Monthly Out of the Box Insights

Restaurant Industry in Review: Trends from July 2024

Trends from July: What Restaurateurs Need to Know

As the economy shows signs of slowing down, restaurants have faced significant challenges over the summer.

However, the trends from July reveal valuable insights that can help restaurant operators navigate the remainder of 2024.

September is a pivotal time for the industry, offering a chance to re-calibrate strategies and prepare for the critical Q4 season. But what can the most recent trends tell them to generate future success?

July’s Anomalous Performance and Industry Recovery

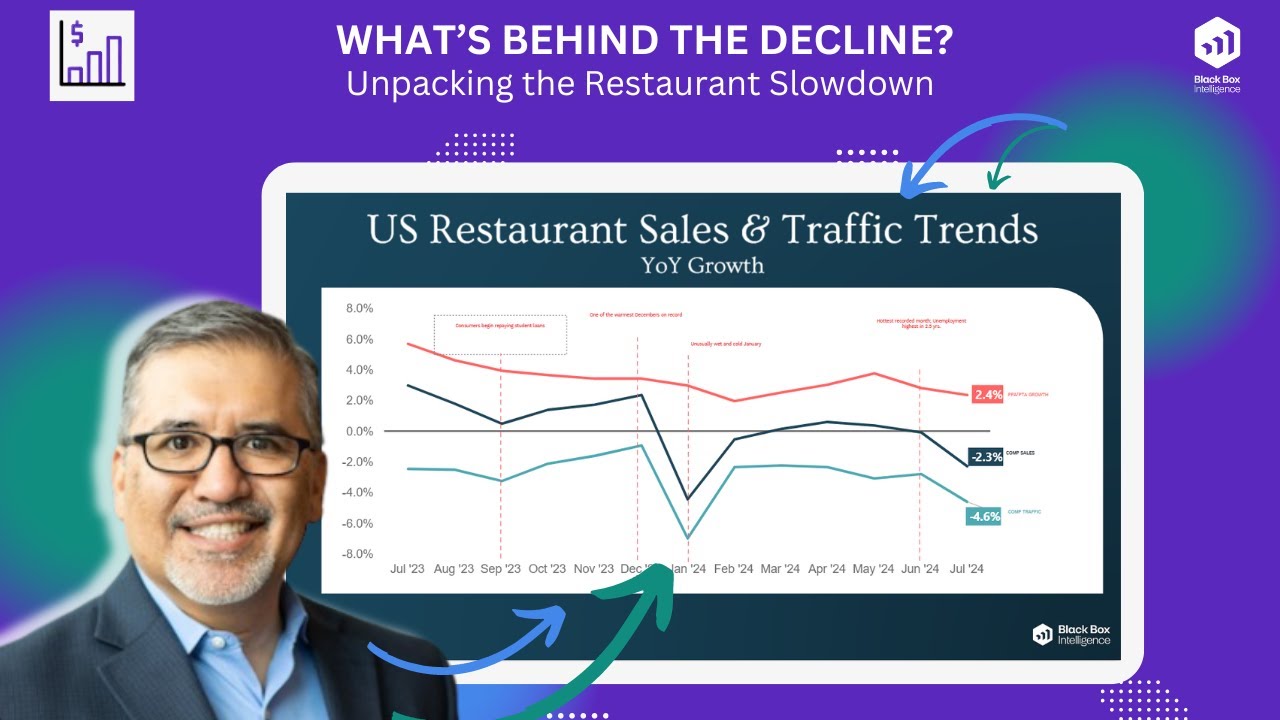

July proved to be a tough month for restaurants, with same-store sales growth.

