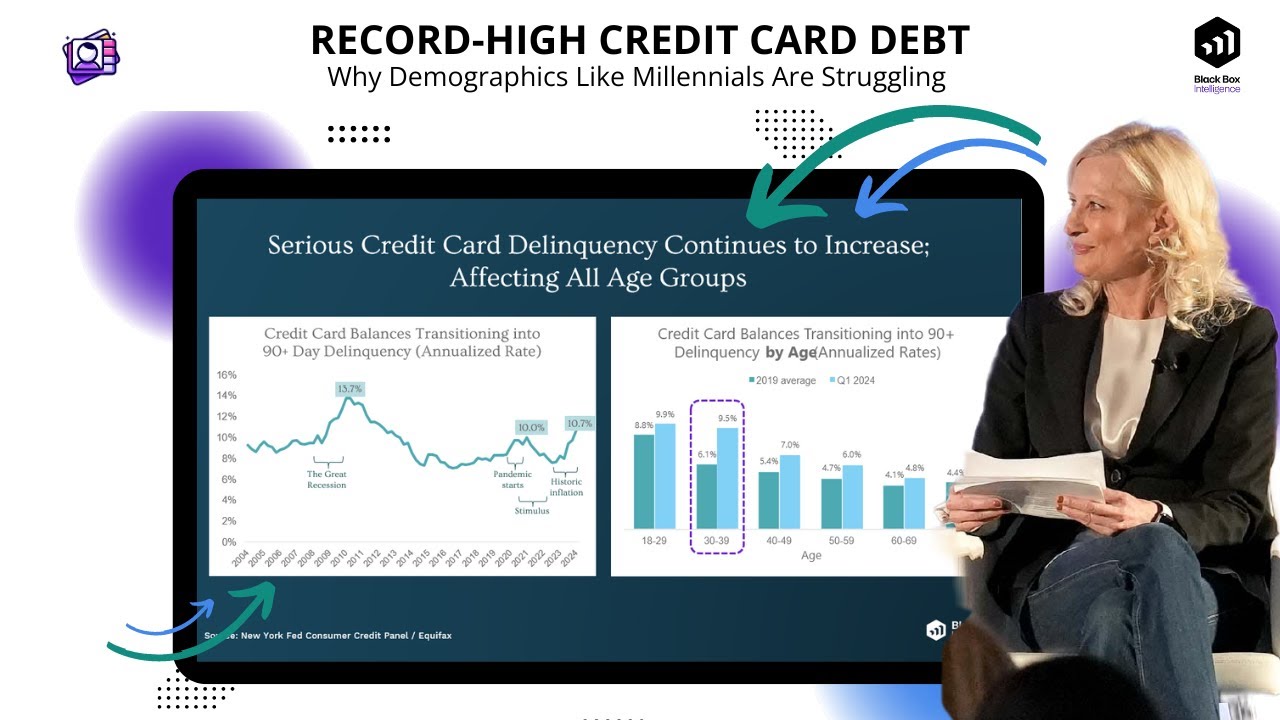

This is not surprising given that inflation is still a top issue for consumers.

September saw the lowest annual inflation gain (2.4%) since 2021.

However, this was still slightly higher than anticipated. Additionally, food prices saw an unexpected rise of 0.4% month over month.

But year over year or month over month numbers do not do justice to the scale of the problem.

To understand the customer’s frustration, you need to look at inflation over the past several years. Cumulatively, since 2019, inflation has risen 25%.

This is akin to being taxed an additional quarter for every dollar spent.

Enter The Value Meal

In response to this demand, McDonald’s and many other Limited Service restaurants have rolled out value meals and the people have noticed.

According to our data, the average QSR brand had 2x more online reviews mentioning “value meals” (and words relating to similar deals) in Q3 2024 compared to the same period last year.

The average star rating for these value meal-related online reviews increased by about a quarter of a star compared to Q3 2023.

Consumers Reward Value

Chiefly, customers are rewarding value with their feet and dollars.

