When you think about customer experience analysis, what comes to mind? A murky, time-consuming process with no clear starting or ending point?

Restaurateurs tend to know that customer experience is important. But fully understanding what is ultimately such a subjective and nuanced concept and quantifying its impact on actual business performance is incredibly challenging.

As a result, brands struggle to know to what extent they should commit to CX—which is totally understandable in an environment where every investment is under scrutiny, from the boardroom down.

Due to our extensive guest experience and financial performance benchmark data, we have a unique capability to provide clarity to what is typically a murky issue. So, what does the data actually say?

Better CX = More Sales and Traffic Growth

Customer insights can be gained from analyzing feedback data. This analysis helps businesses understand what customers truly want and improve their strategies to boost performance.

If this sounds like a bunch of hot air, it’s not. CX analysis uses proven methods to turn customer sentiment into clear numbers that businesses can use to enhance the guest experience and drive profits. And over the years, our data has continued to show that better CX leads to more sales and traffic growth.

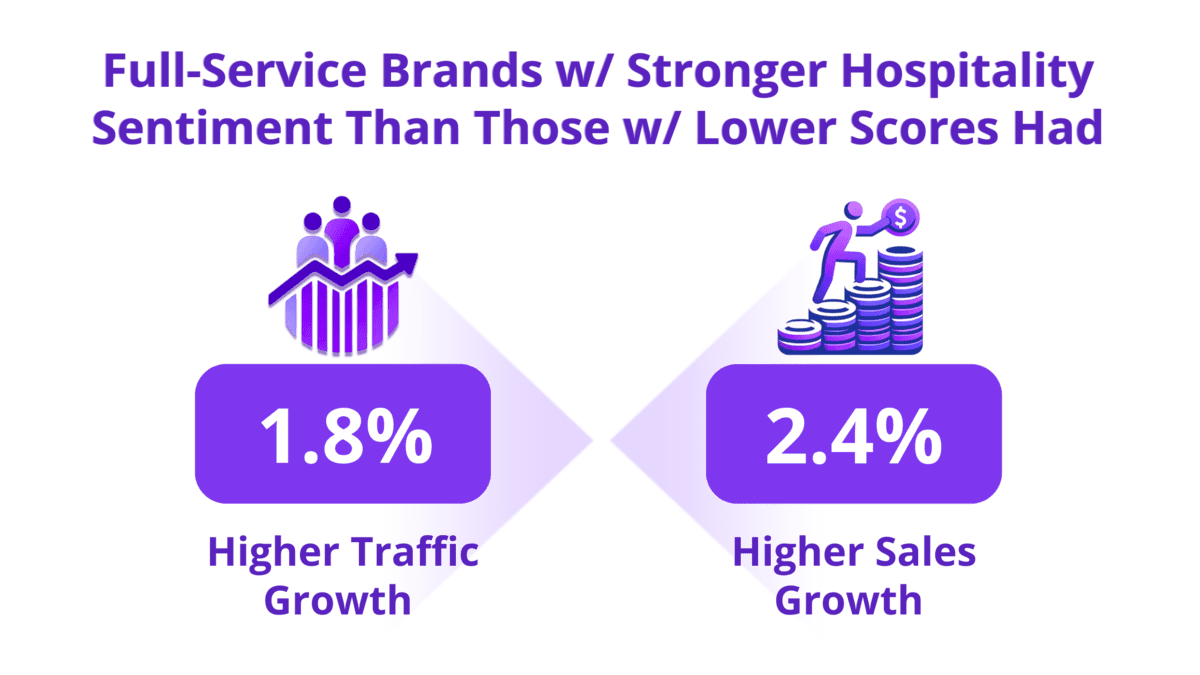

In 2023, we looked into quantifying “hospitality” to explore its correlation with sales and traffic growth, particularly within full-service restaurants where hospitality is typically a top concern.

Using our Natural Language Processing tool, which leverages AI text analytics, online customer reviews were filtered and categorized using positive attributes such as “welcome,” “appreciated,” “attentive,” and “friendly” and negative attributes like “careless,” “rude,” and “unprofessional.”

