Resilient Trends in Q4 Restaurant Sales & Traffic

Unveiling Key Insights from October 2023’s Restaurant Performance

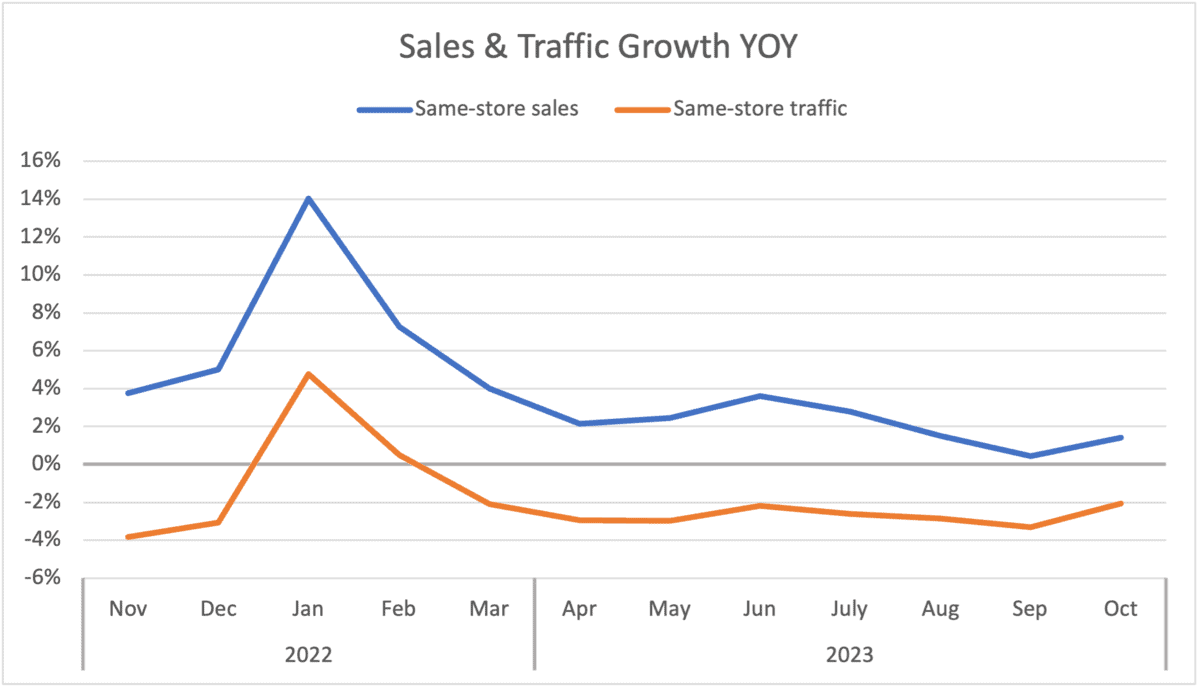

According to GuestXM’s Financial Intelligence, restaurant sales and traffic performance rebounded in October, providing some relief that the disappointing September results were somewhat of an anomaly and not the beginning of a severe downturn for the industry. While October’s same-store sales growth of 1.4% was about the same as what the industry saw in August (1.5%), the trend continues to point toward a softening in sales growth this year. As a comparison, average same-store sales growth between April and July was twice as strong, coming in at an average of 2.8%.

But what is interesting in the new environment experienced by the industry is that traffic growth, albeit negative, has held up much better than sales. October’s -2.1% same-store traffic growth is the strongest posted by the industry since March when the industry was still experiencing some tailwinds due to the easy Omicron-period lap.

Consumers continue to offer signs of resilience despite economic challenges and want to maintain their restaurant visits and orders as much as possible. A factor that is undoubtedly helping alleviate some pressures among consumers is the rapid softening in average guest checks, driven at least in part by more conservative menu-price increases this year.

As has been common during the last few years, limited-service restaurants continue to perform better than those segments classified under full-service. In October, quick service and fast casual were among the top three segments in the industry based on both same-store sales and traffic growth. Casual dining came in at number two based on year-over-year sales growth during the month, but its traffic growth was further down the list.

Only two segments experienced negative same-store sales growth during October: upscale casual and fine dining.

Almost 90% of Limited-Service Employees Would See Pay Increase Due to Minimum Wage Hike in California

Recently, Governor Gavin Newsom signed a bill increasing the California minimum wage for fast food workers. The bill, which will raise the minimum wage from $15.50 to $20, will go into effect in April 2024. According to the National Law Review, this law applies to both quick-service and fast-casual brands with at least 60 locations nationally (with an exception carved out for restaurants that make and sell their bread in-house like Panera Bread).

Spike in Cost of Living

Since 2019, the cumulative rate of inflation is up a massive 20% (for context, the inflation between 2015 and 2019 was 8%, and between 2011 and 2015, it was only 5%). This increase in prices is particularly noticeable in California, the state with the largest GDP, which has the 3rd-highest cost of living but only the 15th-highest annual average salary, according to Forbes.

In response, unions have demanded higher wages. This law, which is the compromise reached after over 100 hours of negotiations between organized labor and representatives for the restaurant industry, represents a sea change in California restaurant compensation.