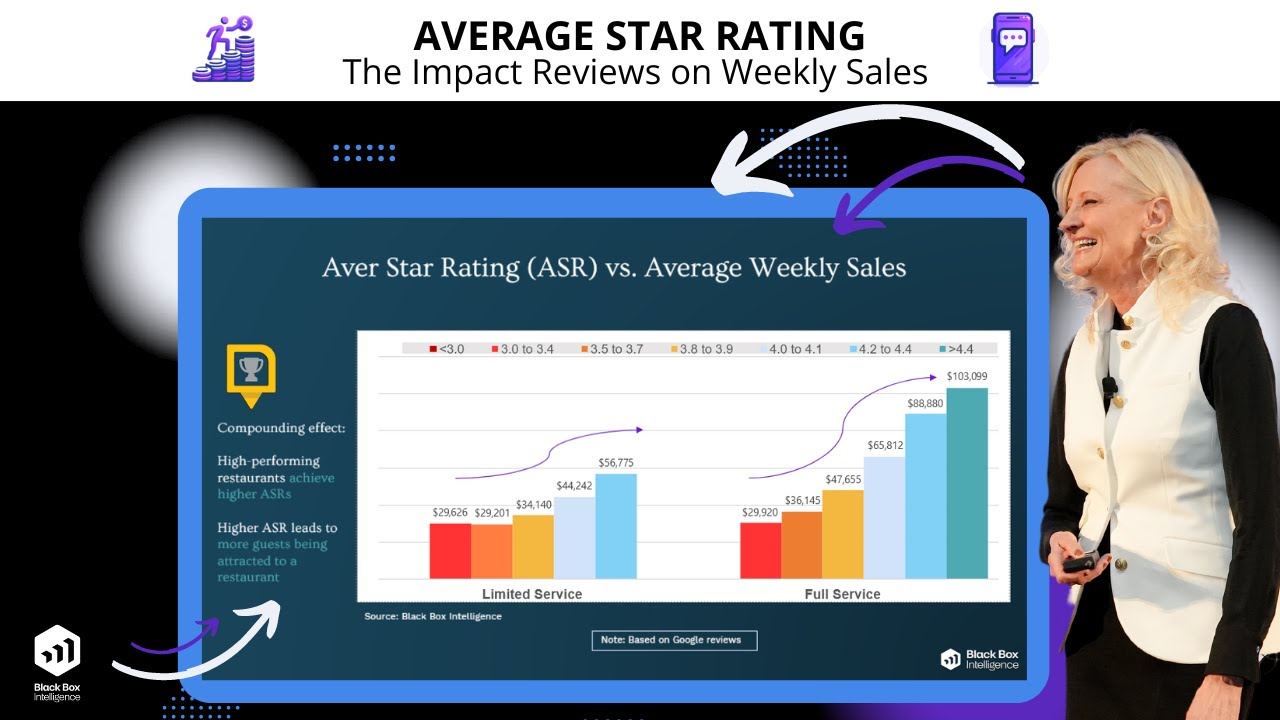

When we correlate guest sentiment and financial performance data, Black Box Intelligence has seen restaurants with the best traffic growth compared to their peers score much higher in value sentiment.

This has been true for both full service and limited-service restaurants for the past several quarters.

Interestingly, the gap in sentiment around value is even more pronounced than the differences in sentiment for food or service quality.

Thus, typically value the stronger driver of restaurant success.

The third quarter of 2024 continues this trend. For both full service and limited service brands, restaurant units with the best same-store traffic compared to their segment have 6 percentage points higher value sentiment than their peers.

Additionally, when we segment “best vs. rest” restaurants based on their value sentiment, we found much stronger same-store traffic growth (1.8 percentage points higher for full service and 1.5 points higher for limited service) for those restaurant units with the strongest value sentiment.

What Do Guests Consider When Evaluating Value

So, how does a brand increase its value score?

Both for full service and limited service brands, the attribute that gets mentioned the most when a restaurant experience is described as being “worth it” or “not worth it” in online reviews is, not surprisingly, price.

But beyond price, the next three most important attributes mentioned in “worth it” restaurant experiences are the attitude of the employees, the taste of the food, and the consistency of the experience.

The order of these attributes may be different for full service and limited service restaurants (for example, attitude is more important in full service than in limited), but the top 4 most important attributes when an experience is described as being worth it for the guest are the same for those two restaurant categories.

At the highest level, that is how the guest evaluates a strong value experience.

However, what about what can derail the value sentiment of a restaurant interaction?

When the guests describe a restaurant experience to have been “not worth it” in their online reviews, they typically discuss the price (most common attribute) and a combination of attitude of the employees, their perception of the food portions, and the accuracy of what they received in relation to their order.

Conclusion

The September 2024 data paints a relatively optimistic picture for the restaurant industry.

Despite a tough summer and setbacks caused by Hurricanes Helene and Milton, recovery is on the horizon with positive momentum in both sales and traffic.

However, challenges like inflation and regional disruptions continue to pose threats to sustained growth.

To stay ahead, restaurant leaders must leverage data-driven insights and prioritize delivering value to customers—whether through competitive pricing, quality food, or exceptional service.

Found this useful? Black Box Intelligence’s suite of products provide a far more up-to-date deeper and customizable insights on the restaurant industry for restaurant brands. We’d be happy to show you how.