Based on these reviews, brands were assigned a “hospitality” net sentiment score (NSS). For reference, an NSS quantifies overall customer sentiment by subtracting negative sentiments from positive ones, providing a clear measure of how customers feel about a certain brand.

Infographic illustrating full-service brands benefiting from stronger hospitality sentiment, demonstrating CX’s Impact on Revenue.

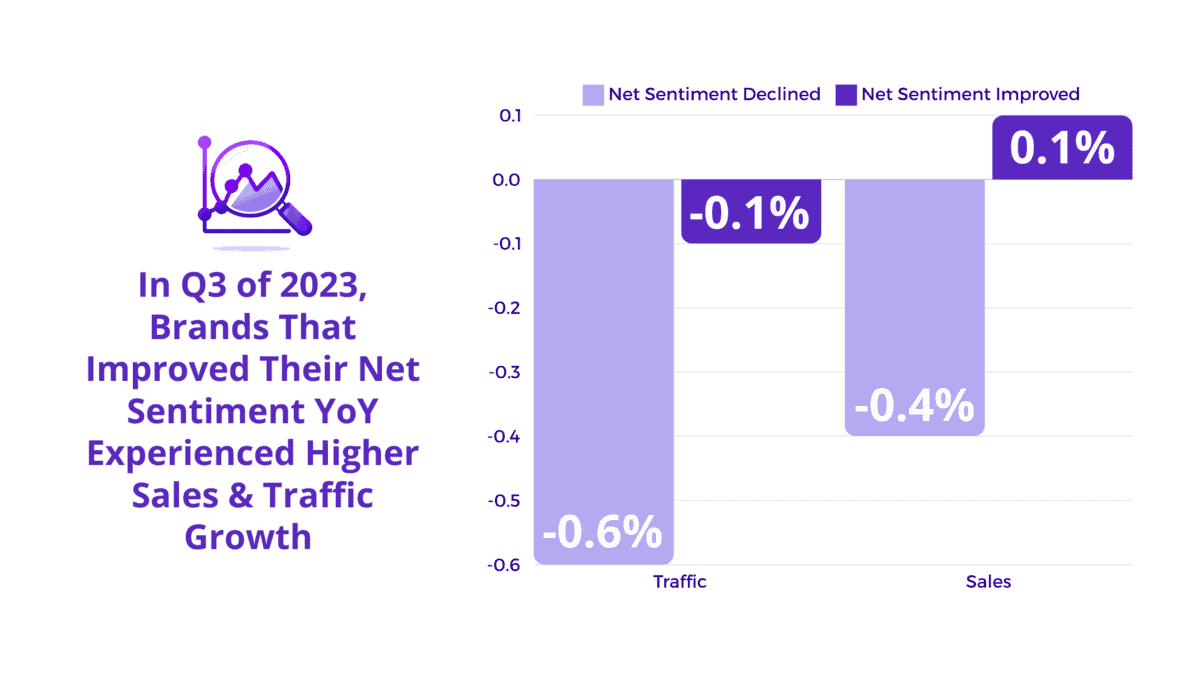

Bar chart showing net sentiment changes for brands in Q3 2023 highlights CX’s impact on revenue.

Our analysis showed that full-service brands with stronger hospitality sentiment outperformed those brands with lower hospitality by 2.4% and 1.8% for same-store sales and traffic growth, respectively. In a separate study, we explored the link between overall net sentiment and growth in traffic and sales. In Q3 of 2023, full- and limited-service brands that improved their net sentiment year over year experienced higher growth in both areas.

What Defines a Guest’s Experience?

As mentioned in our April 2024 insights article, many restaurant operators now believe that the best way to measure success is by looking at their traffic growth rather than just their sales figures.

This shift comes after years of restaurants having little choice but to raise prices in the face of aggressive and relentless inflation, making sales growth less reliable for assessing performance.

