Monthly Restaurant Trends Review

Out of the Box: June 2025

-

Same-store sales rose 2.0% in June, making it the industry’s strongest month since January.

-

Only three of the past 22 months have posted stronger sales growth results than June 2025.

-

The weakest regions in sales growth border the southern edge of the country; the strongest? Clustered along the Northeastern coast.

-

Staffing challenges: 40% of brands report being constantly understaffed in FOH, 54% saying they’re usually understaffed in BOH.

In This Issue:

-

The Big Picture: Sales and Traffic Trends

-

Segment Focus: Fine Dining

-

Best vs Worst: Region, Segment, and Cuisine

-

Staffing Turnover Review: Full Service

June 2025 Restaurant Industry Trends

The Big Picture: Sales and Traffic Trends

Consumers grew more optimistic in June, breaking a five-month streak of declining sentiment. The University of Michigan’s Consumer Sentiment Index recorded its first increase since the start of the year. Consequently, inflation expectations eased, and concerns over tariffs also declined.

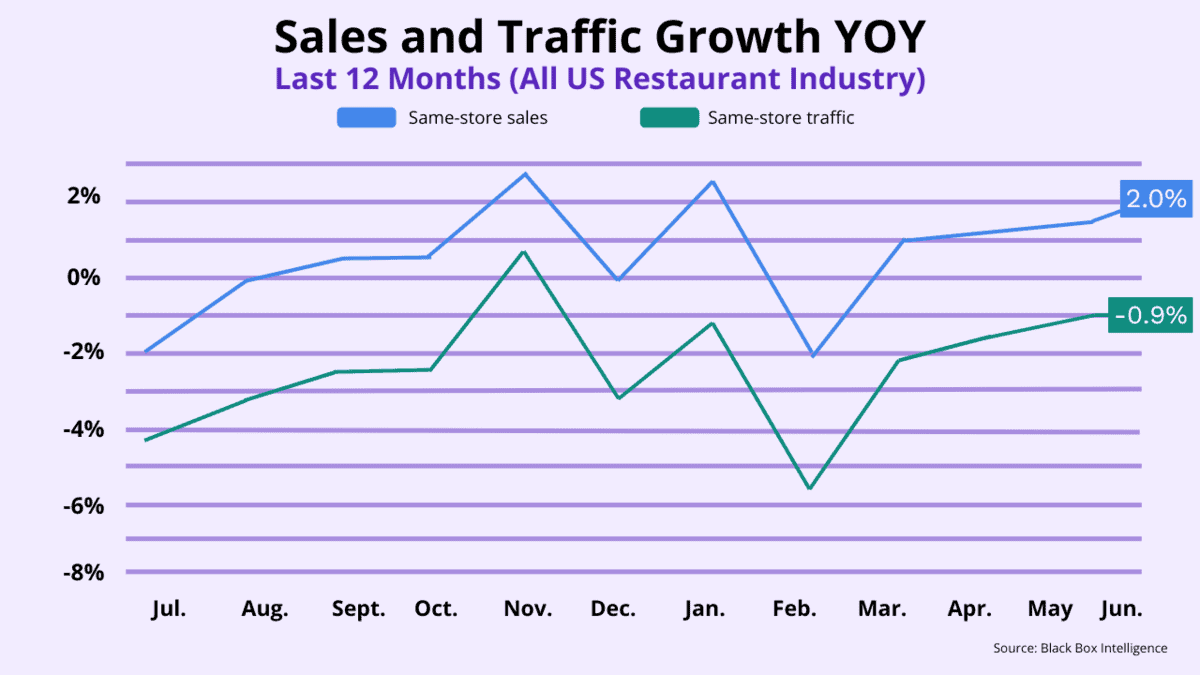

Additionally, this renewed confidence lifted restaurant performance. As well, same-store sales rose 2.0% in June, making it the industry’s strongest month since January. The standout result in the June 2025 Restaurant Industry Trends? Only three of the past 22 months have posted stronger sales growth results than June 2025.

Moreover, same-store traffic dipped by 0.9% in June, but the month still ranked as the best for restaurants since January and the third strongest in more than three years.

| Month | Jul. ’24 | Aug. ’24 | Sept. ’24 | Oct. ’24 | Nov. ’24 | Dec. ’24 | Jan. | Feb. | Mar. | Apr. | May | Jun. |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Comp. Sales | -2.3% | -0.4% | +0.4% | +0.5% | +2.8% | -0.3% | +2.5% | -2.5% | +0.9% | +1.1% | +1.4% | +2.0% |

| Comp. Traffic | -4.6% | -3.6% | -2.7% | -2.5% | +0.9% | -3.2% | -1.3% | -5.7% | -2.2% | -1.5% | -1.0% | -0.9% |

Segment Overview

Who’s Up and Who’s Down Across the U.S.

