JUNE: BY THE NUMBERS

We’ll explore the themes highlighted in this article in more detail at our Restaurant Industry Snapshot webinar.

Sales and Traffic Slow Downs

As we move through the year, it’s becoming increasingly clear how the declining economy is impacting the restaurant industry.

By June, many restaurants started feeling the pinch, with shifts in both sales and customer traffic reflecting broader economic challenges in 2024.

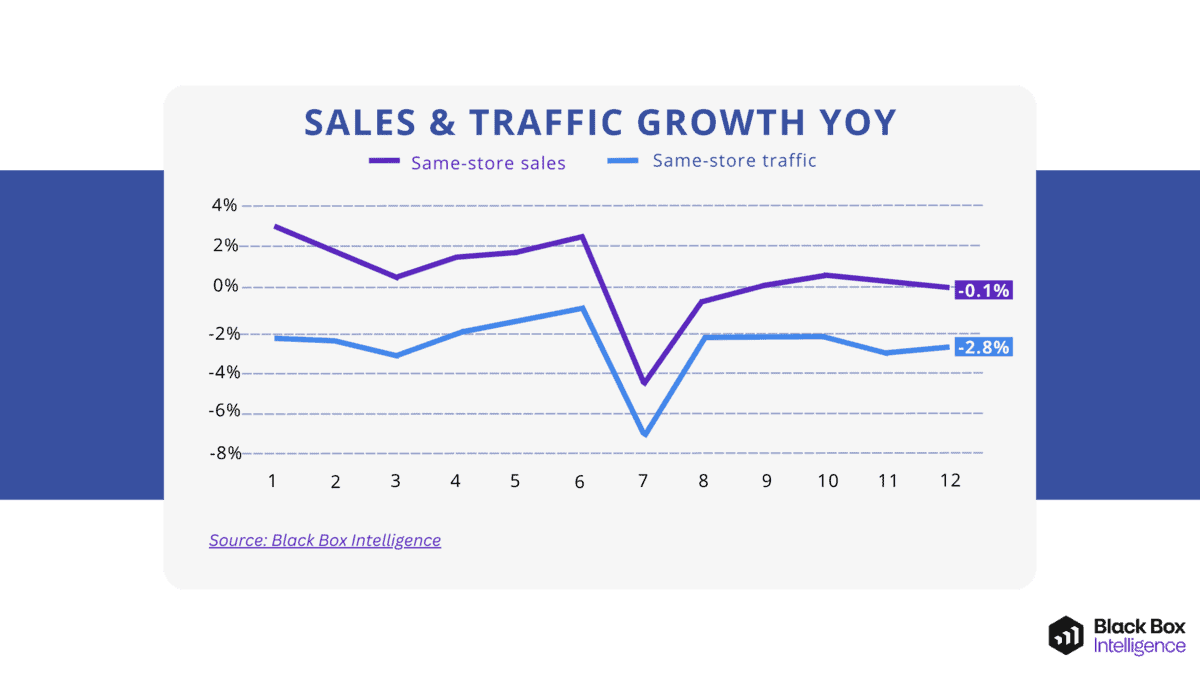

June also marked a significant moment for restaurants, as same-store sales growth slipped to -0.1%, representing a 0.4 percentage point deceleration in sales growth.

This meant it was also the first month since February to experience negative year-over-year sales growth.

And to top it off? June was not an isolated event, as it was the second consecutive month of declining sales performance.

Same-store traffic growth was -2.8% in June, which, although represented a small 0.3 percentage point improvement compared with May, remains very weak compared to historical performance.

Fast forward to July, we moved out of the frying pan and into the fire.

In a possible turning point for the industry, July results showed the industry stumbling from a traffic standpoint.

Data indicated the second-lowest same-store traffic growth since July of 2022 (only January of 2024, with its significant weather headwind, was worse during the period).

But it wasn’t all doom and gloom.

2024 Consumers Expecting More Value From Their Meals

Since the high inflation of the post-COVID years, price-sensitive consumers have adjusted their internal calculation as to when and where to eat out.

And that new mindset favors brands that focus on value.

Inflation Remains Key Concern for Consumers

There are finally some positive signs regarding inflation in the past several months.

The Consumer Price Index (CPI) rose 3% year over year in June, which was less than anticipated.

And prices fell 0.1% from May to June, the first meaningful monthly decline since the early days of the pandemic.

However, most people don’t feel positive when they look at prices. A consumer’s psychology doesn’t consider monthly or yearly growth rates but rather how expensive everything got in just a few years.

Cumulative growth matters when it comes to inflation and since June of 2019, inflation has risen 23%.

Restaurants prices have risen 30% during that same period, which is more than overall inflation and much more than the price of groceries.

Restaurants With Best Traffic Growth Have Better Value Scores

Restaurant-goers have responded to this economic climate by chasing value.

In Q2 2024, the “Best” restaurants (restaurants in the top quartile) for same-store traffic growth had 8% better value scores than the “Rest” (restaurants in the bottom three quartiles) for Full Service and 10% better value scores in Limited Service.

