March 2021: A Glimpse into the Restaurant Industry’s Recovery

Industry Comp Sales & Traffic

Comp sales for March surged to 62.3% year over year, which is not surprising given how hard the industry was hit in 2020. Even more encouraging is positive 2-year same-store sales growth, at 1.8% industry-wide. Traffic still lags behind but still has made considerable improvements. 2-year traffic growth for the month is the best seen by the industry since February 2020. Traffic should improve but will continue to be a challenge for restaurants as operators now struggle with staffing their restaurants with enough employees to handle large volumes of customers. Sales performance improved for all segments, with quick-service, fast casual, and casual dining all posting positive 2-year sales growth. This growth comes from dine-in sales but is still largely lifted by off-premise

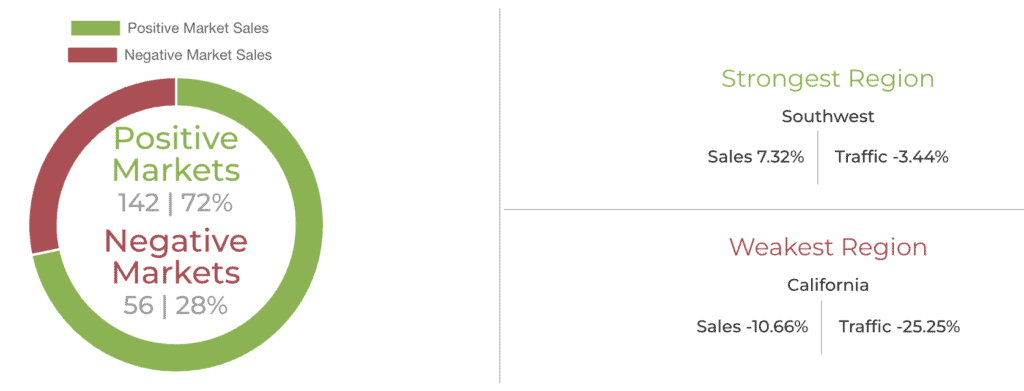

Regional & Market Performance

Sales performance is quite refreshing from a regional perspective. In February, 96% of markets posted negative market sales. In March, 72% posted positive market sales. 7 out of the 11 regions of the US posted positive 2-year sales growth during the month.

Warmer weather certainly helped, as well as the effects of stimulus check disbursement and the release of pent-up consumer demand as restrictions eased. California is still struggling as the worst-performing region, while the Southwest, Southeast, Western parts, and Texas posted the most substantial results.

The Restaurant Workforce

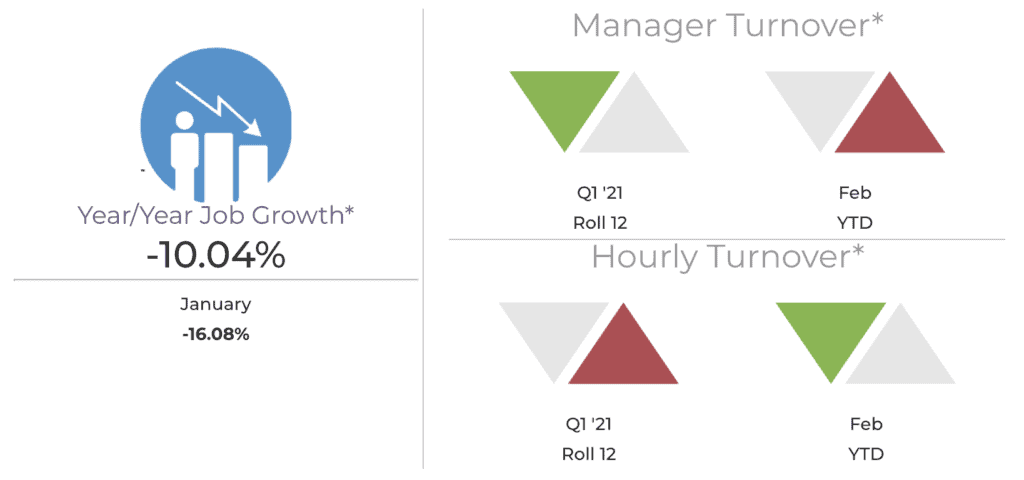

Job Growth & Turnover

Restaurants have put a lot of energy into making sure their locations are safe for guests and employees. The attention must now turn back to finding and keeping qualified employees. Months ago it was common to see signs on restaurant windows stating a limited capacity due to COVID; now that language has shifted. Seating may still be limited for many restaurants, only now it is because there is not enough staff to operate these locations.

The good news is that the restaurant industry still added jobs in March, but other industries have been able to hire at a faster pace, exacerbating the challenge.

Restaurant Sales Get a Boost as Workforce Challenges Resurface for Industry

As the industry lapped over the first month of the pandemic in 2020 where sales plummeted more than 30%, same-store sales growth skyrocketed to 62.3% year over year. For an industry that was among the hardest hit, it is most encouraging that, even on a 2-year comparison, restaurant same-store sales had growth of 1.8%. Not surprisingly, the first time in over a year that the industry has seen positive 2-year same-store sales growth.

