Monthly Restaurant Trends Review

Out of the Box: July 2025

-

Same store sales rises to 2.4% but the 2-year stacked results are flat at 0.5%, making July the worst 2-year growth rate since February.

-

Casual Dining the continued star performer, but only 39% of all Casual Dining brands are growing.

-

Turnover in Limited Service for non-management roles has fallen rapidly over the last year.

-

Brands executing at a high standard are excelling, and devouring market share.

In This Issue:

-

The Big Picture: Sales and Traffic Trends

-

Segment Focus: Casual Dining

-

Best vs Worst: Region, Segment, and Cuisine

-

Staffing Turnover Review: Limited Service

July 2025 Restaurant Industry Trends

The Big Picture: Sales and Traffic Trends

As was expected, July was a pretty good month for restaurant sales and traffic YOY growth. The industry lapped over a particularly soft month last year. Thus, it meant strong results were not surprising. Yet looking at growth rates on a two-year basis (comparing July 2025 with the same month in 2023)? It reveals what could be the beginning of a weakening in restaurant spending.

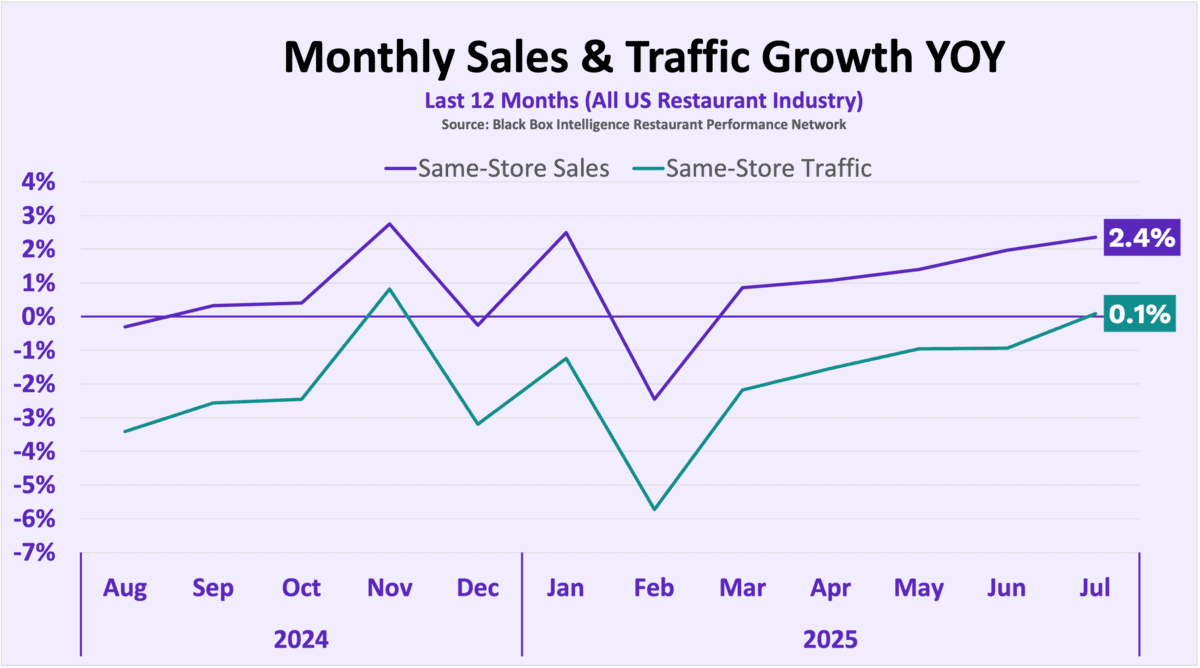

Same-store sales growth was 2.4% YOY during July, but the 2-year stacked results are flat at 0.5%. This is the worst 2-year growth rate since February (when weather was a negative factor). The average 2-year growth for the previous 4 months was a much stronger 1.8%.