So to gain a deeper understanding of what guests want from the customer experience today, we analyzed the highest-trafficked units (relative to direct local competitors) using online reviews of these establishments.

Black Box Intelligence segments guest sentiment data into six key attributes of the dining experience (food, service, ambiance, beverage, value, and intent to return) and their sub-attributes (e.g., portion size and quality for food; attentiveness and speed for service).

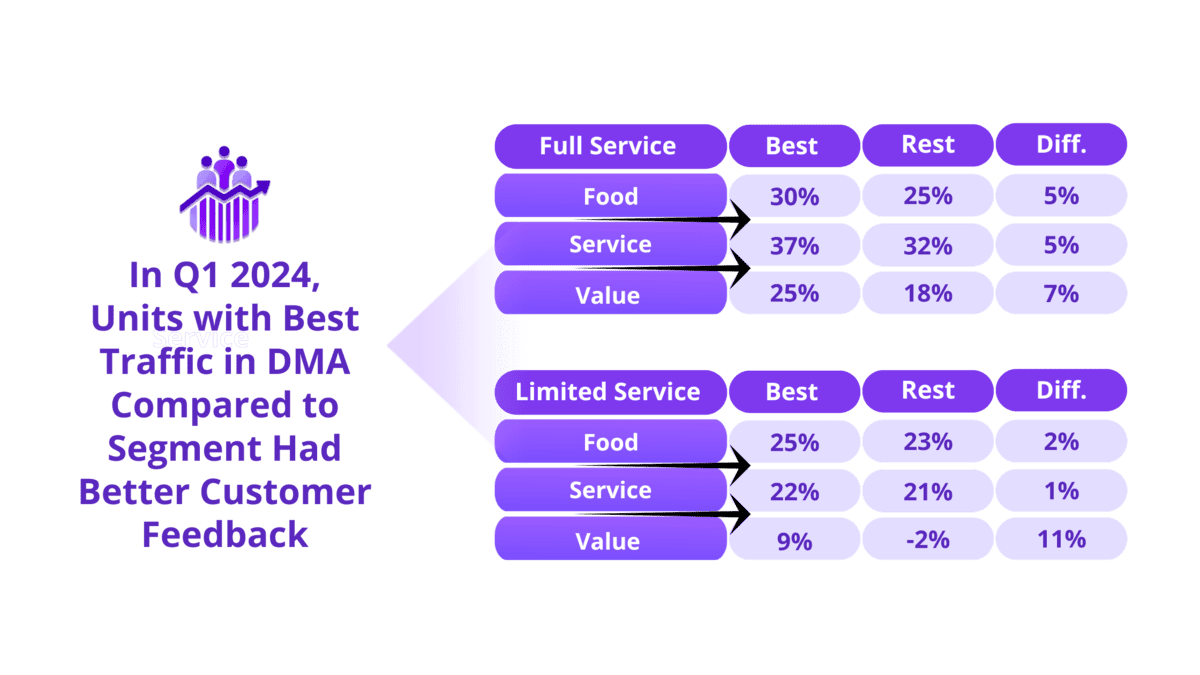

A comparison chart showing customer feedback in Q1 2024 to highlight CX’s Impact on Revenue.

Among the key attributes, food, service, and value emerged as the most important factors influencing traffic growth. On average, restaurants with the highest traffic growth had better food, service, and value NSSs than competitors in their designated market area (DMA):

Service:

- Customers tend to care more about service when dining at full-service restaurants: Full-service restaurants with the highest traffic had 5% better net sentiment than the rest. In limited service, the differential was only 1 point.

- Full-service restaurants with the highest traffic had 7% higher attentiveness, 6% higher experience, and 5% higher speed NSSs.

