February’s Restaurant Report

Slowing Sales and Traffic Signal Upcoming Hurdles Amid Pandemic’s Lingering Effects

All growth numbers are year over year unless specified. The best and worst-performing regions, segments, and cuisines are based on same-store sales growth.

As was expected, once the upward boost created by the easier comparisons due to Omicron started to fade in February, restaurant same-store sales and traffic growth started moderating back to where they were at the end of last year. Yes, February’s sales and traffic results still benefited from easier laps owing to the COVID-19 spikes early in 2022, but at a magnitude much smaller than what we saw in January.

Restaurant same-store sales grew 6.8% in February, down 7.3 percentage points compared to January’s year-over-year growth rate. Despite the drop in sales growth, industry performance was still much better than the sales growth of 4.8% reported for December of 2022.

In the case of traffic, same-store growth was 0.4% in February, which represented a slowdown of 4.6 percentage points compared to the previous month’s results. Traffic growth has been positive for two straight months, something that has not happened since the end of 2021. This is far from being a sign of strength for the industry and more of a result of the favorable comparisons from what was hopefully Covid’s last big impact.

Another expected shift in the industry is a softening in average guest check growth. As commodity and labor cost pressures start to ease, menu price increases and their effect on average guest checks are projected to moderate this year. The average check grew by only 6.5% year over year in February, the lowest it has been since February of 2021.

Inflation Outpaces Wage Growth in Recent Years

Over the past two years, restaurant executives have struggled to find the most effective strategy to mitigate high inflation. Unfortunately for them, many workers have found that their best strategy was to switch jobs.

In 2021 and 2022, annual inflation rates rose to 7.0% and 6.5%, respectively. To put that in context, the previous 8 years had an average annual inflation rate of just 1.6%.

Wages, however, have not kept up with this rampant inflation. As stated by the U.S. Bureau of Labor Statistics, when accounting for inflation, “real average weekly earnings” in February declined by 1.9% year over year. The consumer lost buying power because pay growth was lower than price increases on goods and services.

The Great Resignation Sparks Significant Wage Gains for Job-Switchers

Many restaurant workers realized that their best way to get a raise on pace with inflation was to switch jobs. According to the U.S. Bureau of Labor Statistics, the last two years saw an all-time high in workers voluntarily quitting. Workers switched jobs at such unprecedented levels that economists gave it an aptly foreboding title: “The Great Resignation.”

As of February, those who switched jobs saw a wage increase of 7.7% on a trailing twelve-month basis, while those who stayed in their current position saw a wage increase of only 5.6%. To be clear, except in recession, “job-switchers” typically see more growth than “job-stayers.” However, this 2.1-point difference is staggering given that the historical difference is a mere 0.7 percentage points.

Unprecedented Turnover and Wage Inflation in 2021 and 2022

In many ways, these trends are most apparent within the restaurant industry. According to Black Box Intelligence Workforce data, both 2021 and 2022 had record turnover. In 2022, full-service witnessed a 14% increase in turnover compared to 2019. Limited-service restaurants saw a whopping 24% spike.

Unlike hourly wages on a macro level, restaurant hourly wages have kept up with, and in some cases surpassed inflation. This is due in part to turnover rates being much higher than in most industries and therefore speeding up the process of wage inflation.

Also, the fact that hourly wages in restaurants were lower than those in many competing industries meant that amid the Great Resignation, the restaurant industry needed to grow compensation faster if it were to remain a viable option when it came to attracting and retaining employees. Black Box Intelligence compensation data shows hourly wage growth reaching its peak in March 2022, when limited-service brands saw hourly crew wages increase a substantial 19% year over year, while full-service-restaurant line cooks had a 10% increase.

