Challenges in Restaurant Industry Performance

April 2023 Overview

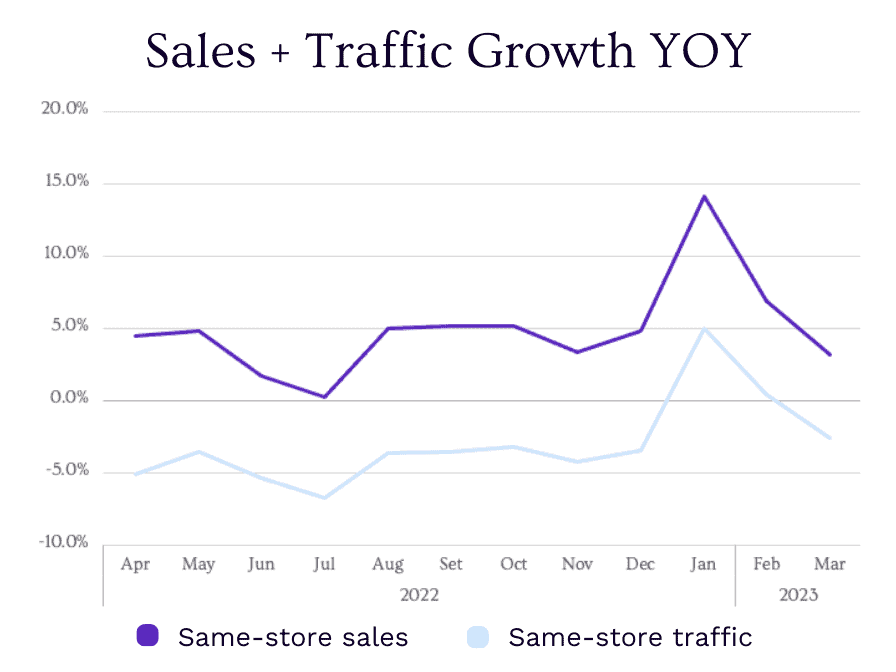

Restaurants saw their year-over-year same-store sales and traffic growth fall for the third consecutive month in April. During this month, the industry experienced its softest sales growth since July of last year, making April the second-worst month in over two years. The Omicron-induced sales growth boost enjoyed during the first months of the year is long gone, and the industry is now contending with a harsher reality: sales growth is now weaker than it was at the end of 2022. Same-store sales growth was 1.3% in April, which represented a 1.9 percentage-point drop in the year-over-year growth rate compared with March. By comparison, sales growth averaged a much stronger 4.4% during the months of Q4 2022.

But this deterioration of sales growth is largely the result of average guest check growth decelerating significantly, while traffic growth has been holding up a little bit better. Same-store traffic growth was -3.5% for the restaurant industry during April; this was a 0.9 percentage-point drop compared to March’s growth rate, meaning sales growth decelerated at a faster rate than traffic during April. Of course, there are still concerns for an industry that has only seen three months of positive year-over-year guest counts since the beginning of 2022 (and all of these months were greatly aided by external factors such as extreme weather or the largest COVID spike). But while sales growth is down compared to late 2022, same-store traffic growth remains just slightly better than the average -3.7% recorded for the Q4 2022 months.

There continue to be signs of guests trading down toward limited-service restaurants, particularly quick-service brands. The traffic challenge affects the entire industry, with all segments posting negative year-over-year same-store traffic during April. But the best-performing segment based on traffic growth during the month was quick service, followed by family dining, then fast casual. Furthermore, only one segment was able to improve its year-over-year sales or traffic growth during April compared to the previous month: quick service.

In what is undoubtedly positive news for consumers heavily impacted by the highest inflation rates in decades during the last two years, average guest check growth in restaurants has fallen significantly over the last three months. A driving factor behind the softening of check growth has been a moderation in menu price increases, as cost pressures for restaurants subside. Average guest checks grew by 5.2% year over year in April, down from 6.2% in March and a considerable drop from the average 8.4% reported for the months in Q4 2022.

