Restaurant Industry Impact and Recovery

Restaurant Industry’s Resilience Shines Through: Swift Recovery Following Hurricanes Helene and Milton

New research shows an impressive and fast bounceback across the southeastern U.S. and demonstrates reliance of local communities on restaurants in times of need.

[FOR IMMEDIATE RELEASE]

[DALLAS, TX, November 14, 2024] — The recent devastation caused by Hurricanes Helene and Milton in the Southeastern United States severely impacted many businesses, with restaurants in South Carolina, Georgia, Tennessee, Florida, Virginia, and North Carolina particularly affected. However, as new data reveals, the industry has shown an impressive ability to bounce back, marking a faster-than-expected recovery.

Initial Impact and the Path to Recovery

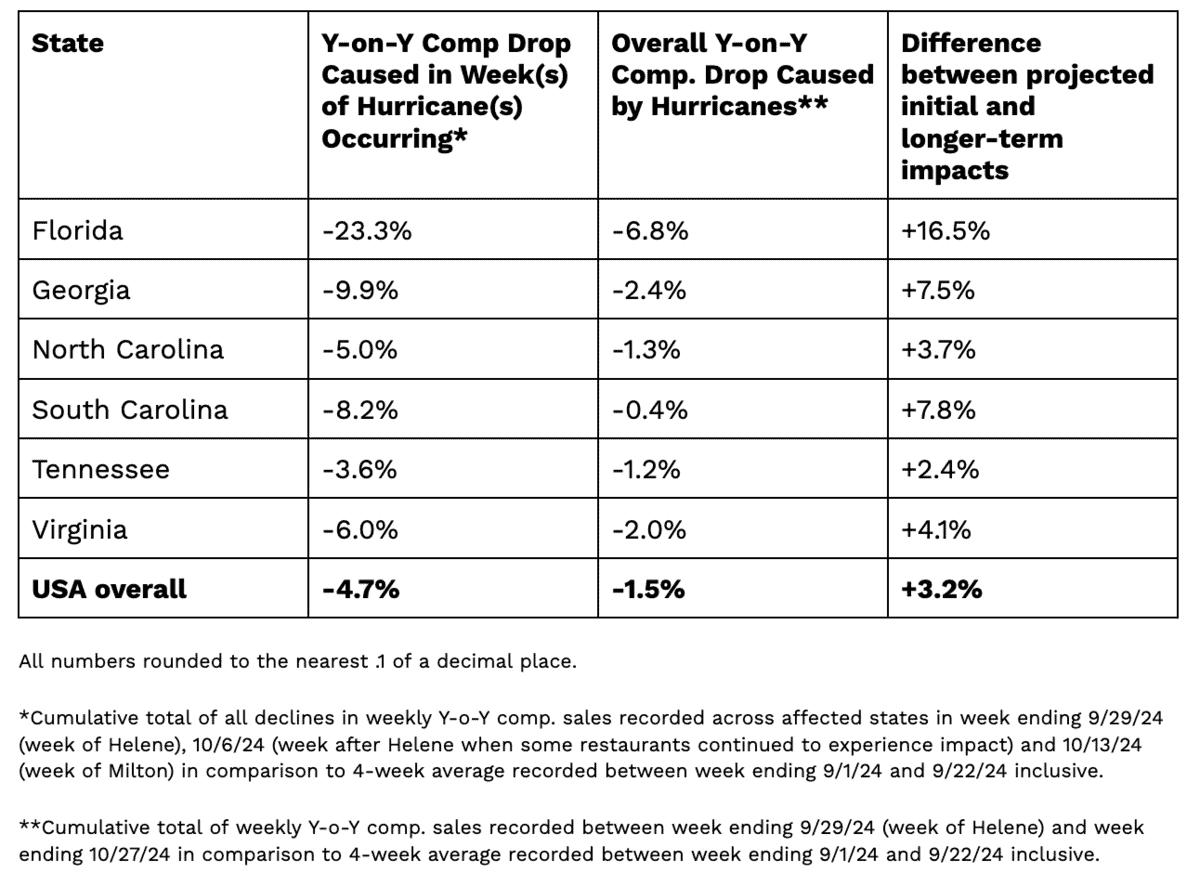

During the week ending September 29, 2024, Hurricane Helene forced widespread restaurant closures, causing a significant drop in sales across the region. Georgia and South Carolina were hardest hit by Hurricane Helene, with comparable sales growth dropping by -9.9% and -8.2% respectively.

Florida experienced Year-on-Year sales declines of -6.2% in the week of and week after Hurricane Helene and a massive -17.1% dropoff in the week of Hurricane Milton.

But due to significant and marked bouncebacks in all affected regions in the weeks immediately following, the overall impact proved to be nowhere near as extreme overall.

In Florida, the difference in the downturn in sales growth during the specific hurricane impact weeks vs sales growth for those same weeks plus the immediate bounceback recovery was a huge +16.5% in comparable sales growth.

However, it is important to mention that this effect does not take into consideration those restaurants that may remain closed or could be permanently closed as a result of the damage.

