Best vs Rest Analysis

Top Performers Quickly Identify & Adapt to Meet Guests’ Shifting Needs

How We Compare Leaders vs. the Rest

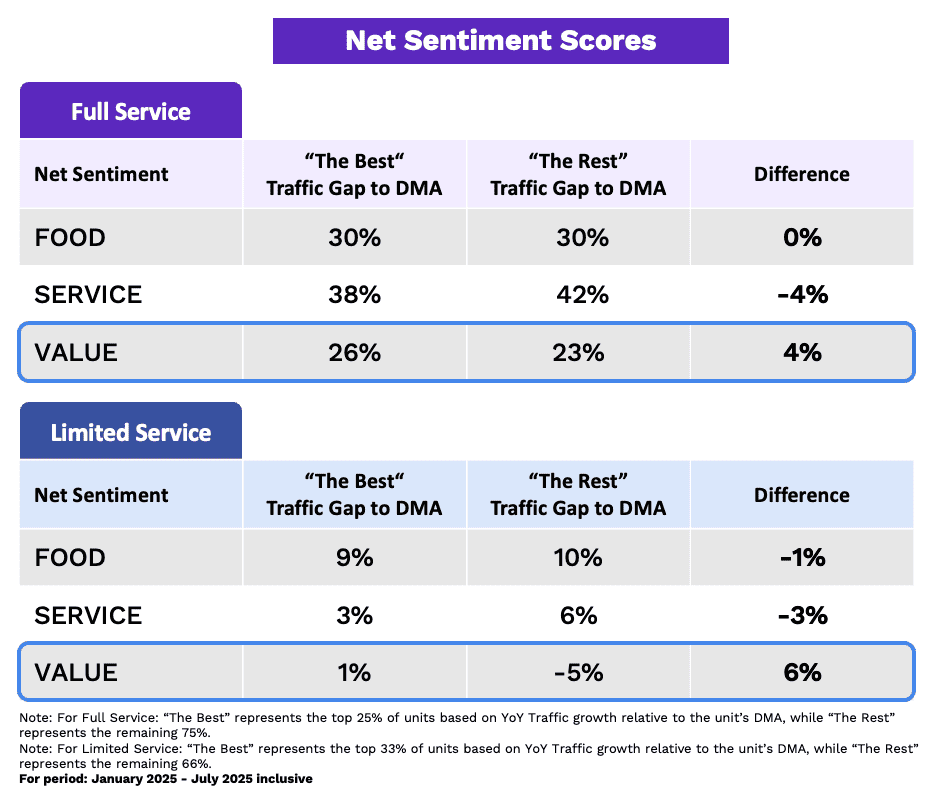

Top performers aren’t lucky—they’re patterned. We compare the top 25% of units by relative comp traffic to the rest using Black Box Intelligence data to surface the specific moves that correlate with better guest sentiment and durable traffic. In this article, we focus on how leaders spot shifting guest needs early and adapt faster. In 2025, this has been all about value – so we focus on that as a prime example.

Why This Matters…And How It Will Always Be a Moving Target

Guest expectations aren’t static. What guests prized most in 2023 was food; in 2025, the center of gravity moved to value. Brands outpacing their markets recognized the shift early and adjusted the offer, not just the price. Leaders keep a live read on what “worth it” means this month, then tune portions, quality, and bundles accordingly.

Value is King in 2025

The consistent separator across segments is Value sentiment – leaders don’t necessarily cook better or deliver friendlier service; they make the experience feel “worth it” (quality + portion fairness at a fair price). That value clarity is what aligns with stronger traffic performance.