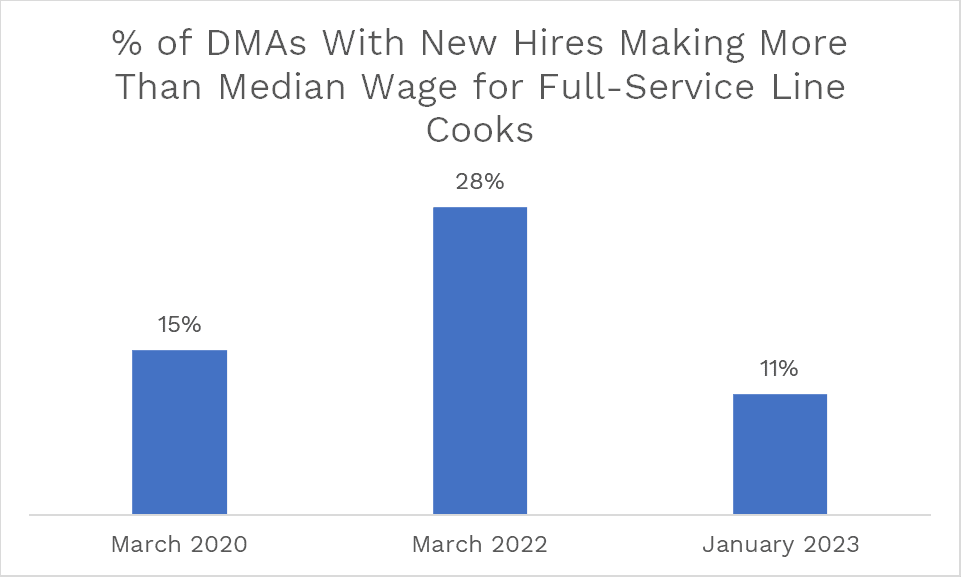

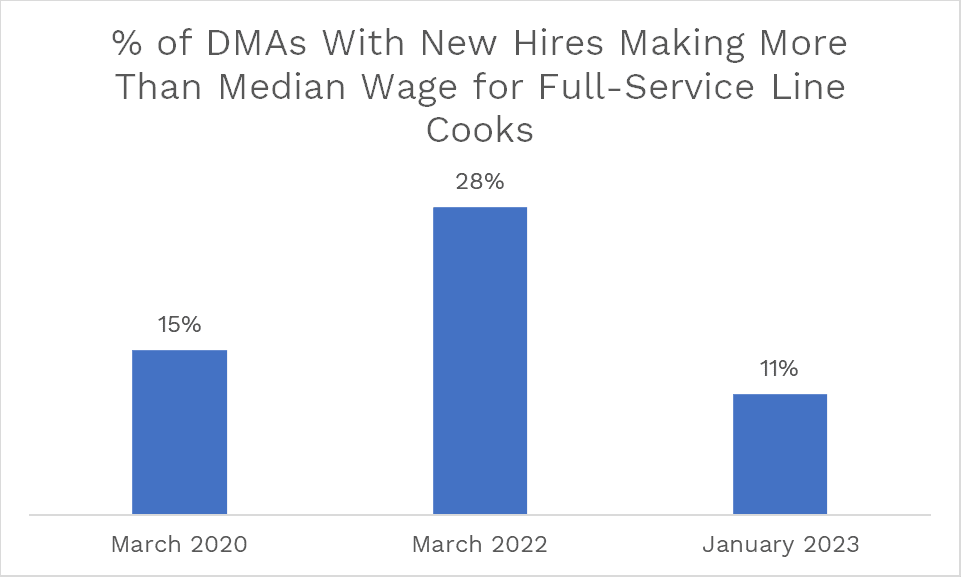

As with the overall economy, the rate of new hires plays a significant factor in elevating the hourly rate. For full-service line cooks, new hires made more than the median pay for all employees in this position in 28% of DMAs (Designated Market Areas). Compare this to two years earlier, where new hires outearned the median cook wage in only 15% of DMAs.

2023 Finds Balance in the Workforce

While wage inflation remains high, January 2023 wage increases have moderated from the March 2022 peak. Limited-service hourly crew wages had a 10% increase year over year, while full-service line cook wages only saw a 6% increase. New-hire wages for full-service line cooks were higher than the median wage for all cooks in only 11% of DMAs, a signal that wages are finally finding equilibrium.

Wages will most likely continue to normalize in 2023 as the Fed has signaled its willingness to continue raising interest rates to fight inflation, despite recession fears, and turnover is likely to decline. In the coming year, workers may find that their best strategy is to be job-stayers.