Reviving the Restaurant Industry

Navigating Consumer Trends in 2018

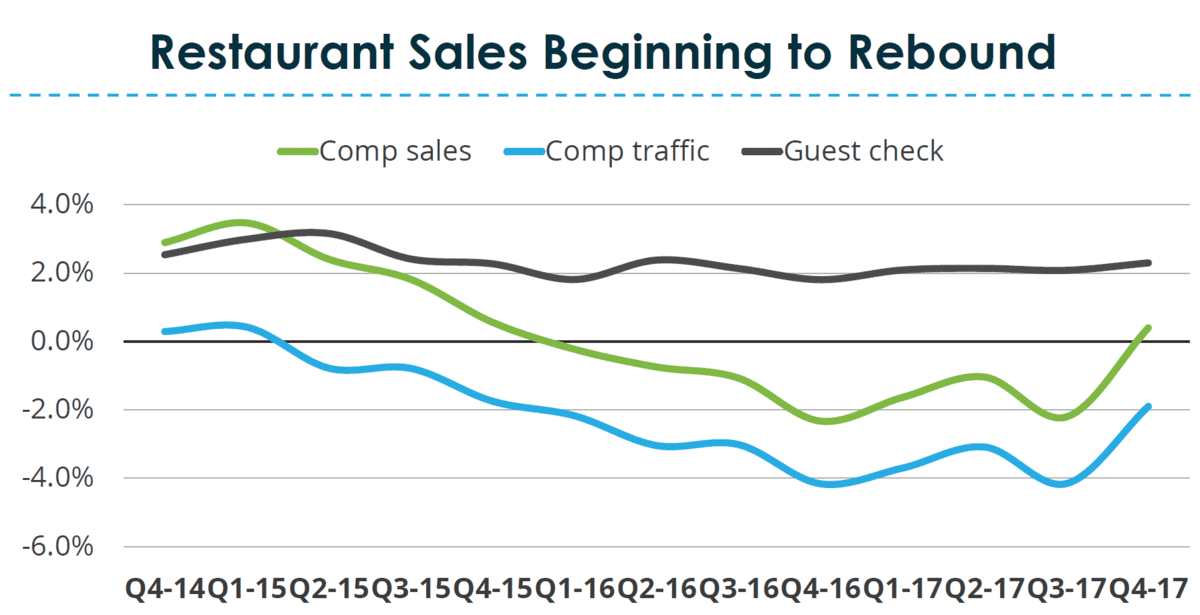

Three years ago, the restaurant industry was in its prime. Comp sales growth was at its peak, and life seemed good for chains. Today, it’s a different story. After back-to-back quarters of negative sales growth, and even worse traffic results, restaurant operators are finding themselves desperate to turn things around again.

Paying attention to consumer trends is one of the first steps to combating the industry’s downturn. Black Box Intelligence (formerly TDn2K) has compiled the insights from 2017 to show you exactly what you need to pay attention to this year.

2018 Restaurant Industry Trends: From Sales Growth to Beverage Innovation

1. More money was spent in restaurants than groceries during 2017.

Chain restaurants may have spotted the light at the end of the tunnel. After two long years, the restaurant industry finally reported its first quarter of positive same-store sales growth. According to Financial Intelligence (formerly Black Box Intelligence), the industry reported a comp sales growth of 0.4 percent in the fourth quarter of 2017. Although sales did slip a little bit in the first month of 2018 (-0.3 percent), optimism remains that the industry is beginning to see the turnaround that it has been desperately waiting for.

This growth is evident across almost all dining segments. Fine dining reported the highest sales growth in the fourth quarter of 2017, with a 3.2 percent growth. Similarly, casual dining slightly rebounded from its year-long downturn with a sales growth of 0.3 percent.

Additionally, for the past two years, consumers have been spending more money in restaurants than in grocery stores. This is both good news and bad news, according to Victor Fernandez, executive director of insights and knowledge at Black Box Intelligence (formerly TDn2K).

The good news is that the restaurant industry is now beating one of its main competitors in overall spending. The bad news is that the continually dismal traffic results suggest that there are too many players in the market right now, making it difficult for brands to get ahead.

“Over half of our food dollar is now going to restaurants, but we have more supply than demand when it comes to local restaurant options in most cases,” Fernandez explained.

2. Spending is shifting towards counter service.

For every $1.00 spent on chain restaurants in 2017, counter-service brands received almost 72 cents. That speaks volumes to how consumers currently look to restaurants – as a sort of meal replacement. This means that price, convenience, speed, and ability to take food to-go are some of the most important factors.

Therefore, it’s not surprising that quick service and fast casual reported the biggest year-over-year change in market share of chain restaurant total sales in 2017. Quick service saw the most market share growth out of all dining segments.

Off-premise sales continue to grow rapidly as well. This includes to-go, drive-thru, catering, and delivery. Again, unsurprisingly, quick service and fast casual have the most off-premise sales as a percentage of total restaurant sales. Additionally, fast casual reported the biggest growth between 2015 and 2017.

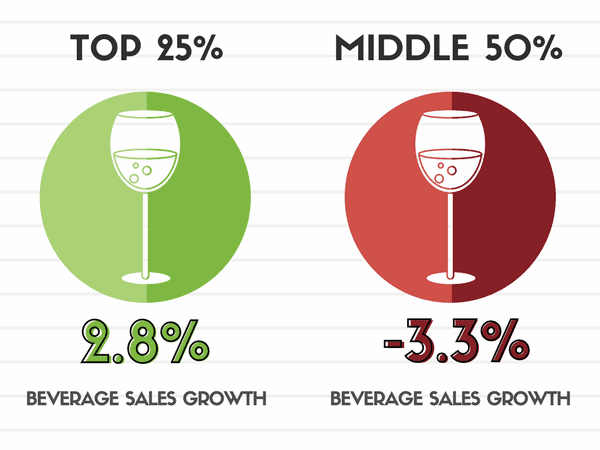

3. Top performers are driving incremental sales through beverages.

Many restaurants appear to be overlooking the value of beverages. Research shows that consumers are willing to pay for delicious, unique beverages. This presents a good opportunity for brands to improve their bottom line. However, a lot of brands are not currently taking advantage of this opportunity.

When it comes to same-store sales growth performance, restaurants in the middle 50 percent reported -3.3 percent beverage sales growth in 2017. Top performers, on the other hand, have jumped on the opportunity. Through combinations of innovative beverage offerings, better marketing, and successful upselling by their employees, top performers reported 2.8 percent beverage sales growth in 2017.