Restaurant Industry Snapshot™ – October 2021

Regional & Market Performance

September’s 6.1% sales growth represented a 0.4% improvement from August, but results are still much weaker than July (8.2%) and June (6.9%). Adding insult to injury, traffic growth was -6.3% during the month compared to –5.7% in August making September the worst month for traffic growth since March, when vaccines were still not widely available and consumers were more guarded.

During the third quarter, sales held up better than traffic. Sales growth was 6.2%, a small slide from the 6.6% reported for the previous quarter. But traffic growth was -5.8%, which meant traffic worsened by 1.0 percentage points compared to traffic results in the second quarter.

“The continued decrease in restaurant traffic could be from the significant increase in average checks, driven primarily in recent months by rapidly increasing menu prices. It’s clear, some consumers may be cutting back some on restaurant visits,” said Victor Fernandez, vice president of insights and knowledge for Black Box Intelligence™. “Checks grew by 14.2% in September compared to the same month in 2019, which is the highest growth we’ve seen since we started tracking this data over a decade ago.”

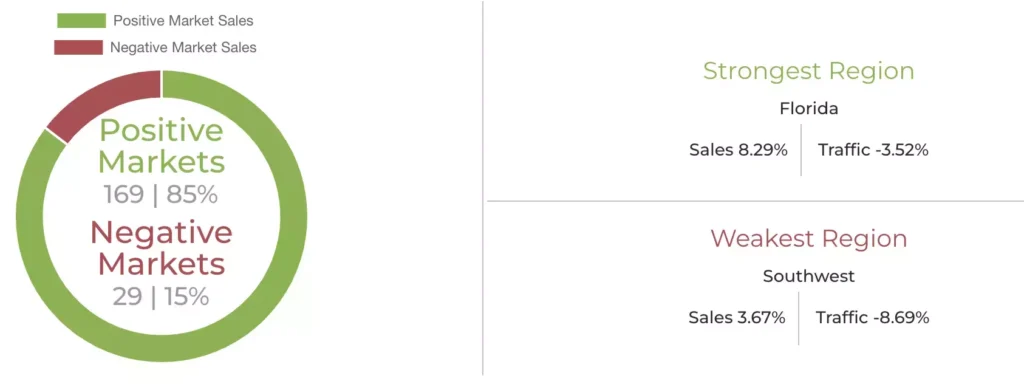

Three regions experienced a decline in their sales growth compared to August, all others improved their performance during September. The biggest slowdown happened in the Midwest, where sales growth dropped by 0.7 percentage points, followed by the Southeast (-0.6 percentage points) and the Mid-Atlantic (-0.1 points).

The best-performing regions based on sales growth were Florida, the Western region, California, and the Southeast. The regions with the smallest sales growth in September were the Southwest, Midwest, New England, and New York-New Jersey.