Estimated Effect in Comparable Sales Caused By Hurricanes Helene and Milton

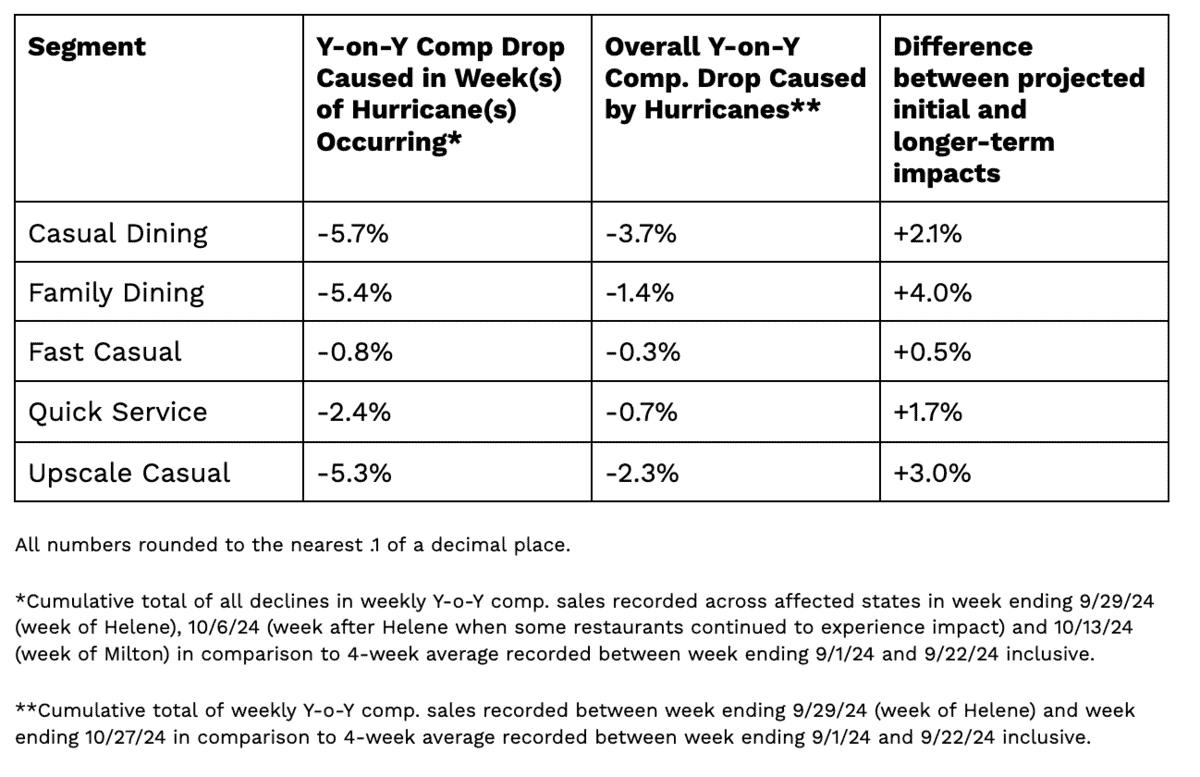

Recovery Across Restaurant Segments

The rate of recovery varied significantly by restaurant type. Quick Service restaurants (QSRs) and Fast Casual led the way, with comparable sales drop offs of -0.7% and -0.3% respectively caused by the hurricanes.

Victor Fernandez, VP of Insights at Black Box Intelligence, commented:

“The restaurant industry’s rapid rebound after Hurricanes Helene and Milton was likely driven by several key factors.

“For example, displaced residents turning to local dining establishments for meals, as many lost access to their kitchens. Additionally, recovery teams from other states boosted sales, while widespread utility outages increased demand for restaurants as people lost access to refrigeration.

“Grocery supply chains also faced challenges meeting the immediate demand once power returned, further positioning restaurants as a critical resource during the recovery phase.”

“As pillars of their communities, restaurants play an essential role not only in daily life but especially in times of crisis. The recent impacts of Hurricanes Helene and Milton have highlighted the resilience and adaptability of the restaurant industry, proving it to be a lifeline for local communities in the aftermath of natural disasters.

“Beyond offering a place to gather and dine, restaurants provide critical support for displaced residents and recovery teams, underscoring their value as both economic drivers and vital community hubs when people need it most.”

About the Research

The data is based on weekly sales and traffic reporting from Black Box Intelligence’s network of 180 restaurant brands. The comparisons were calculated by comparing the Year-on-Year growth averages for the four weeks prior to Hurricane Helene with the Year-on-Year growth percentage for the weeks of Hurricane Helene and Hurricane Milton and the weeks immediately after (up to and including week ending 10/27/24). Full research is available on the Black Box Intelligence website.

About Black Box Intelligence

Black Box Intelligence is a data and technology company serving multi-unit restaurant businesses. With a history built on drawing on financial performance and workforce intelligence from a network of 400+ restaurant brands, it now combines the best benchmarking in the industry with experience management and guest sentiment measurement technology to provide a clear and quantifiable roadmap for operational success.

For more information:

Andy Smith

CMO, Black Box Intelligence