June 2025 Monthly Second Helping: Highlighting Hot Topics in the Industry

How Are Consumers Managing Check Growth: Restaurateurs Weigh-In

For years, BBI has reported on the impacts of inflation and economic fears in the restaurant industry.

Whether it be financial, workforce, or review data: economic woes have affected nearly every metric we collect.

Yes, Black Box Intelligence is built on analyzing the data. However, getting the anecdotal thoughts, opinions, and observations of those actually working in the industry is vital to enhance our findings.

This is why every State of the Industry webinar includes a poll for the restaurateurs in attendance.

Our latest poll offers invaluable insights into how customers are managing their checks during these economically uncertain times.

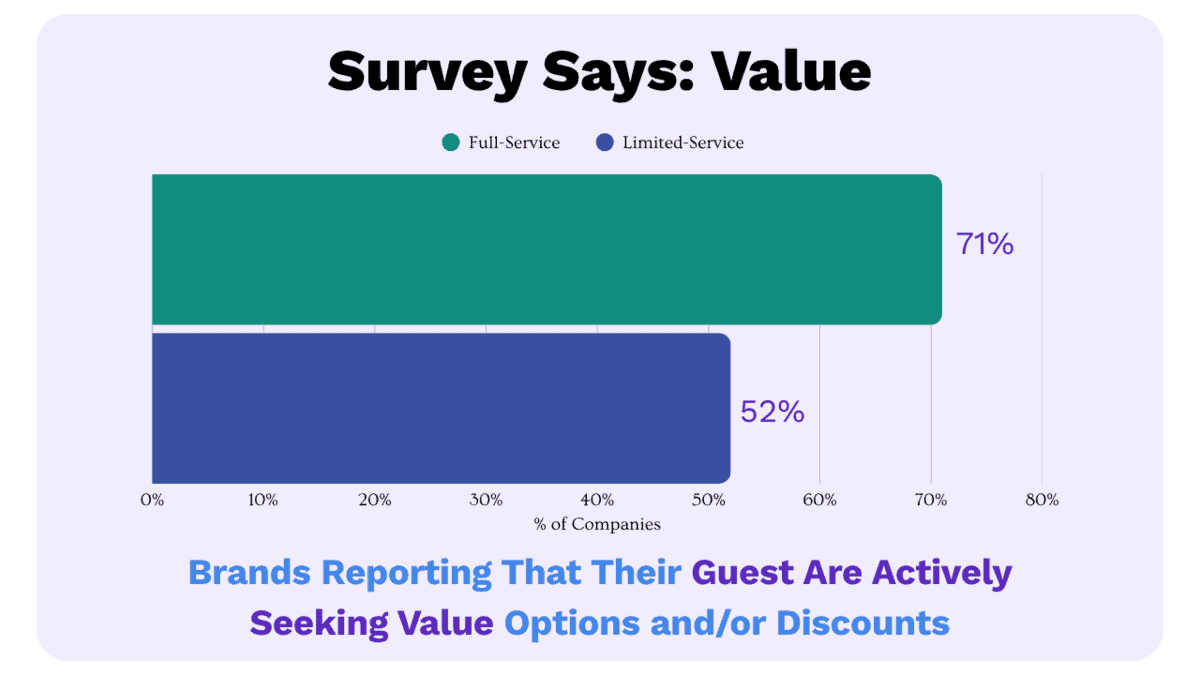

Survey Says: Value

More than two-thirds of the companies have noticed a shift in customers seeking more value. This breaks down to 71% of Full-Service brands and 52% of Limited-Service Brands.

Nearly all segments are now expected to offer deals to make their experience worthwhile for guests.

These real-world observations corroborate Black Box Intelligence’s analysis.

In recent quarters, value sentiment has been the top driver of traffic outperformance.

It is no coincidence that so many brands are leaning into value with:

- “McValue” platforms

- “Luxe Cravings Boxes”

- “Really Big Meal Deals”

- “3-For-Me Deals.”

Cutting Back Within Meals

The second most common strategy of wallet-conscious patrons.

This was according to restaurateurs, since they are cutting back on items.

42% of Full-Service brands reported that they’ve noticed their diners forego alcohol more than they’ve in years past. Again, this is backed up by Black Box Intelligence’s data.

Our experts observed a decline in same-store beverage year-over-year growth for every segment.

This occurred in both 2024 and 2025. This is with the exception of only Fine Dining in 2025 to-date (likely because it recorded a dismal -7.4% in 2024).

Similarly, 29% of both Full and Limited Service companies said that consumers were cutting back on soft drinks.

Full Service concepts also noticed that more customers were cutting back on dessert (35%) and appetizers (29%).

And 29% of Limited Service companies also noticed more customers splitting entrees. 26% of Full Service brands in attendance noticed this as well.

How Companies Say Their Customers Are Managing Check

Takeaway

2024 and 2025 have proven that people are still willing to go out to eat but will be more strategic and calculated about it than in past years.

This is despite consumers managing check growth.

However, the best restaurant executives will need to be equally strategic and calculated to get their business.

What’s the Monthly Second Helping?

Every Month Black Box Intelligence releases the latest data in our Out of the Box industry review. But we want to dive deeper into the latest hot topics, takes, and insights we are seeing industry-wide. That’s where “Monthly Second Helping” comes in. Read more to see our industry experts’ unfiltered perspectives and insights on a key topic or theme of the hour.