The Affected Parties

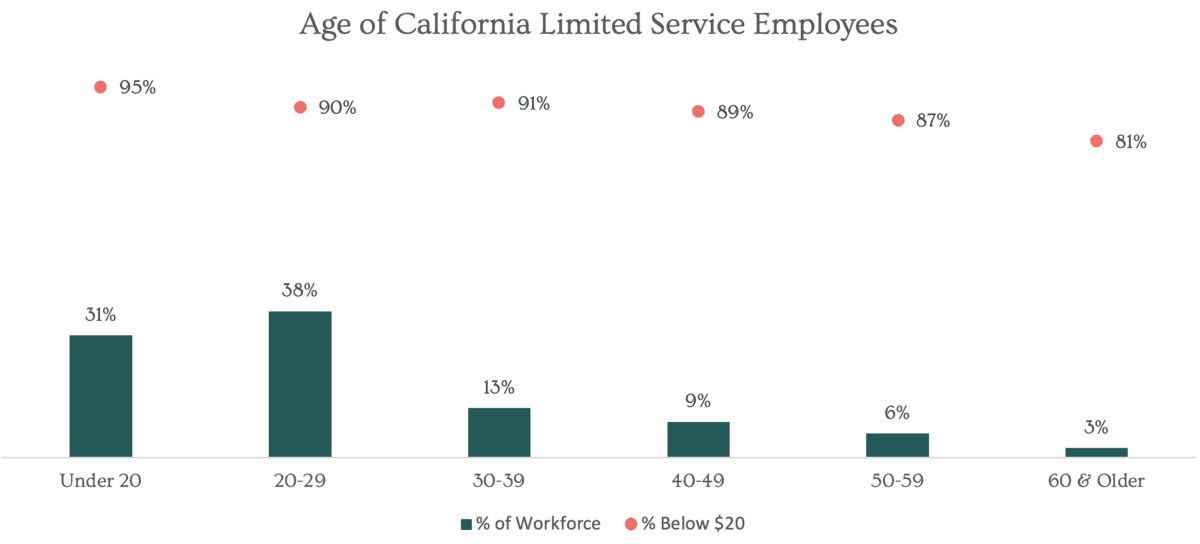

According to the US Bureau of Labor Statistics, California’s 550,000 fast-food workers earn an average of $16.60 per hour. Based on companies in GuestXM’s internal dataset, only 12% of limited-service restaurant hourly workers in California make more than $20. Assuming this is a representative sampling, this means that come April, just under half a million fast-food workers will be receiving a substantial raise.

Governor Newsom argues that this increase will help low-income families. In response to critics, Newsom pushed back on the notion that fast food positions are only after-school jobs for teenagers. GuestXM data supports his claim as only 10% of fast food workers are under the age of 17. It should be noted, however, that 50% of the workforce is under the age of 23.

The vast majority of employees will benefit from the minimum wage increase. As could be expected, restaurant-employee wages are correlated with age. Of the 31% of limited-service employees that are under the age of 20 in California, 95% of them currently make less than $20 an hour in base pay and will be impacted by the planned increase in pay. Although smaller in its share of the workforce, of the 3% that are 60 or older, a very significant 81% will also see their pay increase when minimum wage rises in April of next year.

Newsom also added that over 80% of these workers are minorities, which also correlates with GuestXM Workforce Intelligence data, which shows that nearly half of all employees are Hispanic, 85% of whom are making under $20 per hour.

Brands’ Reaction to Increase

According to CNBC, many brands including McDonald’s and Chipotle already plan to raise California prices to offset the increase in labor. The prospect of raising prices is a particularly painful proposition right now since consumers are already so price-conscious. According to GuestXM’s Feedback & Sentiment Analysis data, net sentiment related to “value” is 24 percentage points less positive among limited-service guests since 2019. McDonald’s executives already noticed a drop in traffic among consumers making less than $45,000 per year.

Meanwhile, some full-service companies are looking to seize the moment. NRN’s podcast First Bite discusses several Q3 brand earnings calls, including BJ’s and Darden, where executives think the inevitability of more parity in pricing between full-service and limited-service restaurants is an opportunity for the former. They believe with a smaller price difference, the customer will opt for an experience, that benefits those in full-service.

While California is the only state where this wage hike is effective, other regions should pay attention. The national cost of living has risen, and as the popular adage says: As California goes, so goes the nation.

Q3 Top Performers Based on Net Sentiment

Food

- Seasons 52

- Eddie V’s

- The Capital Grille

- Shrimp Basket

- Nando’s

Beverage

- Cooper’s Hawk Winery

- Seasons 52

- Eddie V’s

- The Capital Grille

- Willie’s Grill & Icehouse

Service

- Seasons 52

- The Capital Grille

- Eddie V’s

- Twin Peaks

- Willie’s Grill & Icehouse

Ambiance

- Seasons 52

- Eddie V’s

- The Capital Grille

- Nando’s

- Cooper’s Hawk Winery

Value

- In-N-Out

- Seasons 52

- The Capital Grille

- Maggiano’s Little Italy

- Eggs Up Grill

Intent to Return

- Seasons 52

- Eddie V’s

- The Capital Grille

- In-N-Out

- Twin Peaks