Same-store traffic growth was 0.1% for July. Only three other months had seen positive Y-O-Y same-store traffic growth during the last three years, all of them tied to some sort of weather or holiday anomaly.

But calculated over 2 years shows same-store traffic at -4.0%, which is the lowest it has been since March. The average 2-year growth for the industry’s traffic was -3.4% during the previous three months.

| Month | Aug. ’24 | Sept. ’24 | Oct. ’24 | Nov. ’24 | Dec. ’24 | Jan. | Feb. | Mar. | Apr. | May | Jun. | July |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Comp. Sales | -0.4% | +0.4% | +0.5% | +2.8% | -0.3% | +2.5% | -2.5% | +0.9% | +1.1% | +1.4% | +2.0% | +2.4% |

| Comp. Traffic | -3.6% | -2.7% | -2.5% | +0.9% | -3.2% | -1.3% | -5.7% | -2.2% | -1.5% | -1.0% | -0.9% | +0.1 |

Segment Overview

Best vs Worst: Restaurant Industry Segment

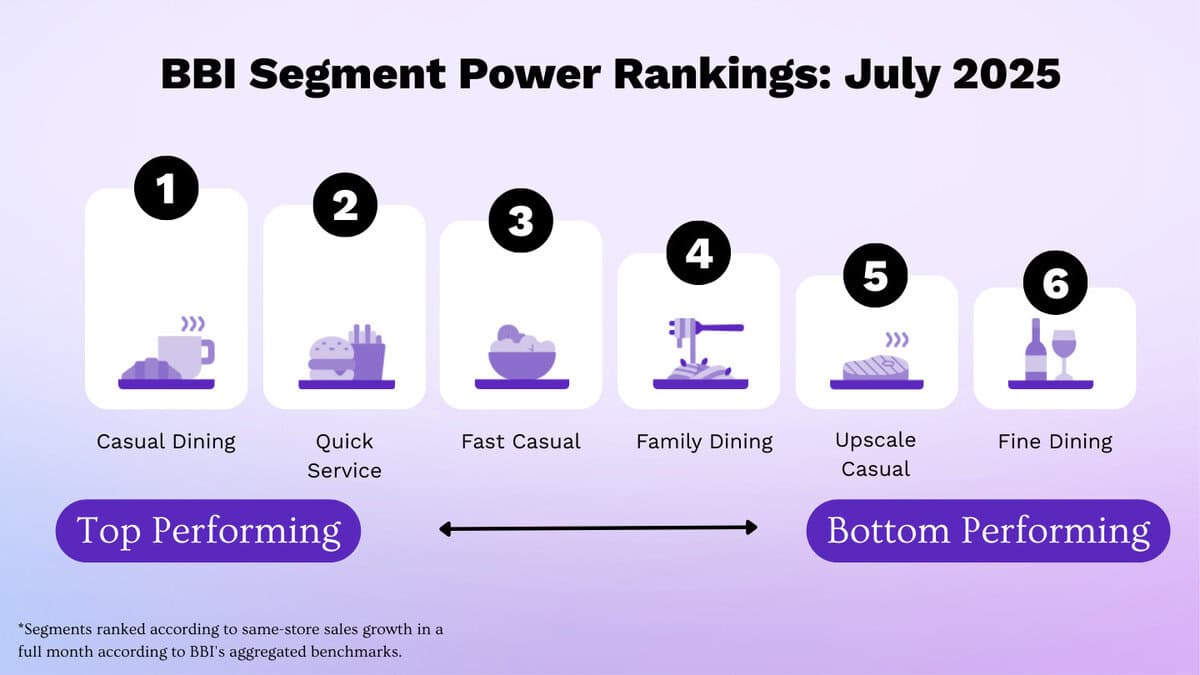

July was a strong month for most restaurant segments. With the exception of Fine Dining and Upscale Casual, every segment improved its year-over-year same-store sales growth compared to June—and all but those two posted positive growth for the month.

Casual Dining remains the standout. It has led the industry in sales growth every month since March. More on that below.