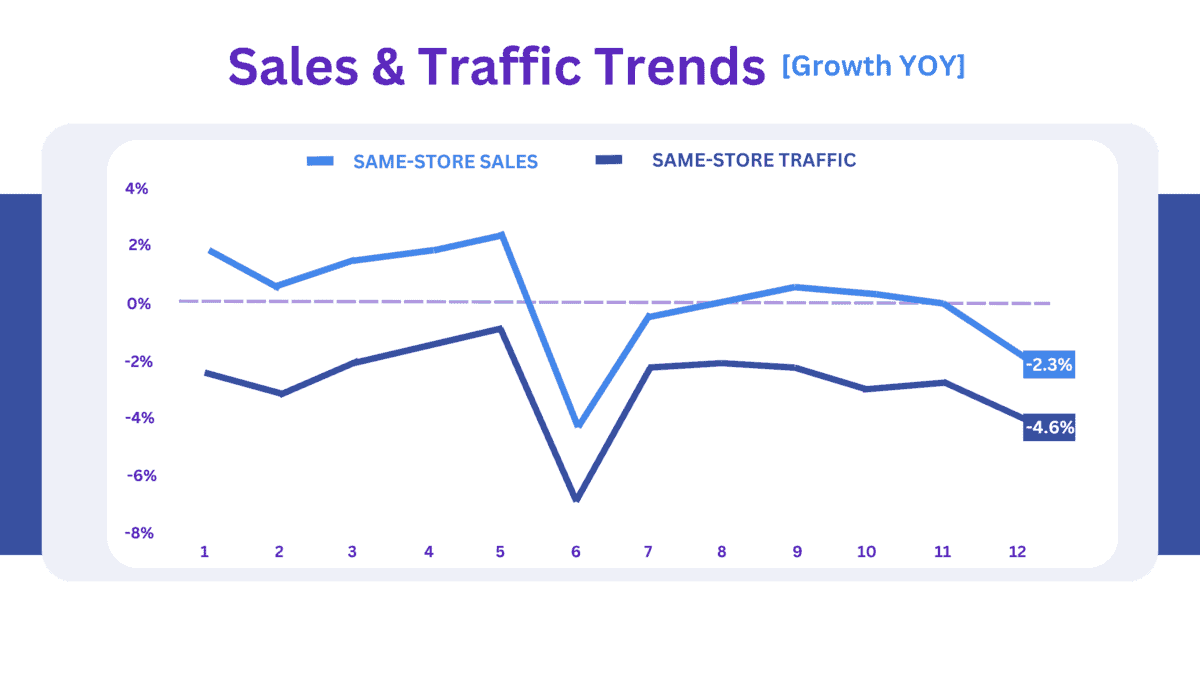

Same-store sales growth was -2.3% in July.

Meanwhile, traffic growth fell by -4.6%.

This steep decline was driven by a combination of external factors, including a surge in viewership for the summer Olympics, a rise in Covid-19 cases, and unusually hot weather in the West and Northeast.

These issues led to decreased consumer traffic and spending, resulting in the worst performance the industry has seen since January.

July’s traffic growth was the worst for the industry since January’s -7.0%, which was mostly weather driven.

And guests seemingly also slowed down their average spending per restaurant visit or order during July.

The Average check growth YOY was 2.4% during the month, down from 2.8% in June and the lowest since February.

August’s Steps toward Recovery

In August the industry experienced three consecutive months of negative sales growth—something not seen in over three years.

Despite that, August still offered a glimmer of hope with a slight uptick in sales growth.

However, although same-store sales growth remained negative, it was less pronounced.

Trends from July indicated that it was a temporary setback rather than a long-term trend.

Segment-Specific Performance: Winners and Losers

The entire industry segments experienced negative same-store traffic growth during July, and all saw their YOY traffic growth fall compared to their June growth rates.

However, when we break down performance by restaurant segment, clear winners and losers emerge.

- Best Performers: Quick Service and Fast CasualDespite the overall industry downturn, the Quick Service and Fast Casual segments performed relatively well comparatively.Their value-driven propositions and convenience factor seem to resonate with cost-conscious consumers during times of economic uncertainty.

- Struggling Segments: Casual and Upscale Casual DiningThese segments faced the steepest traffic declines in July.This was a reflection of a broader trend of consumers cutting back on discretionary spending.And it was especially the case in higher-cost dining environments.

Understanding these segment-specific trends is crucial for restaurant operators looking to adapt to shifting consumer preferences.

Quick Service and Fast Casual restaurants are clearly meeting the needs of today’s diners, and other segments can take cues from their approach to attract more traffic.

Why Customers Return (Or Don’t)

So now that we have looked into the September 2024 Restaurant trends, how can we get customers in the door and ordering food?

Well, let’s consider one question:

“Would you recommend this to a friend?”

Any marketer will tell you this is the fundamental question of any survey.

The same level of importance should be given to online reviews.