The Restaurant Workforce

Job Growth & Turnover

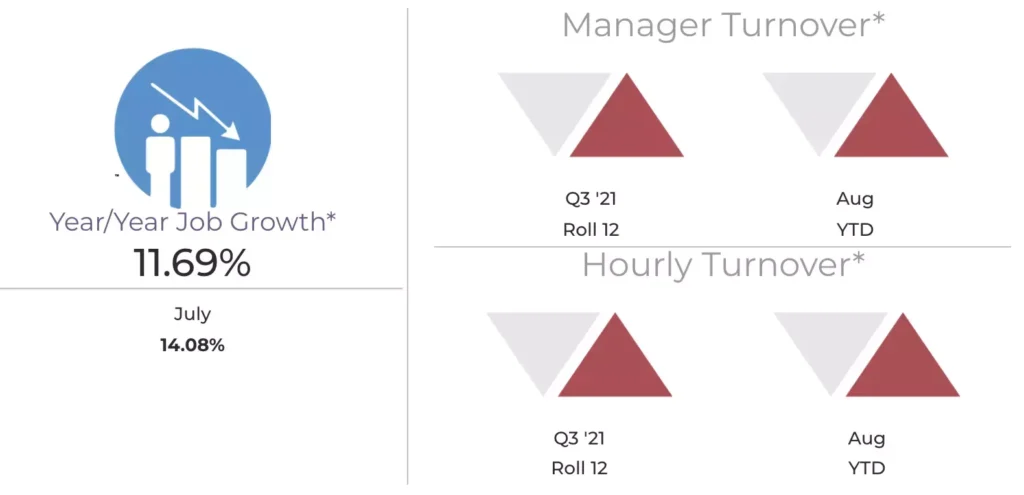

Limited-service concepts lost ground on staffing during August. The median restaurant company in limited service operated with an average of 1.1 fewer employees than they did in 2019. The reduction in staff improved in July to only being down by 0.7 employees, but the August staffing levels reverted closer to what was seen back in June. A big driver behind this reversal in staffing levels is a significant jump in restaurant hourly turnover in August.

Full service had some positive shifts when combating the current staffing crisis, however, restaurants are still down from typical pre-COVID levels. The median full-service brands operated with an average of 5.3 fewer front-of-house hourly employees and 1.3 fewer back-of-house hourly employees per location during August. This represented an improvement of an average of 0.9 front-of-house and 1.5 back-of-house employees per restaurant.

Sales Growth Improved for Full Service in September

The segments with the best sales growth in September were fine dining, fast casual, and quick service. Family dining was the only segment that suffered negative sales growth during the month. Limited service posted sales growth of 10.7% down from 11.3% in August. The drop was primarily the result of the sales growth decline in fast-casual restaurants. Sales growth in quick service remained essentially flat vs. the previous month.

Sales growth was 3.1% for full-service brands during the month, up from 2.2% in August. Fine dining improved sales growth the most relative to the previous month, followed by upscale casual and casual dining. Family dining’s sales growth performance slipped slightly in September, which was the segment’s worst month since May.

Best Performing Dayparts Still Mid-Afternoon & Dinner

Since March, the mid-afternoon daypart has had the highest sales growth, followed by dinner. Sales growth for breakfast improved during September, which positioned it as the third-best performing daypart for the industry. Lunch, which occupied that third spot since March, had a small improvement in sales growth in September compared to August.

Late-night is the only daypart that continues experiencing negative sales growth. The last time this daypart posted positive sales growth was in January of 2020. Reduced operating hours continue to plague this daypart at some restaurants, including some that were 24-hour locations pre-pandemic and have not yet returned to their full hours of operation.

Macroeconomic Conditions Suggest Restaurant Sales and Traffic Growth Could Slow Down

Commentary provided by Joel Naroff, president of Naroff Economic Advisors

The economy is being pulled in different directions, most of which are troubling. On the plus side, while overall September job growth looked weak, the private sector continued to add significant numbers of workers. Wages are rising sharply and that is adding to household disposable income and spending power. But it is also increasing operating costs, as are the continued problems with the global supply chain, as well as rising oil prices, which have reached their highest level in 7 years. High inflation is likely to stay there for an extended period. Interest rates across the curve should continue rising, with the Fed likely increasing the funds rate by year’s end.

Consequently, overall economic growth is likely to slow. While that was expected, the deceleration toward trend growth in the 2% to 2.5% range could occur by the fall, rather than late this year or early next. This is not a recession, just a slowdown. The economy is still solid, and restaurants should be able to sustain their higher levels of demand. Going forward, though, traffic and sales growth be more modest.

Looking Ahead

The big picture will likely remain the same for the restaurant industry through the rest of the year: sales will continue to be better than they were back in 2019, but guest counts will continue to be down while guest checks stay growing at an unusually high pace.

Digging a bit deeper reveals three hardening conditions for restaurants that point towards more slowdown in sales and traffic in upcoming months.

- The fact that prices for food at restaurants have been increasing at a much faster rate than prices for food prepared at home means restaurants are becoming less competitive versus grocery stores. Given that disparity, there is little room for traffic improvement.

- The expected slowdown in the overall economic growth and rising inflation will be a drag on future restaurant sales growth.

- Restaurant performance was stronger during the fourth quarter of 2019 than it was in previous quarters, which means tougher comparisons when analyzing sales and traffic growth in the upcoming quarter.

However, there is also a reason for some optimism about what could be a good holiday season for restaurants. There is still pent-up demand and people are hungry to go out and celebrate again with friends and family, especially after having to skip much of that last year.