Typically, for full service restaurants, food and service scores are what separates successful and struggling restaurants, while food and value matter equally for Limited Service.

However, in 2024, value has become far and away the prime differentiator for driving traffic in both of these industry segments.

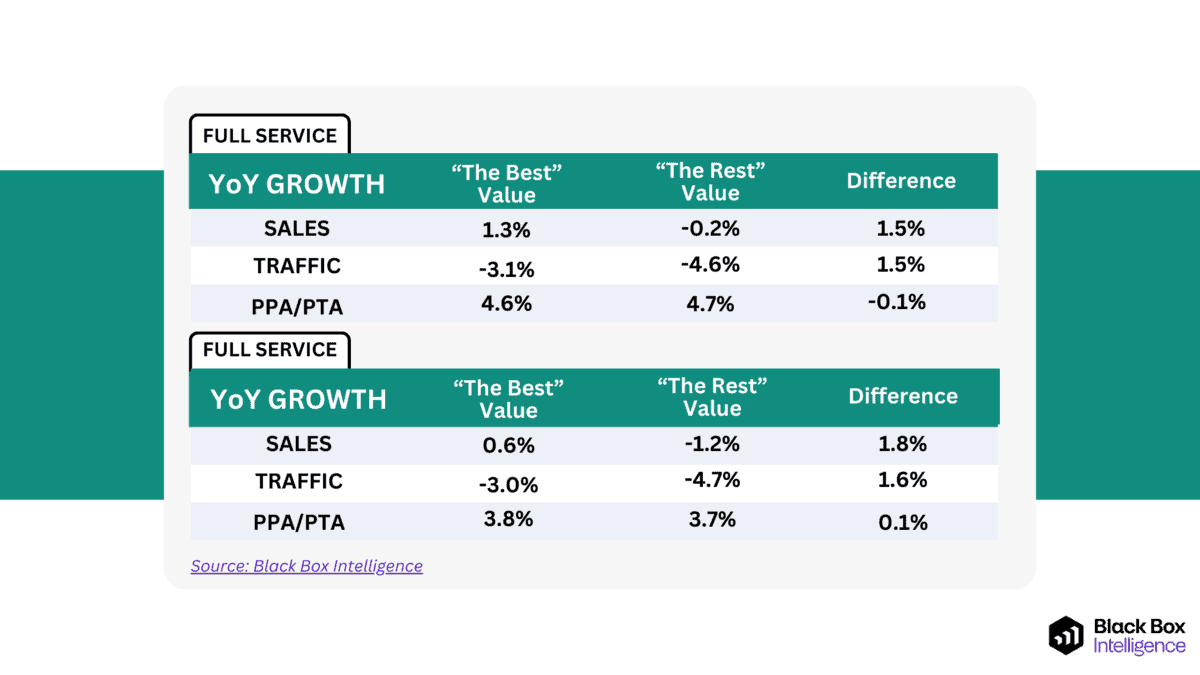

If we flip this, and look at “Best” versus “Rest” for value scores, we’ll find the “Best” among full service restaurants have 1.5% better Sales and Traffic growth than the “Rest”.

For Limited Service, the “Best” value restaurant locations have 1.8% better sales growth and 1.6% better traffic growth than the Rest.

Value Is Not Just Low Check Growth

Surprisingly, the Best value scores in Full Service recorded only -0.1% lower check growth than the Rest and in Limited Service the difference was a 0.1% increase.

This does not mean that customers don’t care about price. Customers care a great deal about cost but as mentioned earlier, they rarely think of “good value” in terms of yearly check increase.

Worth It Or Not Worth It

However, this lack of correlation suggests there is more to value than price. When we dig into GuestXM reviews and look at words used often in reviews describing a restaurant experience as “worth it”, we find common themes of:

- Taste

- Variety

- Atmosphere

- Hospitality (Full Service)

- Feeling (Full Service)

- Convenience (Limited Service)

- Freshness (Limited Service)

Conversely, when looking at words used often in “not worth it” reviews, we find these common themes beyond price:

- Accuracy

- Texture

- Temperature

- Preparation (Full Service)

- Speed (Full Service)

- Portion (Limited Service)

Even if inflation continues to ease, until consumers have become accustomed to these price levels, restaurateurs should expect value to have an outsized influence in purchasing decisions for the remainder of the year.

Segment Performance: Who’s Thriving and Who’s Struggling?

When looking at specific industry segments, quick service, fine dining, and fast casual emerged as the top performers in June regarding same-store sales growth.

In contrast, Family Dining and casual dining were the only segments experiencing negative year-over-year sales growth amidst the economic challenges in 2024.

Across the board, however, all industry segments saw negative same-store traffic growth in June.

But as we continue to navigate the opportunities and economic challenges in 2024, we will keep you updated with resources like our webinars.

This includes our upcoming webinar, in which we will discuss industry data captured and benchmarked from more than 100,000 US restaurant units and concepts.

Learn more and register by clicking below.