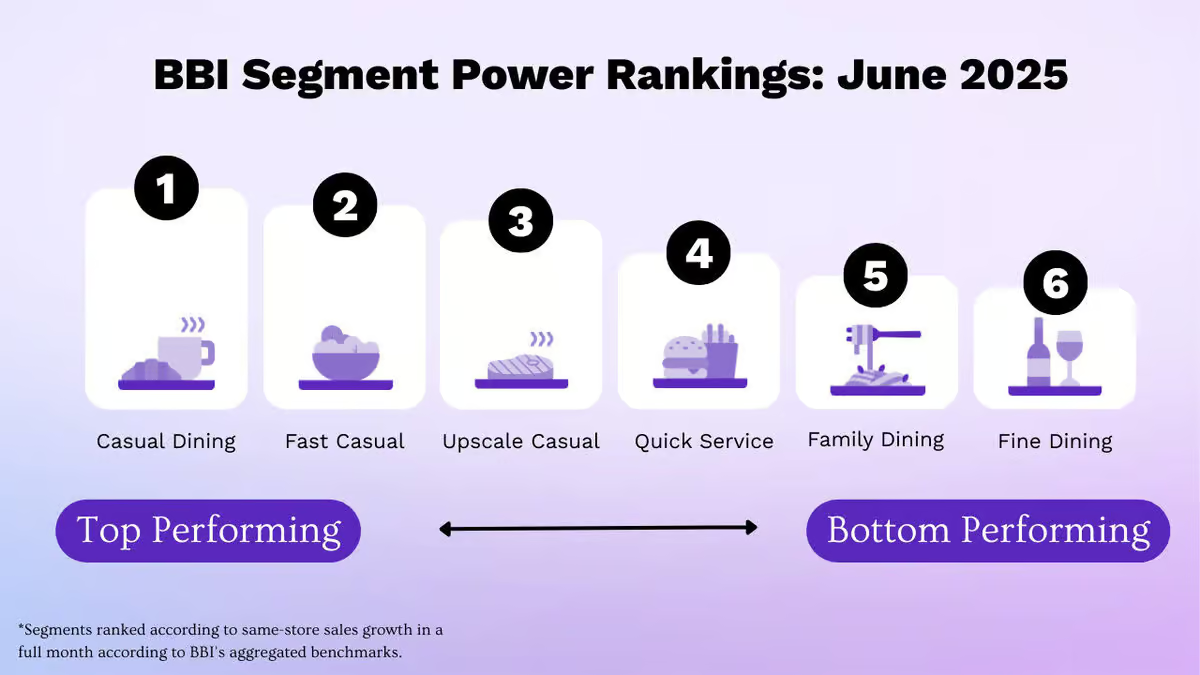

June’s strong performance wasn’t an isolated event. It spread across nearly every restaurant segment, with all but Fast Casual accelerating their year-over-year same-store sales growth compared to May.

Casual Dining led the pack once again, outperforming every other segment by a wide margin. It has held the top spot since March. Additionally, this segment has several large, legacy brands who are owned by public companies. Moreover, many recently shared their very strong year-over-year sales results in their latest earnings filings.

Still, strong top-line performance doesn’t tell the full story.

Only 39% of Casual Dining brands tracked by Black Box Intelligence achieved positive same-store sales growth in June.

And about the same percentage of brands in the segment saw sales drop by more than 3%.

On the other hand, Fine Dining posted the weakest same-store sales growth for the second consecutive month. This is the third time since March. Also, experts point to weakening economic conditions in 2025, suggesting even higher-income consumers are trading down.

YOY same-store sales growth

Best vs Worst: Region, Segment, and Cuisine

Restaurant sales improved across most of the country in June. Year-over-year same-store sales growth accelerated in 10 of the 11 regions compared to May. Whereas, the Midwest was the only region where growth slowed slightly.

Nearly every region posted positive same-store sales growth in June… except for California.

California remained the worst-performing region for the fourth straight month. Subsequently, it has only recorded positive sales growth once this year, back in January.

Thus, a clear trend emerged among the regions with the softest June sales growth: they all border the southern edge of the country.