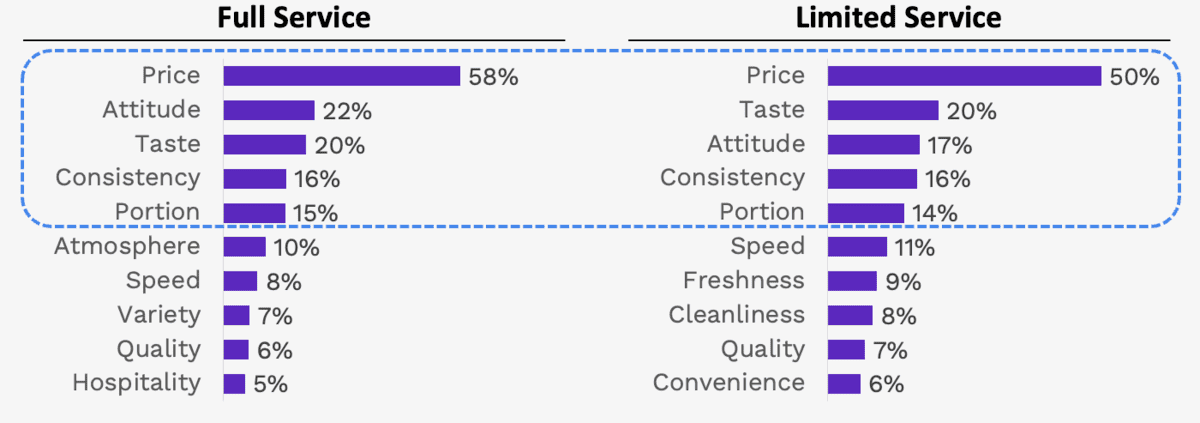

What “Value” Really Means to Guests

Price is only part of the equation. When guests say an experience was “worth it” in 2025 YTD, they’re primarily responding to (1) quality that meets/exceeds expectations, (2) portion that feels fair, with great-tasting food trailing as a distant third driver. In other words: fairness and fit first, flavor second. That’s why blunt price cuts often underperform smarter offer design.

What Makes the Experience “Worth It” for Guests in 2025

(Top 10 Positive Aspects Mentioned by Guests)

What Do Guests Really Mean by Positive “Price”?

Top Aspects Mentioned Much More Often By Guests

Limited Service

| Theme | Mention Rate Compared to Normal |

| Quality | 4.0x |

| Portion | 3.9x |

| Taste | 1.9x |

| Speed | 1.9x |

Full Service

| Theme | Mention Rate Compared to Normal |

| Quality | 5.8x |

| Portion | 4.3x |

| Taste | 1.8x |

| Speed | 1.8x |

This chart breaks down what guests actually mean when they compliment “price” in a review. In Full Service, when price is praised it usually comes bundled with mentions of quality (5.8× more likely than normal), portion fairness (4.3×), and then taste and atmosphere (~1.8×). In Limited Service, the themes are similar but slightly different in rank: quality (4.0×) and portion fairness (3.9×) dominate, with taste (1.9×) and speed (1.5×) also registering.

Why it matters: Guests aren’t rewarding “cheapness.” They’re praising value fairness—quality and portion consistency that match or exceed expectations—then reinforcing it with elements like speed or atmosphere depending on the segment. This reframes pricing strategy: the real lever isn’t raw discounting but delivering fair quality-per-dollar and portion clarity that guests immediately recognize as worth it.