Food:

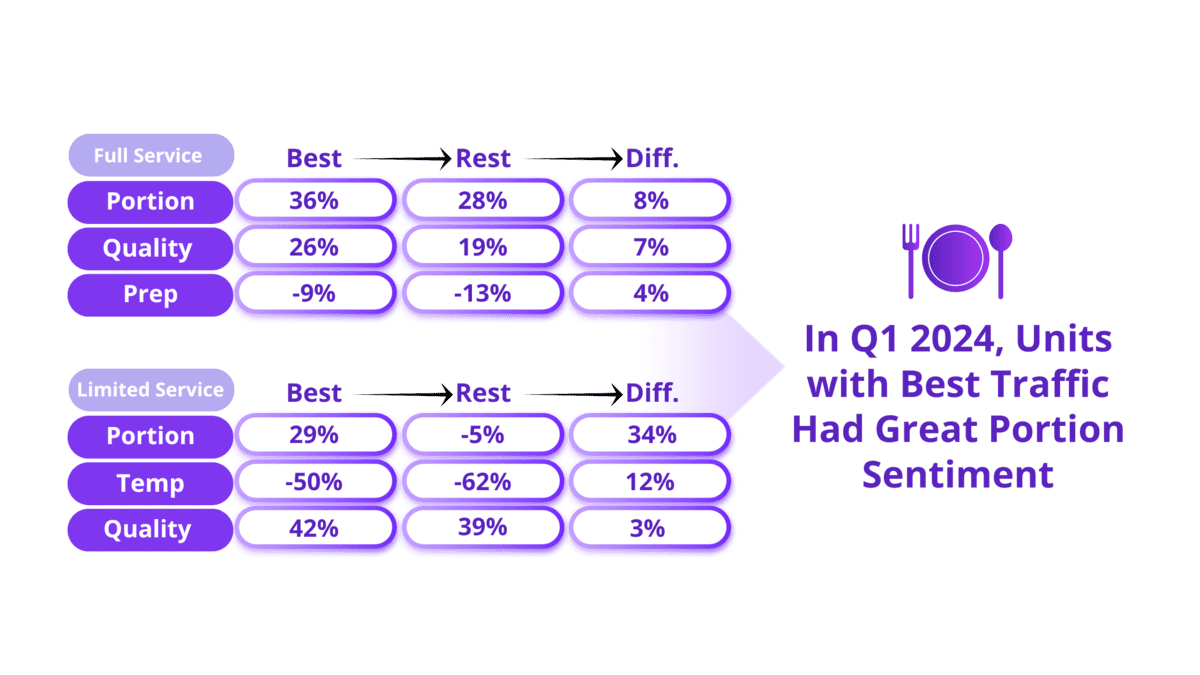

- Quality was a key factor for customers dining at full-service restaurants, while limited-service customers prioritized temperature.

- However, portion size mattered most in both restaurant categories: Units with higher traffic had 8 points higher portion scores for full service and a massive 34-point difference in limited service.

A comparison chart highlights data for “Full Service” and “Limited Service” in portions, quality, and preparation, emphasizing CX’s Impact on Revenue.

Value:

- Value was a more significant differentiator than both food and service: restaurants with the best traffic growth averaged 7 points higher value net sentiment scores in full service and 11 points higher in limited service.

- This makes sense: value is especially important to customers during times of economic uncertainty. Brands that saw the most improvement in their value net sentiment scores between 2019 and 2023 had 1.5 times higher sales growth and an enormous 8 times higher traffic growth.