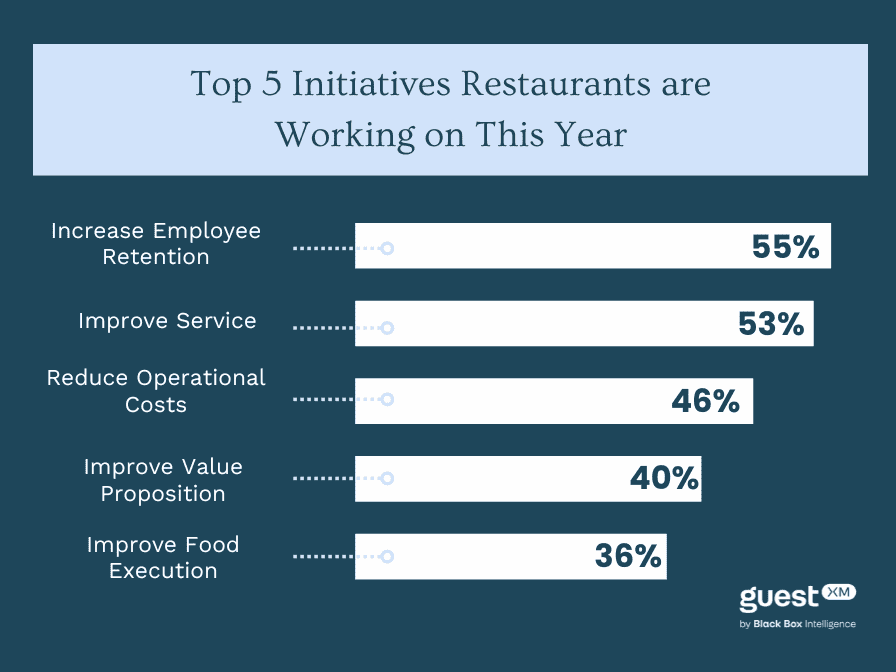

Every quarter, Black Box Intelligence hosts executives from the nation’s leading restaurant chains for our quarterly State of the Industry Webinar. These webinars are valuable not only because of the actionable data that is presented but also due to the information shared by top brand leaders. We asked our attendees to list their major initiatives for the coming year. The responses are a window into the health and direction of the industry.

Top Priority

An overwhelming 55% of respondents consider employee retention as a main initiative in 2023. This is especially germane to our current social landscape. The post-COVID “Great Resignation” was just an accelerant to the decades-long decline in labor-force participation. Leisure and Hospitality (and therefore restaurants) have lost the most workers of any US industry. As of February, there were 1.3 million unfilled jobs in the Food Service and Accommodations sector. According to GuestXM Workforce data, limited-service restaurants are operating with 1.7 fewer hourly employees on average per location than they did in 2019, while full-service restaurants are operating with 3.7 fewer front-of-house hourly employees. A significant factor behind the industry’s staffing woes is employee turnover, which although reduced in recent months, continues to be much higher than it was back in 2019.

Prioritizing Service Excellence for Business Growth

Considering these staffing issues and the associated turnover, it is understandable that 53% of the webinar attendees responded that enhancing service was a major goal for the coming year.

Companies that receive positive service reviews are amply rewarded. According to our Guest and Financial Intelligence data, brands in the top quartile of service net sentiment have a 1.5 times better four-year sales growth and 6 times better traffic growth than their competitors.

As companies invest heavily in employee retention and elevating service, 46% of survey takers are looking to reduce operational costs. One of the most newsworthy examples of this was Wendy’s recent announcement that they will be experimenting with AI by using a Chatbot to take orders at a location in Ohio. While this is an extreme example, restaurant cost inflation is forcing companies to adapt quickly and thoroughly to a volatile environment by making cuts where possible, improving efficiency, streamlining procedures, and thinking out of the box.

Inflation rising 19% in the past four years is likely the reason 40% of survey takers listed improving their brand’s value proposition as one of their most important focuses this year. Consumers are much more aware of price and portion than they were a few years ago. This is reflected in Black Box Guest Intelligence data. Brands that saw the most improvement in their value net sentiment scores over the past four years saw 1.5 times better sales growth and 8 times better traffic, more significant than any other guest sentiment category.

These survey responses provide a glimpse into the thoughts of restaurant executives. And clearly, staffing woes and inflation remain top of mind.