Same Goal, Different Paths: Full-Service vs. Limited-Service

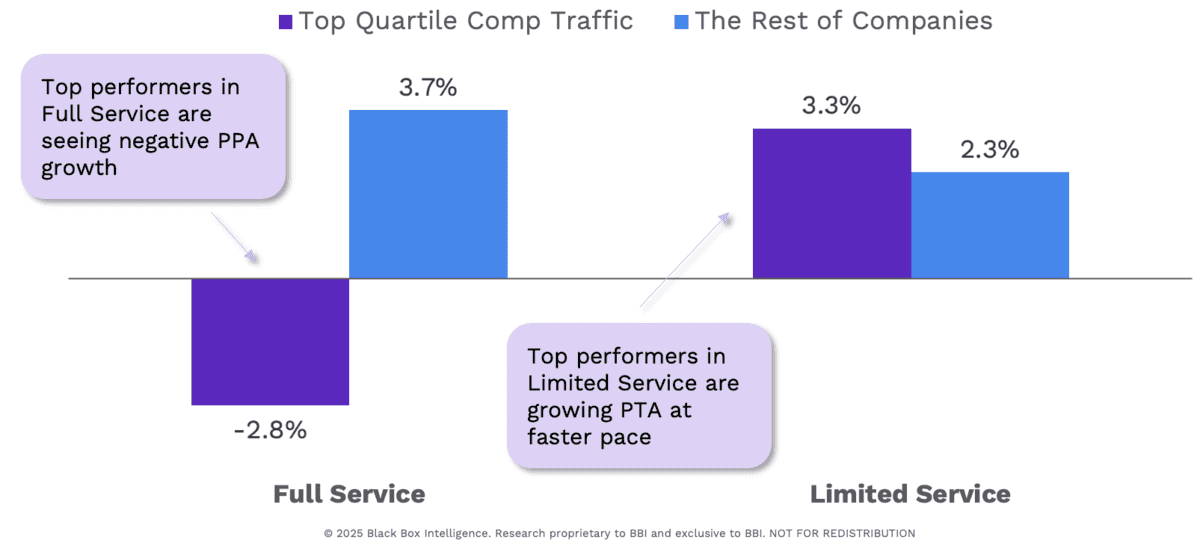

Leaders converge on better value sentiment, but they get there differently by segment.

- Full-service: Units with the strongest traffic reduced average spending per guest year over year. They used promotions, bundles, and portion right-sizing that guests welcomed—lowering per-person average (PPA) while protecting traffic and value scores. Guests felt in control and rewarded the brand with visits.

- Limited-service: Leaders posted faster growth in per-transaction average (PTA) and strong value sentiment. They built mix and attachment (e.g., add-ons, daypart bundles, flavor ladders) that guests happily opted into because the base offer already felt fair.

Value Does Not Necessarily Mean Discounting

Per Person or Per Transaction Average Spend Growth YoY

This isn’t contradictory. In FSR, guests appreciate a visibly fair base experience; in LSR, they accept self-directed upsell when the base feels fair. In both cases, value clarity unlocks spend—either more visits (FSR) or more items (LSR).

Key Recommendations: How to Improve Your Value Strategy

1) Implement a “Value Scorecard”

Track:

- Value sentiment (guest feedback comments, not just stars)

- “Quality meets/exceeds” and “portion fairness” mentions

- PPA (FS) or PTA (LS) trend

- Attach-rate for high-value bundles/add-ons (by daypart & channel)

2) Tune Offers for Perceived Fairness

- FSR: Pilot portion right-sizing (e.g., half-plates, shareables), transparent bundles (no “gotcha” upcharges), and occasion-fit pricing (weekday value, lunch pairings). Your goal is lower PPA without cheapening the brand.

- LSR: Keep the base item obviously fair—then layer choice-driven attachments (sides, beverage flavors, premium toppings) and daypart bundles guests can customize. This preserves value while lifting PTA.

3) Shorten the “Detect → Adapt” Cycle

- Detect: Mine weekly review text for value drivers (quality, portion, speed, consistency).

- Decide: If value sentiment dips, run a two-week initiative in a limited number of units to A/B test portion clarity and/or bundle framing.

- Deploy: Scale only the variants that raise value sentiment and hold margins.Leaders close this loop monthly, not quarterly.

4) Message the value you engineered

Guests reward truly fair offers—but only if they notice them.

- In FSR, menu copy and server scripting should emphasize portion clarity, quality assurances, and “smart pairings.”

- In LSR, digital menus and kiosks should make customization + perceived deal effortless (clear “good/better/best” ladders).

Learning and Takeaways

The throughline in our cuts is speed of response: top-quartile units appear to react to shifting guest needs faster than peers.

Value is the clearest example. As the center of gravity moved toward “worth it” in 2025, leaders more often posted higher value sentiment than the rest.

Within that, full-service leaders more frequently showed lower YoY per-person average spend, while limited-service leaders more often showed faster per-transaction spend growth—patterns consistent with quick adjustments to how value is delivered (e.g., portion clarity, bundles, or guest-led attachments).

Taken together, these insights demonstrate that the edge came from detecting this shift early and iterating the offer sooner.

Latest Research

More From BBI