Fine Dining, on the other hand, continues to struggle. Softer demand may reflect higher-income consumers trading down and businesses curbing dining expenses amid weaker economic confidence. The segment has posted the lowest same-store sales growth in four of the last five months—the only exception being April, when the Easter holiday boosted results.

Region Focus: Y-on-Y Sales

Best vs Worst: Region

July delivered broad-based strength, with ten of eleven regions posting positive same-store sales growth. The exception was California, which has ranked last in sales growth every month since March and continued to struggle in July.

The weakest regions for the month were California, the Western region, Mountain Plains, and Texas. Black Box Intelligence analysis shows that zip codes with large Hispanic populations have trailed the rest of the country in same-store traffic growth for the past three quarters. This trend may help explain the softer performance in states such as California and Texas, where Hispanic populations are large.

The top-performing regions in July were the Midwest, New York–New Jersey, the Mid-Atlantic, and Florida. However, for New York–New Jersey and Florida, results were boosted by easier comparisons: both regions still reported lower sales than they did in July 2023.

Segment Focus Deep Dive

Current Performance Trends in Casual Dining

The Casual Dining Resurgence Continues But Not Every Brand is Excelling…

Casual Dining is experiencing a strong resurgence. The segment has posted robust sales and traffic growth, capturing share from the rest of the industry. For the past five months, it has led all segments in same-store sales growth. Even more notable, Casual Dining has achieved positive same-store traffic growth every month since March—the only segment able to make that claim.

Earnings calls from several iconic, large Casual Dining brands confirm this momentum, with reports of strong Q2 sales. Guests are signaling through visits and spending that they are willing and able to spend more at Casual Dining than a year ago.

However, part of this growth reflects easier comparisons. Casual Dining was the second-worst performer in July 2024, recorded the weakest same-store sales growth in June 2024, and ranked second-worst overall for Q2 2024.

Performance is also uneven across brands.

In July, only 34% of Casual Dining companies tracked by Black Box Intelligence achieved positive same-store sales growth. The remainder saw sales decline by an average of 5% year-over-year.

Staffing, Workforce, And Employment Focus

Current Turnover Trends in Limited-Service Restaurants

As the labor market cools and hiring slows, non-management turnover in Limited Service restaurants is falling rapidly—bringing much-needed relief to operators. Recent data shows Quick Service and Fast Casual brands have made significant progress: turnover rates are not only far below the record highs of the pandemic but are now even lower than pre-2019 levels.

Despite this progress, staffing remains a challenge. According to Black Box Intelligence’s recent Total Rewards Survey, only 50% of Limited Service companies report being fully staffed for non-management front-of-house roles. Back-of-house staffing is only slightly better at 54%.

These figures mark clear improvement compared to recent years, yet they also highlight ongoing execution hurdles. For many restaurants, processes and strategies still depend heavily on staff availability.

Victor Fernandez, Chief Insights Officer, On:

July 2025 Restaurant Performance

“The headline results for restaurants have been good in recent months, but digging a bit deeper shows a reality in which only a few companies are stealing market share, seemingly deciphering the question “what are guests looking for?” and executing on their strategies at a higher level.

“And even for those outperformers things may get tougher in upcoming months. Consumer confidence may have rebounded during the last two months, but it remains lower than it was at any point during the last two years, as measured by the University of Michigan Index. Restaurant prices continue rising at a much faster pace than prices at the grocery store, making affordability a constant challenge for restaurants. And overall inflation is expected to accelerate through the rest of 2025, as the effect of tariffs takes hold, putting further pressure on consumers.

“The two-year same-store sales growth softening in July may be an indicator of things to come. Furthermore, the segments with the strongest two-year sales growth in July were Fast Casual and Quick Service, with Casual Dining coming in third. We expect these segments to remain relatively strong as economic pressures drive guests to lower price points.”

For Deeper Analysis

Quarterly SOTI Webinars

We go into way more detail in our flagship quarterly State of the Industry (SOTI) webinar – our definitive take on the latest developments and a must attend for anyone in the restaurant industry.