Restaurant Sales and Traffic for September 2023

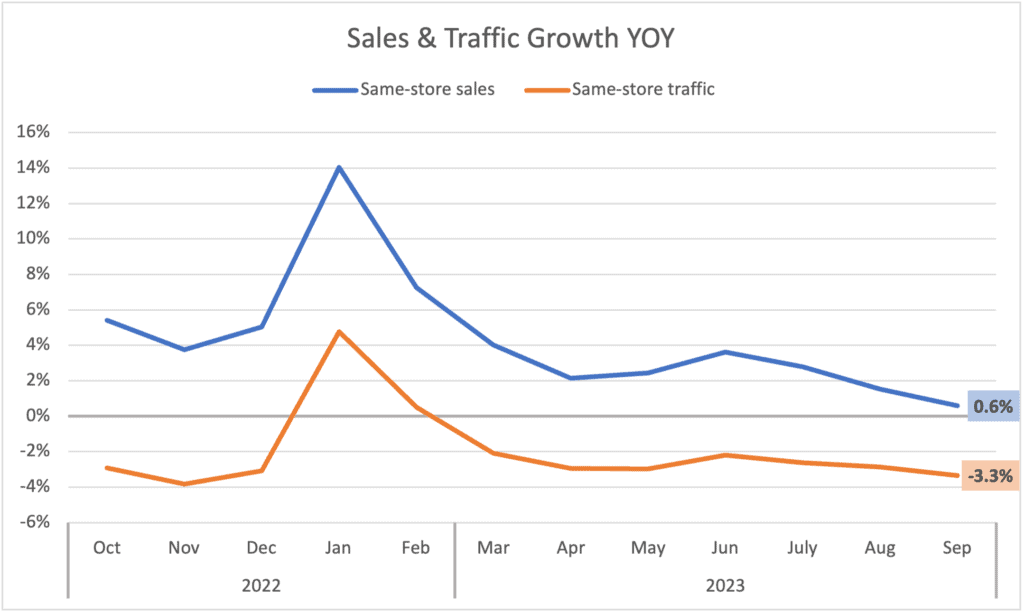

There is no doubt September was a weak month for restaurant sales. Same-store sales growth during the month fell to 0.6%, down from 1.5% in August and a much stronger 2.8% in July. September’s sales growth rate was the softest experienced by the industry in over two years. The last time restaurant same-store year-over-year (YoY) growth was weaker was back in February of 2021, the last month of the pandemic period in which the industry lapped over “normal” pre-COVID sales.

Traffic growth also fell during September, although at a more moderate rate than sales. Same-store traffic growth was -3.3% during the month, down 0.5 percentage points relative to August’s growth rate (as a comparison, the decline in sales growth was 0.9 percentage points during the same period). After experiencing a slowdown during each of the last three straight months, YoY same-store traffic growth reached its lowest level since November of last year.

A factor that is contributing to sales growth declining at a faster rate, while traffic is experiencing smaller erosion, is average check growth decelerating on a YoY basis. Yes, consumers continue spending more on average every time they go out to eat or order food from their favorite restaurants, but the rate at which check is increasing has moderated significantly in recent months. Average check growth YoY was slightly above 4.0% in September, while guests experienced check growth averaging 6.5% during the first half of 2023.

The slowdown in restaurant traffic growth impacted the majority of industry segments during September. The only two segments that saw an improvement in traffic growth were fine dining, which was able to position itself as the top-performing segment based on YoY traffic growth in September, and family dining, which despite the improvement, remains at the bottom of the segment ranking based on traffic growth. Behind fine dining, we find limited-service restaurants continuing to perform better than most in this environment. Fast casual occupied the second spot based on YoY traffic growth in September, with quick service coming in at number three.

With consumers becoming increasingly cautious and an impending economic slowdown seemingly on the horizon, the expectation remains for those segments in the lowest price points (fast casual, and especially quick service) to continue to outperform most in full service during the year ahead.

Maintaining Value Amidst Inflation

High check growth has become an inevitability for restaurants. Since 2019, inflation has risen 20.4%. This mirrors our GuestXM Financial Intelligence data, which shows the median four-year check growth for the industry at 22.2% (23.1% for full service and 16.1% for limited service). Not surprisingly, the perception of “value” has suffered. According to GuestXM’s internal Guest Intelligence data, value net sentiment is down 7% in full service and 24% in limited service since 2019.

In this inflationary environment, value has become a key metric. As detailed in our April blog post, the brands that saw the most improvement in their value net sentiment scores over the past four years had 1.5 times better sales growth and an enormous 8 times better traffic growth.