Intent to Return: The Bottom Line

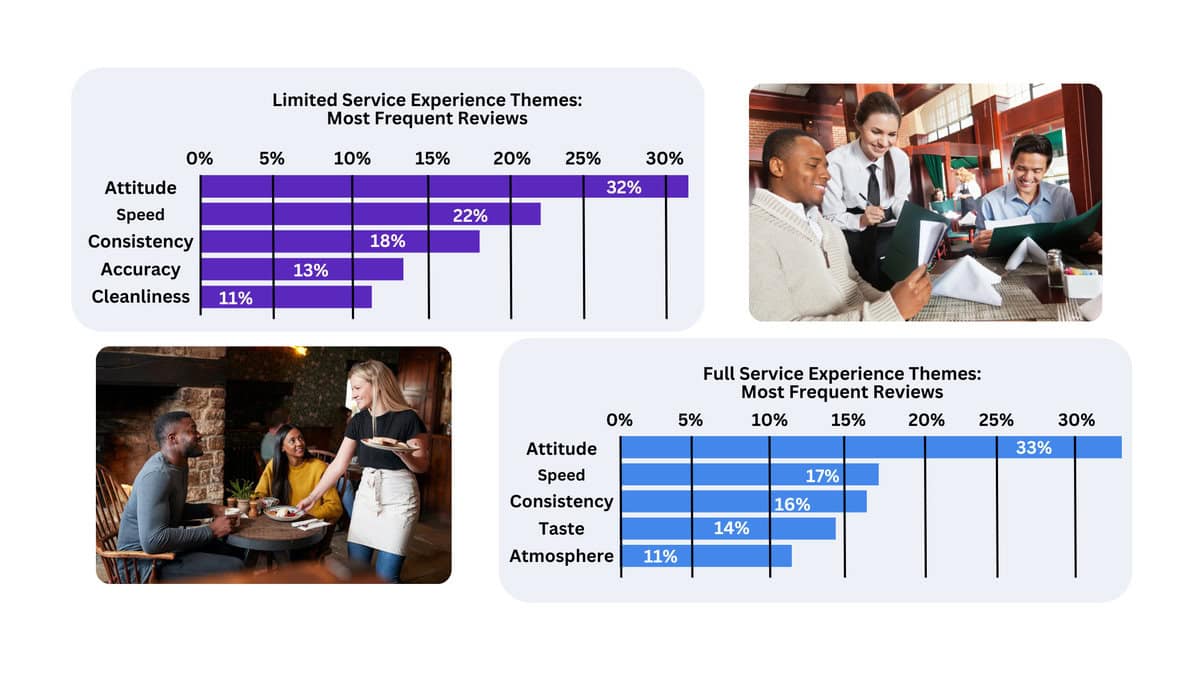

Online reviews can tell us a lot about a restaurant.

Customers may share thoughts on the food or ramble in a typo-riddled tirade about the service.

These sentiments should be carefully analyzed.

And nobody knows better than Black Box Intelligence.

The value in breaking down feedback into actionable improvements can mean the difference between a restaurant thriving or closing it’s doors.

Limited Service brands with an ASR of 4.4 or higher see their Average Weekly Sales at around $57k, compared to those with an ASR of 3 or less, which saw only $30k.

And Full Service? The gap widens: brands with an ASR of 4.4 or higher see their Average Weekly Sales at around $100k, compared to ones with an ASR of 3 or less, which saw only $30k.

And after seeing the September 2024 Restaurant trends, it’s even imperative to pay special attention to the underlying point of a review: will the customer return?

And, just as important, will they recommend the restaurant to a friend?

Reviews that answer these two primary questions are analyzed using Black Box Intelligence’s natural language processing AI .

We then give reviews an “Intent to Return” net sentiment score that is comparable to a “Net Promoter Score” in guest satisfaction surveys.

Learn more about review management and our AI here.

What Brings Customers Back

So, what can we glean from these Intent to Return scores?

One way to determine what customers want is by looking to see what else reviewers are saying when they state they plan to return to a restaurant.

Conclusion: Preparing for a Potential Rebound

With the September 2024 Restaurant trends we are seeing, we suggest that there is cautious optimism moving forward.

By leveraging data, monitoring economic conditions, and adapting to consumer behavior, restaurant operators can strategically position themselves for success in the final months of 2024.

The key to thriving in this environment is maintaining agility and staying informed.

By staying on top of the data, making data-driven operational adjustments, and focusing on delivering value to consumers, restaurants can emerge from this period stronger and better prepared for the future.

But you don’t have to do it alone!

Join us for our FREE upcoming State of the Workforce 2024 Webinar!

We will be covering everything you need to stay up to date on the current state of the restaurant workforce, with the most comprehensive trend analysis available.

We have limited spots available, so make sure to save yours now by clicking below!