Do you want the bad news or the good news first? At the close of the second quarter of the year, there was quite a bit of both for restaurant operators. From a difficult recruiting environment to a possible traffic rebound, here’s the latest take on what’s happening in the restaurant industry.

Bad News

1. Negative sales growth continues across the board.

Although the industry reported a slight increase in comp sales growth last month, restaurants remain in negative territory. Four out of six segments have reported negative comp sales since the fourth quarter of 2016. Additionally, fast casual, family dining and casual dining have reported negative sales for the past five quarters. Even quick service, once the high-flying segment of the restaurant industry, has been trending downward since the beginning of 2017. Fine dining and upscale casual are the only segments edging out of the negative sales trend.

2. Chain restaurants are growing at twice the rate of the total population.

The “share of stomach” battle is getting trickier to manage. With chain restaurants growing rapidly, supply is beginning to outpace consumer demand. Furthermore, the competition for customers is no longer an internal battle. Grocery stores continue to rise as a formidable opponent for chains, particularly with decreasing prices and new adaptations to consumer demands such as healthy foods and on-the-go meals.

3. Back-of-house employees are the toughest to both recruit and retain.

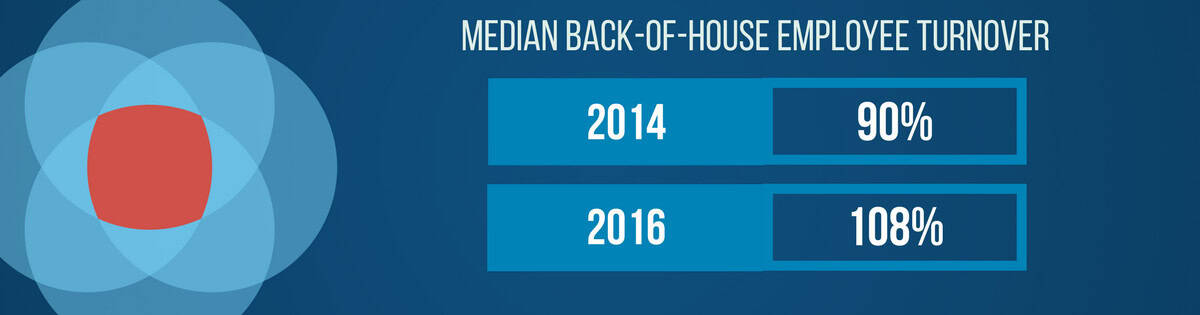

You guessed it – employee turnover is still at an all-time high for restaurants. The latest Restaurant Industry Snapshot™ from Financial Intelligence (formerly Black Box Intelligence) confirmed that both management and hourly turnover levels increased yet again during June. Moreover, back-of-house positions are presenting an even more challenging recruiting environment, in addition to having high turnover rates. Workforce Intelligence (formerly People Report) research indicates these positions receive fewer applicants and take longer to fill during the hiring process. Even top-performing restaurants struggle with finding and keeping back-of-house employees. Over the last three years, the gap in turnover rates for these positions has shrunk between those restaurants obtaining the best and worst retention results.

Although this turnover gap presents a growing problem, there is still a glimmer of hope for operators. Here is some good news about the current state of the industry:

Good News

1. Economic growth remains steady.

According to Black Box Intelligence economist Joel Naroff, the economy is likely to continue along its path of an average 2.25 percent expansion. This is not extraordinary growth by any means, but it does indicate a steady economic environment. The downside is that as wage gains remain stagnant, consumer spending is not likely to increase. However, considering the nation is already near full employment, faster growth would only put more pressure on the markets. “Fast growth creates bubbles. And bubbles, when they burst, are usually pretty ugly.” So, although restaurants will not see any rapid increase in spending, this moderate economic growth will make way for steady increases over time.

2. Although negative, sales and traffic appear to be moving in the right direction.

Although negative comp sales and traffic have been plaguing most dining segments, both measures have begun heading back in the right direction since the beginning of the year. Traffic in particular appears to be mildly improving for most restaurant segments. Five out of six segments experienced a higher percentage of brands with positive traffic growth in the past quarter compared to the second quarter of 2016. The segment that reported the biggest increase was family dining – 18 percent more companies recorded positive traffic compared to last year.

3. Top-performing restaurants prove it is possible to restrain turnover.

Despite the aforementioned recruiting and retention challenges, top-performing restaurant brands are proving that keeping turnover rates in check is indeed possible. Top quartile brands are seeing significantly lower hourly and management turnover levels than bottom quartile brands. Restaurant brands with the highest comp sales report 5 percent lower management turnover and 6 percent lower hourly turnover than their segment median. Likewise, brands with the lowest comp sales report 7 percent higher management turnover and 15 percent hourly turnover. This turnover gap between top and bottom performers has widened over the past few years, indicating that top performers have indeed figured out how to hold onto employees. It’s not impossible, it just requires knowing how to keep employees satisfied. Workforce Intelligence research suggests maintaining higher staffing levels and investing more in manager development could make a big difference in employee satisfaction and performance.