It is crucial to realize, however, that check growth and value are not perfectly associated. In fact, in Q3 2023 half of all the brands above the median in value net sentiment were also over the median in check growth YoY. Price is only one aspect of the value score. Hospitality also plays a huge part. Restaurants with great hospitality can make a guest feel that they got their money’s worth even when the check increased.

Since the COVID-19 pandemic, restaurateurs have had to shift their focus from one challenge to the next, and hospitality has become an afterthought rather than an obligation for many brands. While this is understandable given the difficulties—a fluctuating mix shift toward off-premises orders, the Great Resignation, which led to historic-high turnover rates in the industry, unprecedented levels of inflation, and an ever-present fear of recession—concepts that have leaned into hospitality have thrived despite these macroeconomic difficulties.

Defining Hospitality

How can we define hospitality for restaurants? Not easily. It incorporates features of both service and ambiance while going above and beyond their usual limits. It all comes down to touchpoints and micro-experiences that make each guest feel valued, welcome, and at ease.

According to famous restaurateur and co-founder of Shake Shack Danny Meyer, “Service is the technical delivery of a product. Hospitality is how the delivery of that product makes its recipients feel.”

In a recent study, GuestXM looked into quantifying this nebulous term. Using our Natural Language Processing (NLP) tool, all reviews were filtered and categorized using positive attributes such as “welcome,” “appreciated,” “attentive,” and “friendly” and negative attributes like “careless,” “rude,” and “unprofessional.” From there, brands were given a “hospitality score.”

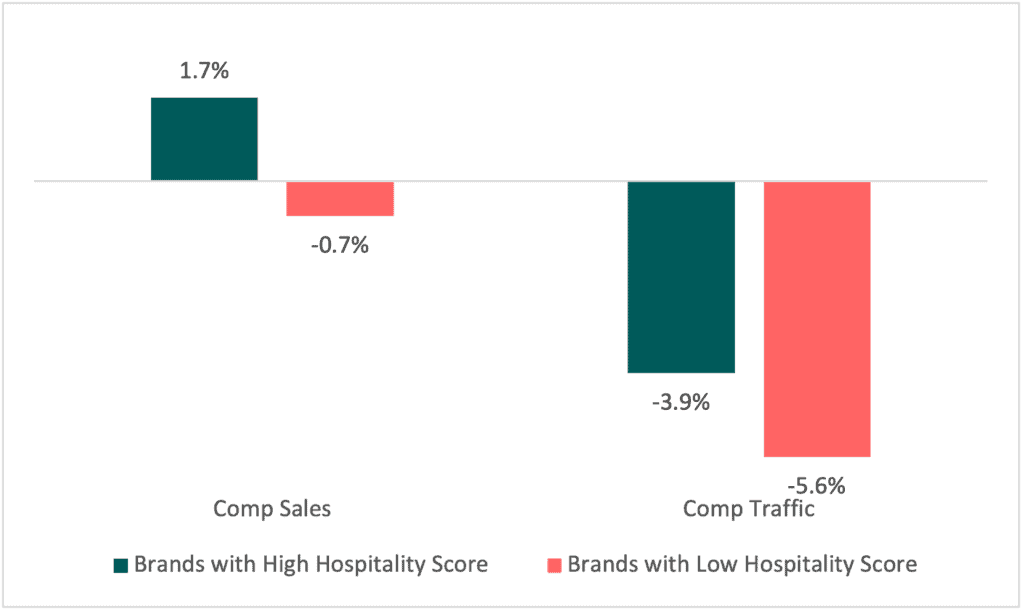

In Q2 of this year, full-service brands with stronger hospitality sentiment outperformed those brands with low hospitality by 2.4% and 1.8% for same-store sales and traffic growth, respectively. Not surprisingly, those restaurants with strong hospitality scores were also better at retaining their employees and reducing churn. Brands with a high hospitality score had 85% non-management turnover rates annually, while for those with low levels of hospitality, turnover was a much higher 105%. Delivering higher levels of hospitality requires greater commitment from employees, at least from a key core of highly engaged individuals.

Hospitality in a Digital World

Hospitality will only increase in importance from here. As of 2023, Forbes’ research on remote work shows that 12.7% of full-time employees work from home while 28.2% work a hybrid model. Furthermore, the social sphere has been removed from many other aspects of everyday life. E-commerce is becoming a larger and larger percentage of all retail as consumers have ditched the mall for Amazon. Domestic box office revenue was down 40% in 2022 compared to 2019, according to the Hollywood Reporter, as moviegoers are opting to stream in greater numbers.

Given these trends, going out to eat has become one of the few remaining avenues for in-person socialization, so the stakes are even higher to create a welcoming environment to make the rarefied outing feel special and worthwhile. Honing in on hospitality will give smart brands a competitive edge over those who underestimate its power.