June 2023: Signs of Growth Amidst Lingering Challenges

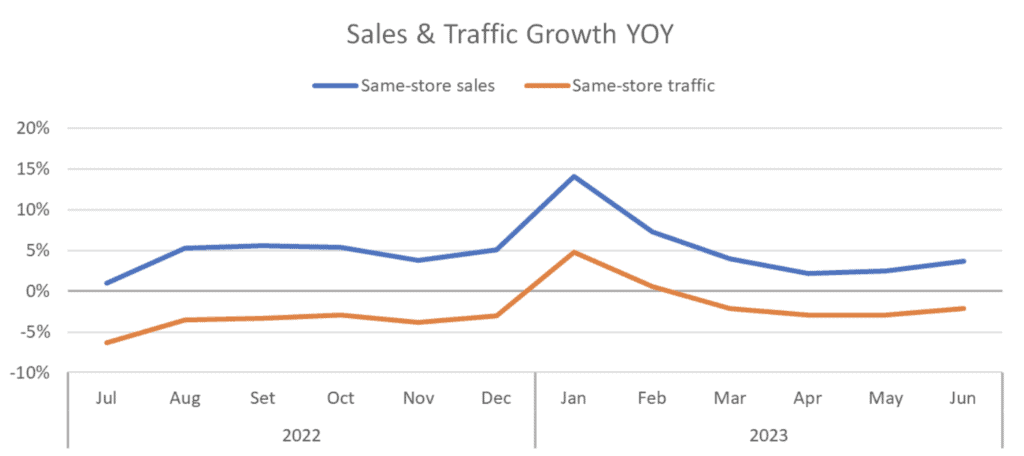

June was a relatively good month for restaurants. Same-store sales and traffic growth reached their highest levels since March, with each of the last two months posting stronger year-over-year (YoY) results than the previous month. The fact that the industry lapped over the month with the highest inflation rate in more than 40 years (June 2022 experienced inflation of 8.9% YoY), as gas prices hit an all-time high during that same month, likely played a part in boosting sales and traffic growth during June 2023.

Same-store sales growth was 3.6% in June, up 1.2 percentage points compared to May’s YoY growth rate. Despite the improvement during the month, sales growth remains softer than what was seen in late 2022. Sales growth averaged 4.7% for the three months in the last quarter of last year.

Furthermore, any optimism provided by the recent improvement in sales growth is tempered by the fact that restaurants continue to experience declining guest counts. Same-store traffic growth was -2.2% during June, an improvement of 0.8 percentage points compared to May’s growth. Traffic growth has now been negative for 10 of the last 12 months, and the only two months with growing guest counts (January and February of this year) were when the easy Omicron-led lap boosted traffic growth.

Most industry segments experienced an acceleration in their YoY same-store traffic growth rate during June, except for quick service (which saw a small 0.3 percentage point slip) and fine dining (suffering a larger 2.5 percentage point decline). Despite the slowdown in quick service, the best performing segments based on traffic growth year over year continue to be those in limited service: fast casual and quick service.

The Direct Correlation Between Employee Retention and Enhanced Service Ratings

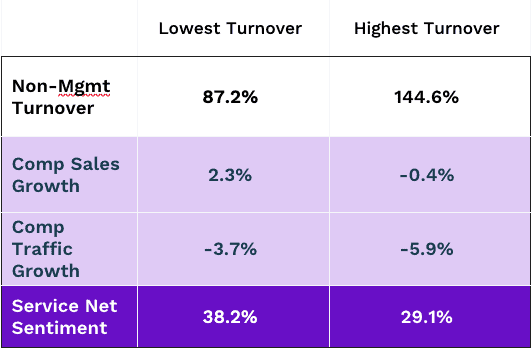

What steps can a company take to raise its service rating? Limiting employee turnover is easier said than done, but it is nonetheless an important factor with great potential impact on restaurant performance. Less turnover means longer employee tenure, which leads to a better guest experience. Brands in the quartile with the lowest non-management turnover have nearly 10 percentage points higher service net sentiment, an impressive 2.2 percentage points higher YoY traffic growth, and nearly 3.0 percentage points higher sales growth. Concepts in the quartile with the lowest general manager turnover have 7 percentage points higher service guest sentiment and traffic growth nearly 2.0 percentage points better than the rest.

Fortunately, the second half of 2023 is looking more positive for employers. Labor inflation is starting to slow down, and staffing levels have improved recently as turnover continues its slow but steady decline. As a result of the recessionary concerns and the deceleration of starting wages, employees are likely to moderate their job-hopping intentions, further lowering turnover rates and contributing to an increase in service ratings among guests.

Q2 Top Performers Based on Net Sentiment

Food

- Eddie V’s

- Seasons 52

- The Capital Grille

- Dave’s Hot Chicken

- Willie’s Grill & Icehouse

Beverage

- Seasons 52

- Eddie V’s

- Tous Les Jours

- Cooper’s Hawk Winery

- The Capital Grille

Service

- Eddie V’s

- Seasons 52

- The Capital Grille

- Willie’s Grill & Icehouse

- Twin Peaks

Ambiance

- Eddie V’s

- Seasons 52

- The Capital Grille

- In-N-Out

- Pappadeaux

Value

- In-N-Out

- Seasons 52

- The Capital Grille

- MOD Pizza

- Eddie V’s

Intent to Return

- Seasons 52

- Eddie V’s

- The Capital Grille

- In-N-Out

- Willie’s Grill & Icehouse