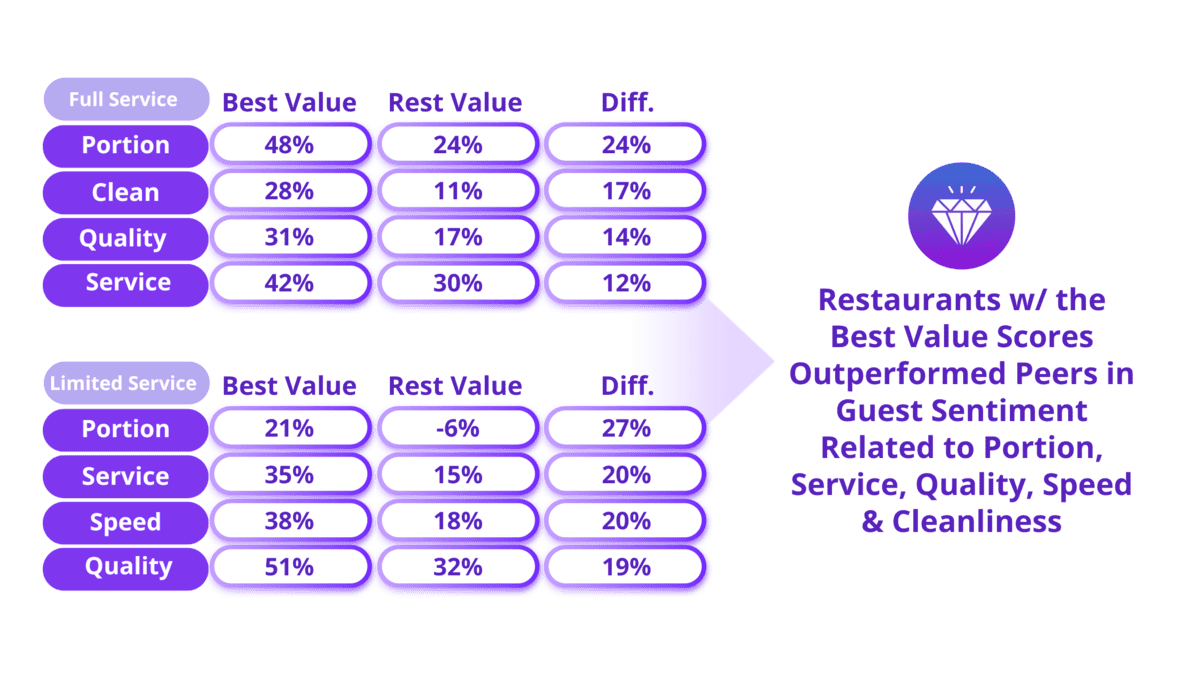

- Additionally, in Q1 of 2024, restaurants with the best value scores outperformed their peers in guest sentiment related to portion (which was found to be the biggest differentiator), service, quality, speed, and cleanliness.

Review Star Rating and Traffic

Star ratings can have a profound effect on a business’ performance. They often serve as the first impression for potential customers—for better or worse.

When we looked at a sample of over 1.4 million reviews across Google, Yelp, Facebook, and TripAdvisor, Google stood out as the most critical review channel. So when customers are searching for a business online, chances are they’ll catch a glimpse of the company’s Google average star rating (ASR) first. Google star ratings are not only a helpful statistic—they are actually one of the most important predictors of the success of a business.