Additionally, the 2-year sales growth improvement for March is almost 14 percentage points higher compared to sales growth for February. This was the biggest monthly improvement in that 2-year growth rate since June when restaurants in many parts of the country were just starting to open again after severe lockdown restrictions.

It’s important to note that although the 2-year growth comparisons will be the best way to assess restaurant performance on the road back to “normal”, year-over-year comparisons will still be reported as appropriate.

Year-over-year same-store sales growth was 10.8% in Q1. There are several factors at play behind the surge in restaurant sales. Stimulus checks put money in consumers’ pockets and accelerated the recovery of the labor market by boosting demand. The rollout of vaccines and decreasing number of COVID cases bolstered consumer sentiment as well as contributed to roll-backs in restaurant restrictions. Warmer weather is always welcome news for restaurants in the Spring and last, but not least, there is no shortage of consumer pent-up demand to enjoy the full restaurant experience after a year of limitations.

Traffic is Lagging Behind Sales on the Road to Recovery

Unfortunately, the good news for restaurant sales does not apply to traffic. Same-store traffic for the month was -9.4% and all industry segments are still experiencing declining guest counts compared to where they were 2 years ago.

However, while not in positive territory yet, there have been significant improvements in traffic. 2-year traffic growth results for March are the best for the industry since February 2020. The latest numbers also represent an 11 percentage point improvement on February’s 2-year traffic growth results.

Check Growth Highest in Recent Years

The average check per guest/transaction continues growing at a rapid pace and is the reason the industry posted positive 2-year sales growth numbers during March. Average check grew by 8.8% year over year, an acceleration of 1.3 percentage points compared to February. On a 2-year basis, check growth was 12.1% in March, a 2.1 percentage point jump from February.

March results were the highest for both year over year and 2-year growth in average check in many years, a testament to the unprecedented times the industry has gone through. But the recent acceleration in check may also suggest that as guests unleash pent-up demand they may be spending even more at restaurants every time they visit.

The segments with the biggest jumps in 2-year check growth in March were family dining (an acceleration of 3.7 percentage points compared to February) and fine dining (an improvement of 1.8 percentage points).

All Industry Segments Improved Sales Performance

Same-store sales growth compared to March of 2019 was up 6.9% for limited-service restaurants, which continue to benefit from the market shifts created by the pandemic and are seeing their strongest performance in years. Despite improvements, 2-year same-store sales growth for full-service restaurants remained negative in March at -2.4%.

All industry segments improved their 2-year same-store sales growth compared to February. Quick service, fast casual, and casual dining all posted positive sales growth on a 2-year basis. Fine dining had flat sales year over year (quite the accomplishment for a segment that was consistently the worst performer most of the pandemic). The only two segments with negative 2-year same-store sales growth were upscale casual and family dining.

Sales Growth Coming from Both Dine-In and Off-Premise

The strong sales performance in March is a result of sales growth for both dine-in and off-premise sales. Guests spent more regardless of channel in both full-service and limited-service restaurants. However, it is still the positive off-premise sales growth that is lifting restaurant sales and offsetting the bigger losses incurred in dine-in.

Same-store dine-in sales growth over 2 years in full-service restaurants was -21.2% during March. Although negative, this represented a 15.4 percentage point jump compared to February. For limited-service restaurants, 2-year dine-in sales growth was -54% during the month, an 8.5 percentage point upswing from February’s dine-in results.

For full-service restaurants, off-premise sales growth continues to be highly elevated at 139% for March compared to 2 years ago. Off-premise 2-year sales growth accelerated by 18.9 percentage points compared to February. For limited-service restaurants, which have always had much more of their sales through off-premise, 2-year sales growth was 24%. This continues to be extremely high growth for these segments and an acceleration of 9.4 percentage points in 2-year off-premise growth compared to February.

Despite the rapid growth in off-premise, dine-in sales are gaining some ground from a sales mix perspective. However, the percentage of restaurant sales that come through off-premise channels continues to be considerably higher than it was pre-COVID.

Alcohol Sales Grew Rapidly but Were Outpaced by Food Sales

There was considerable improvement in alcoholic beverage sales in restaurants during March. But those sales are still down between 16% and 20% over 2 years for the casual dining, upscale casual, and fine dining segments. By comparison, alcoholic beverage sales were down by more than 30% in these segments during the last 4 months.

But as rapidly as alcoholic beverage sales improved during March, they were outpaced by food sales. As a result, alcohol mix as a percentage of total sales in these three segments declined from 11.8% in February to 11.2% in March. And alcohol mix is still much lower than the usual 14% seen in the months before COVID first hit. The increased reliance on off-premise sales which remains, even among full-service restaurants, will continue to be the biggest challenge for beverage sales to fully recover to 2019 levels.