In addition to California, the weakest performers in June were…

-

Texas

-

The Western region

-

The Southeast region

-

The Southwest region

In contrast, the regions with the strongest sales growth clustered along the Northeastern coast.

-

New England

-

The Mid-Atlantic

-

New York-New Jersey

New England has now been the best performing region during three of the last four months.

Segment Focus Deep Dive

Current Performance Trends in Fine Dining

Fine Dining continues to struggle — and it’s not just a recent trend.

The segment has faced ongoing challenges over the past five years and is still losing sales on top of earlier declines in the first half of 2024.

Several factors likely contribute to this soft performance:

High inflation has eroded consumer purchasing power, prompting many guests to shift special occasion meals to more affordable options. Further, even higher-income diners appear to be trading down some of their usual fine dining occasions, influenced by rising prices and declining guest sentiment.

Above all, higher prices also raise expectations.

Guests expect the experience to justify the cost. And if it doesn’t, they’re less likely to return.

Black Box Intelligence data shows that while average star ratings (ASR) for online reviews are improving across most segments, Upscale Casual and Fine Dining are exceptions. In these higher check categories, guest sentiment has slightly declined.

So, when guests pay more but don’t get the same experience they remember, they’re less likely to return.

Staffing, Workforce, And Employment Focus

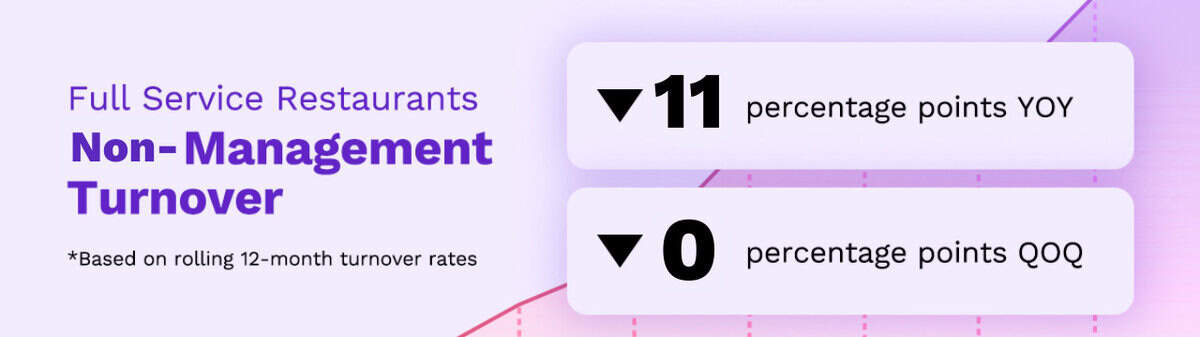

Current Turnover Trends in Full-Service Restaurants

Workforce trends offer some good news… but challenges remain.

Turnover rates for non-management employees in Full Service restaurants have steadily declined and stayed below pre-pandemic levels for the past year. But even with these improvements, many restaurants still struggle to hire and retain enough staff to operate at full strength.

The 2025 Black Box Intelligence Total Rewards Survey highlights the issue:

- 40% of Full Service restaurant companies say they are constantly understaffed in front-of-house non-management roles.

- 54% report they are usually understaffed in back-of-house positions.

This staffing shortage directly affects execution and guest experience.

Black Box Intelligence analysis shows that Full Service restaurants with the lowest turnover rates consistently earn higher guest ratings —> especially for food, service, and cleanliness.

Victor Fernandez, Chief Insights Officer, On:

Expectations for Q4 of the year

“The economy continues to add jobs, but it is only through a very small of industries expanding, while most are beginning to experience contraction. Interestingly, leisure and hospitality and healthcare are the private sectors continuing to add jobs to their payrolls. The number of people falling behind in their debt payments continues to rise. And the threat of inflation due to tariffs remains.

The consumer may be feeling a little less pessimistic than in previous months, but the bigger story continues to be the expected slowdown in the economy this year, with a rise in inflation and the unemployment rate.

July will likely be a good month for sales and traffic growth, given the very weak results posted by the industry in July of 2024. But the forecast continues to be for softening sales and traffic growth through the rest of the year, particularly in Q4.”

For Deeper Analysis

Quarterly SOTI Webinars

We go into way more detail in our flagship quarterly State of the Industry (SOTI) webinar – our definitive take on the latest developments and a must attend for anyone in the restaurant industry.