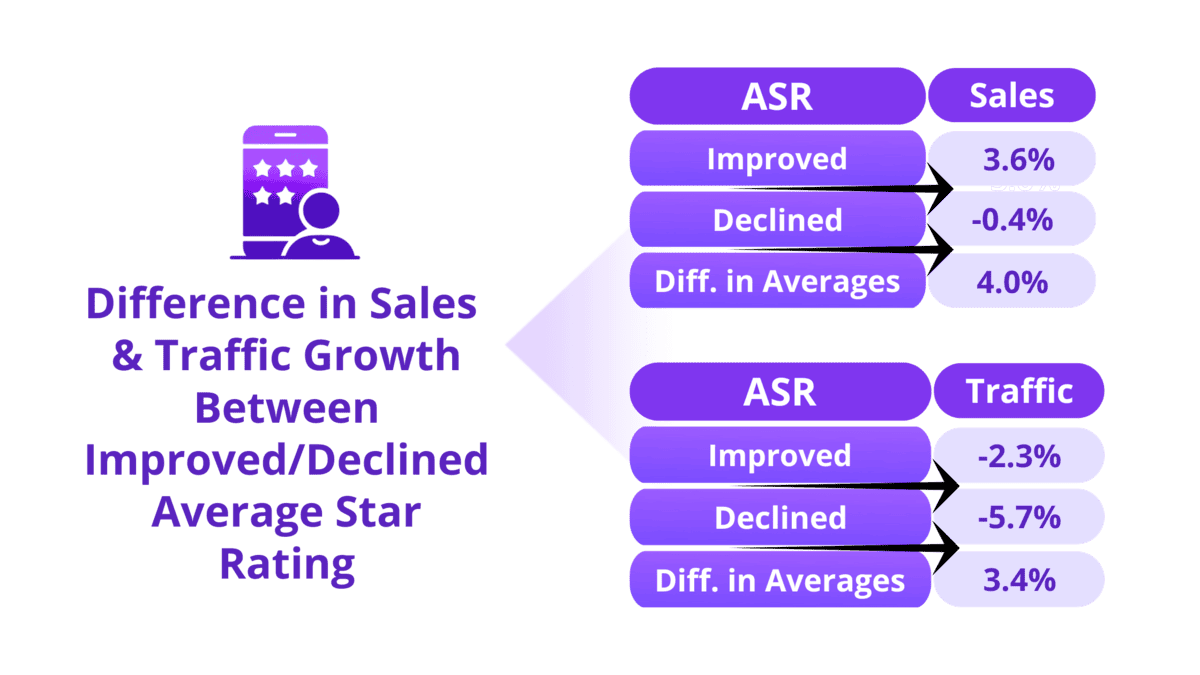

And according to our data from 2023, an improvement in ASR tends to lead to higher sales and traffic growth:

- Brands that generated an improvement in their ASRs had, on average, 4 percentage points higher sales growth and 3.4 percentage points higher traffic growth than those who experienced a decline in ratings.

- Limited-service restaurants with a 3.0-or-lower star rating had 23% worse absolute traffic than the average for all restaurants in their industry segment operating in the same market. Full-service restaurant units with the same low rating had 54% worse absolute traffic than their local peers.

- Limited-service and full-service units with a 4.4 rating or higher had better absolute traffic (12% and 13%, respectively) than their local benchmarks.

- Full-service restaurants with a rating of 3.6 to 3.9 still had 23% worse traffic than peers operating in their DMA, emphasizing just how important it is for a full-service restaurant unit to reach a 4.0-star rating.

What to Do About Declining Star Ratings

To know what’s dragging down their ASRs, brands can analyze individual reviews to extract keywords or terms (e.g., “cold food,” “rude staff,” “dirty tables,” etc.) that highlight common issues.

For example, throughout 2023, cleanliness-related terms appeared in 6% of full-service restaurant reviews and 9% of limited-service restaurant reviews.

While this may seem insignificant, considering that food and service were both mentioned in 73% of full-service reviews (69% and 59%, respectively, for limited service), one cleanliness mention for every 10 to 20 reviews is actually more significant than it may seem.

Why? Reviews that mention cleanliness had an ASR of 3.2 for full-service restaurants, nearly a full star lower than the overall average rating. For limited-service restaurants, the ASR was 3.3, almost half a star lower than the category’s average.

So to truly get to the meat of the matter, it’s essential to find the key terms that could be hiding in the jumble of customer opinions.

More than a “Soft” Metric

CX is not just a fluffy, overused concept; it’s a smart financial investment that can drive real, measurable success.

While financial metrics give you a snapshot of how your business is performing, they don’t always tell the whole story. For example, if you notice a sudden drop in traffic, examining feedback data may reveal that a decrease in traffic corresponds with an uptick in negative reviews about slow service. In this case, your focus should shift to enhancing service speed.

In addition, by comparing customer feedback across different units, brands can pinpoint the best practices from top-performing locations and use those insights to help underperforming units. Likewise, analyzing competitor feedback can reveal effective strategies that restaurants can adopt to improve their own performance.

These examples barely scratch the surface of how CX insights can be used to improve business outcomes. It is a vital tool for identifying where to invest for the best return and for spotting and resolving customer issues before they snowball into bigger problems.

And at this point, there’s no stopping the constant flood of customer feedback—it can either sink a business or propel it forward. Brands that are willing to leverage the wealth of sentiment data available today are well-positioned to maximize profits.