Mid-afternoon, Breakfast, and Dinner Experienced Positive Sales Growth

All restaurant dayparts improved their 2-year same-store sales growth performance in March. Mid-afternoon, breakfast, and dinner achieved positive 2-year sales growth. Offering another signal of the return to normalcy, breakfast was the daypart of the quick service with the highest same-store sales growth performance.

Mid-afternoon was the best-performing daypart, overall, and for casual dining. Dinner, a vital daypart for full-service restaurants, also saw positive 2-year same-store sales growth for casual dining during March.

The late-night daypart continues to be heavily challenged. This daypart improved its performance the most compared to February, nonetheless, its 2-year sales growth is still close to -20%. It remains the worst performer for both full-service and limited-service restaurants.

Limited-Service Cuisine Types are Top Performers, Others Showing Signs of Recovery

Hamburgers, chicken, and pizza, the cuisine staples of limited service (particularly quick service), are doing better in terms of sales growth. All had positive sales growth on a 2-year basis during March. Throughout the pandemic, these cuisines were heavily favored by consumers, which is likely a consequence of their close ties to quick service and fast casual and the off-premise slant that goes with them.

But in a welcome surprise, steak and bar and grill concepts were able to post positive 2-year sales growth for the first time in over a year.

7 US Regions Achieved Positive Sales Growth

The strength of the sales results in March was very widespread from a regional perspective. All regions improved their 2-year same-store sales growth rates compared to February and 7 of the country’s 11 regions posted positive 2-year sales growth during March.

The best-performing regions based on that sales growth were the Southwest, Southeast, the Western region, and Texas. The Midwest, Mountain Plains, and Florida rounded out the list of regions with positive sales growth.

The only regions with declining sales growth on a 2-year basis were California, New England, New York-New Jersey, and the Mid-Atlantic. California continues to be, by far, the worst-performing region of the country for same-store sales growth.

Staffing Challenges Accelerate for Restaurants as Labor Market Tightens

Restaurants are hiring again and they are doing so at an unbelievably high rate. According to the Bureau of Labor Statistics, the restaurant industry added over 175,000 jobs in March, following the impressive 286,000 restaurant jobs added in February. This translates to almost half a million people recently hired to work at restaurants. But despite this rapid growth, there are still about 1.8 million restaurant jobs that are still lost.

In addition to growth in restaurant employment, the overall economy has been creating jobs at an accelerated pace. Over 900,000 total new jobs were registered in March compared to just one month ago.

With this acceleration of economic activity and tightening of the labor market, as well as restaurants doing much better from a sales perspective, pressure is mounting for those responsible for restaurant staffing. It is not uncommon to hear stories in the media about companies saying they can’t find enough people to staff their restaurants. Part of the problem seems to be that while millions of restaurant jobs were lost (at least temporarily) to the pandemic last year, other industries have been hiring at a faster pace, attracting employees from those industries that shrank.

While this is concerning, staffing challenges for restaurants are not new. For context, at the beginning of 2020, only 13% of limited-service restaurant companies reported being fully staffed for their restaurant hourly, non-management positions according to Black Box Workforce Intelligence™.

The staffing situation before the pandemic was a bit better for full-service employees in the front of the house, with 38% of companies reporting they were fully staffed for those hourly positions. But for years the challenge has been greater for back-of-house positions. Only 10% of full-service restaurant companies reported having their kitchens fully staffed a year ago.

Economic Outlook Remains Optimistic, Sustained Restaurant Recovery Expected

If there were any doubts about the strength of the recovery, they were dispelled when it was reported that over 900,000 jobs were added to the nation’s payrolls in March. Firms are not only reopening, but they are showing a great willingness to hire back most of their workers. But we still have a long way to go, as there are still about nine million fewer positions in the private sector than in February 2020.

“That is good news for the restaurant industry as it means we should be seeing large job and income gains for months to come,” stated Joel Naroff, president of Naroff Economic Advisors. “The solid recovery in food service sales should be sustained through the rest of this year. Reinforcing that view is the reality that the latest stimulus package is just getting checks to people and those will be spent over an extended period. And finally, the high supply of vaccines is boosting confidence and the willingness to spend. Growth this year could be the strongest in nearly forty years. That could provide critical pricing power to restaurants, but it would also likely raise input and labor costs.”

Looking Ahead

Navigating the Road to Restaurant Recovery

All indicators point to a continued acceleration of the restaurant industry’s recovery and likely getting back to pre-pandemic sales numbers earlier than initially expected. Although sales in March 2021 were better than those in March 2019, we’ll have to wait and see if that can be sustained in the months ahead. The other possibility is that this sales growth may be an overcorrection of the market resulting from stimulus checks and the liberation of mounting pent-up demand from the last twelve months.

Hiring and retaining employees will once again rise to the top of concerns and most likely will result in rising pressures on wages. Additionally, there is also the increased likelihood of a rise in the federal minimum wage, which adds to those labor cost concerns for restaurants.

But with the anticipation of additional aid in the form of child tax credits, expanded unemployment benefits, talks of another round of stimulus payments and millions of people being hired throughout the economy, there are many reasons to be optimistic about restaurants’ prospects in the next few months.